The Open Network (TON), an independent layer-1 blockchain closely integrated with the Telegram messaging platform, experienced a brief outage on June 1st, temporarily halting block production before functionality was restored.

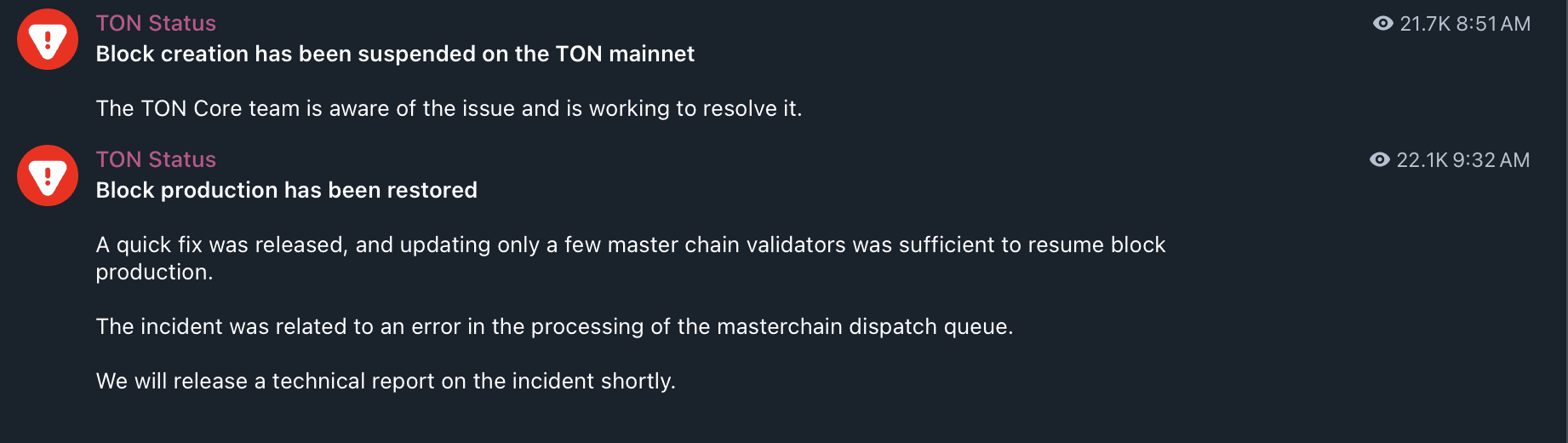

TON’s development team acknowledged the issue at 12:51:00 UTC and restored network functionality approximately 40 minutes later. TON developers stated in an update:

“A quick fix was released, and updating only a few master chain validators was sufficient to resume block production. The incident was related to an error in the processing of the masterchain dispatch queue.”

The team assured users that no funds were affected by the outage and that transactions submitted during the downtime were not at risk of loss.

Blockchain network outages typically affect higher-throughput, high-speed blockchains due to the increased technical complexity. As the sophistication of blockchain networks increases, brief outages may become more common, potentially impacting consumer confidence in cryptocurrencies.

TON experienced several outages in 2024 caused by DOGS memecoin minting

In August 2024, TON experienced several brief outages caused by high demand for the DOGS memecoin, which created network congestion that forced a chain halt.

The first outage on Aug. 27 halted block production at workchain block 45,341,899. The network downtime lasted for several hours before validators reset their nodes at 4:00 am UTC to restore network consensus.

At 5:30 am UTC functionality was briefly restored before the network crashed again hours later, once again due to high traffic from users minting DOGS memecoins on the TON blockchain.

TON experienced another brief outage the following day on Aug. 28, with block production halting at workchain block 45,350,522.

This second outage lasted for roughly six hours before the issue was fixed, and block production resumed on Aug. 28.

Despite the brief network outages, TON continues to attract retail interest and institutional investment, particularly from large, well-known players in the digital asset space.

In March 2025, TON raised $400 million from venture capital firms, including Sequoia Capital, Draper Associates, CoinFund, SkyBridge and others.