Tokenized gold is gaining traction as a compelling alternative to traditional paper gold investments, such as gold exchange-traded funds (ETFs). Representatives from Gold DAO, a decentralized autonomous organization (DAO) focused on gold tokenization, highlight key advantages that make tokenized gold a more attractive option for investors.

Key Advantages of Tokenized Gold

According to Melissa Song and Dustin Becker of Gold DAO, tokenized gold offers three primary benefits:

- 1:1 Redeemability: Each token represents a specific quantity of physical, serialized gold, ensuring direct ownership and the ability to redeem the tokens for the underlying gold.

- DeFi Collateral: Tokenized gold can be used as collateral within decentralized finance (DeFi) applications, unlocking new opportunities for lending, borrowing, and yield generation.

- Transactional Efficiency: Tokenized gold facilitates faster and more efficient transactions through on-demand liquidity, eliminating the delays and complexities associated with traditional gold trading.

“When you buy an ETF, you are betting on the gold price going up, but you do not own any specific gold bar,” explains Song. This distinction underscores a fundamental difference between tokenized gold and ETFs.

The Rise of Gold Amidst Economic Uncertainty

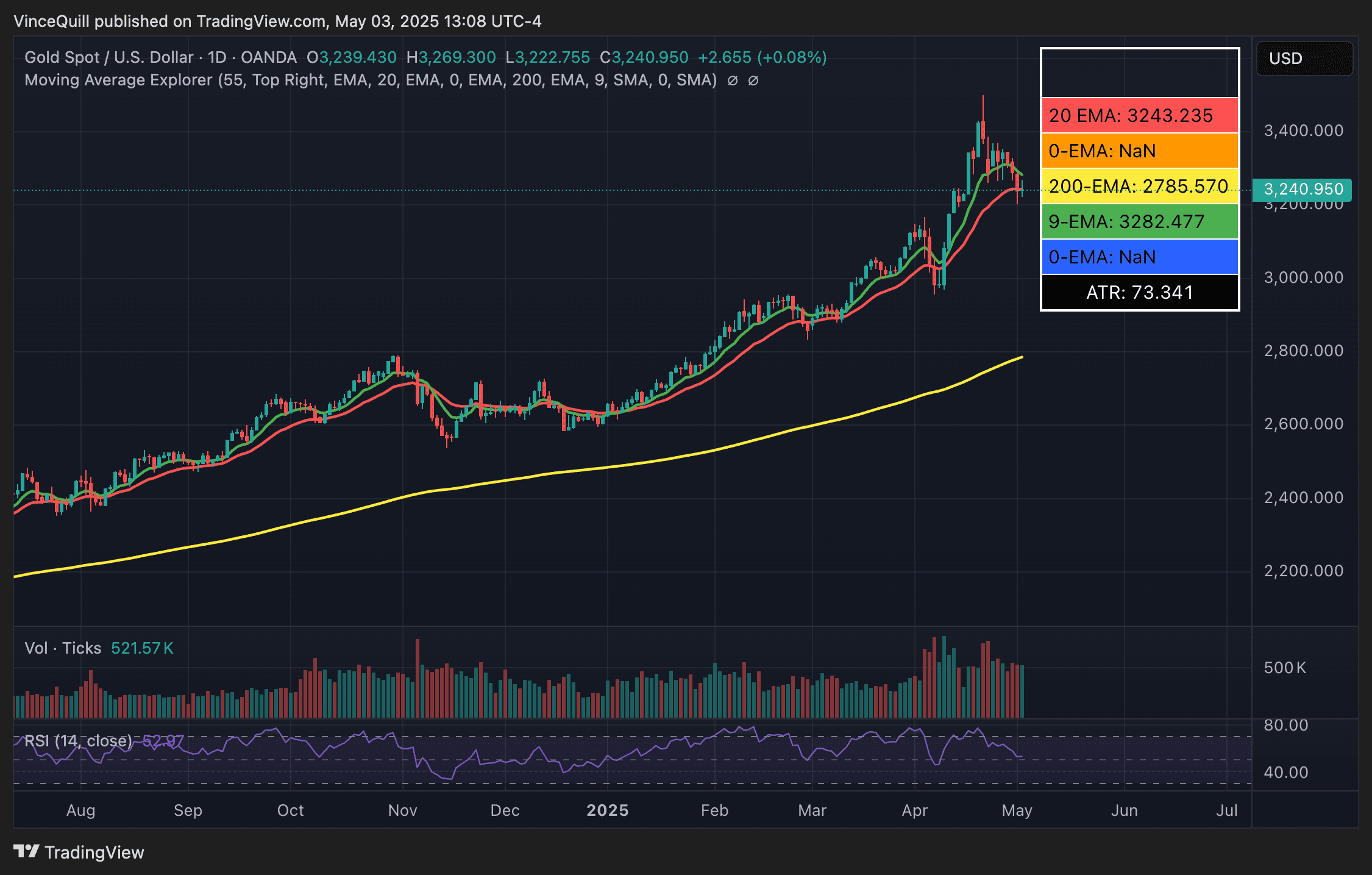

In recent years, gold prices have surged, reaching an all-time high of $3,500 per ounce in April 2025. This surge can be attributed to several factors, including macroeconomic uncertainty, rising US government debt, and escalating geopolitical tensions. These factors have collectively driven investors towards safe-haven assets like gold.

Tokenized Gold in the Face of Trade Wars and Volatility

The announcement of trade tariffs by the United States President in 2025 triggered significant volatility in risk-on asset markets. This led investors to shift towards safe-haven assets, including gold and cash. This environment proved beneficial for gold-backed cryptocurrencies like Paxos Gold (PAXG) and Tether Gold (XAUT), which experienced price spikes during this period.

The Future of Stablecoins: Gold vs. Fiat

Bitcoin advocate Max Keiser argues that gold-backed tokens possess the potential to outperform fiat-backed stablecoins. He believes that gold’s inherent inflationary resistance and lack of geopolitical risk make it a superior store of value.

“A stablecoin backed by Gold would out-compete a USD-backed stablecoin in world markets: Russia, China, and Iran should take note,” Keiser stated, highlighting the potential geopolitical advantages of gold-backed digital assets.

Gold and Bitcoin: A Symbiotic Relationship?

The current rally in gold prices could potentially spill over into Bitcoin. As investors increasingly view Bitcoin as a store of value rather than a purely risk-on asset, it could benefit from the same economic uncertainties that are driving gold’s upward trajectory. This shift in perception could position Bitcoin as a counter-cyclical asset, similar to gold, attracting further investment during turbulent economic times.

Digging Deeper: Why Tokenized Gold Matters

While the advantages listed above provide a good overview, let’s examine why these points resonate so strongly with modern investors:

- Transparency and Auditability: Tokenized gold transactions are recorded on a blockchain, providing a transparent and auditable record of ownership. This enhanced transparency builds trust and reduces the risk of fraud.

- Fractional Ownership: Tokenization allows for fractional ownership of gold, making it accessible to a broader range of investors who may not be able to afford to purchase entire gold bars.

- Global Accessibility: Tokenized gold can be easily transferred and traded globally, bypassing the geographical limitations of traditional gold markets.

- Integration with Smart Contracts: The ability to integrate tokenized gold with smart contracts opens up possibilities for automating complex financial transactions and creating innovative DeFi applications.

The Role of Gold DAO

Gold DAO plays a crucial role in facilitating the adoption of tokenized gold. By providing a decentralized platform for investors to access and manage their tokenized gold holdings, Gold DAO is contributing to the growth and development of the tokenized gold ecosystem. Their focus on education and community building further supports the wider understanding and acceptance of this new asset class.