Theo Network Raises $20M to Democratize Advanced Trading Strategies

Theo, a company focused on providing on-chain trading infrastructure, has successfully raised $20 million in a funding round backed by a diverse group of 17 investors. The capital infusion is aimed at bolstering Theo’s institutional-grade trading platform, designed to make sophisticated trading tools accessible to retail investors.

The funding round was co-led by Hack VC and Anthos Capital, demonstrating strong confidence in Theo’s vision. Other notable participants included venture capital firms such as Manifold Trading, Miranda Ventures, Flowdesk, MEXC, and Amber Group.

Adding significant weight to the investment are angel investors from established financial institutions like Citadel, Jane Street, IMC, and JPMorgan, signaling a growing interest from traditional finance in the on-chain trading space.

Founded by former quant traders, Theo aims to bridge the gap between institutional and retail trading by providing access to advanced strategies previously limited to professional trading firms. This includes techniques like high-frequency trading and market making, empowering retail investors with powerful tools to optimize their trading activities.

Theo’s infrastructure is designed to be versatile and compatible with both centralized exchanges and decentralized finance (DeFi) protocols, increasing its reach and usability within the broader cryptocurrency ecosystem.

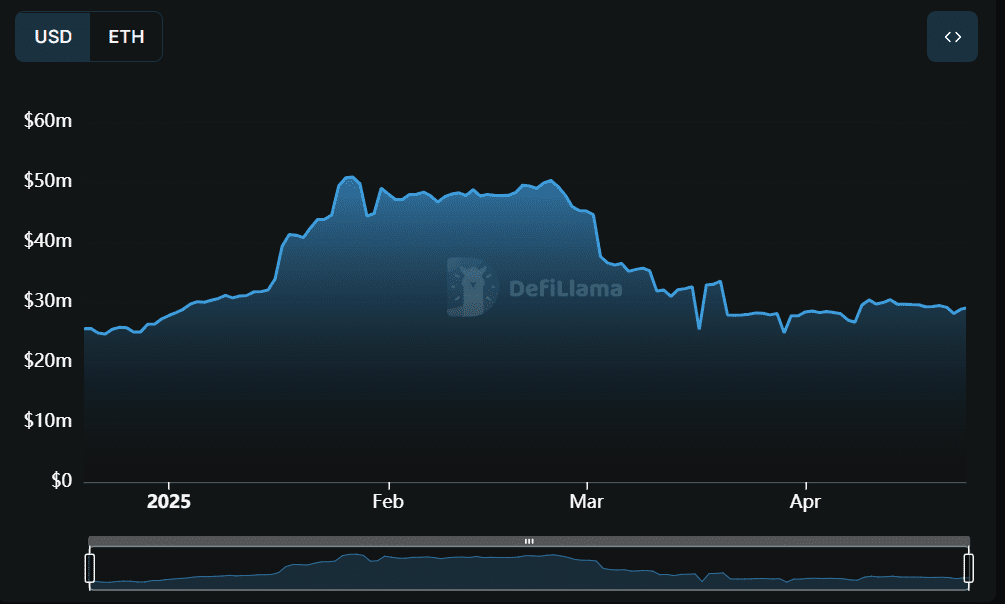

As of April 23, the Theo network boasts approximately $29 million in total value locked (TVL), reflecting growing adoption and trust in the platform. However, it’s important to note that TVL has decreased since its peak in February, indicating potential market fluctuations or shifting user preferences.

Bridging the Gap: Institutional Finance and Retail Crypto Trading

Theo is part of a broader trend of blockchain protocols seeking to connect institutional finance with the retail cryptocurrency market. Several other companies, including Polygon, Fireblocks, Ondo Finance, Lido, and BloFin, are also actively contributing to this evolution, each offering unique solutions to facilitate institutional participation in the crypto space.

Institutional Interest in On-Chain Assets is Growing

While companies like Theo are focused on empowering retail users with institutional-grade tools, there is also increasing evidence of institutional influence flowing in the opposite direction. After years of speculation, institutional involvement in digital assets has become a reality, fueled by several key developments:

- Bitcoin Exchange-Traded Funds (ETFs): The launch of Bitcoin ETFs has provided traditional investors with a regulated and accessible way to gain exposure to Bitcoin.

- Real-World Asset Tokenization: The increasing tokenization of real-world assets is attracting institutional interest by creating new investment opportunities and improving market efficiency.

- On-Chain Lending: The emergence of on-chain lending platforms offers attractive yields and greater transparency, appealing to institutional investors seeking to diversify their portfolios.

- Stablecoins: The growing dominance of stablecoins as a preferred funding method provides stability and efficiency for institutional trading activities.

According to a report by Moody’s, blockchain-based secondary markets can streamline the investing process by eliminating inefficiencies and reducing barriers to asset ownership. This improved efficiency is a major draw for institutional investors.

Recent surveys, such as the one conducted by Coinbase and EY-Parthenon, indicate that a majority of institutional investors plan to increase their crypto allocations this year. The survey also suggests that three-quarters of institutions could become active DeFi users within the next two years, highlighting the growing acceptance and adoption of decentralized finance within the institutional world.

This convergence of institutional and retail finance within the cryptocurrency market is creating exciting opportunities for innovation and growth. Companies like Theo are playing a crucial role in democratizing access to advanced trading tools and empowering retail investors to participate more effectively in the digital asset ecosystem.