Trendspotting in Crypto: Discovering Winning Projects Early

Spotting the next big crypto project before it explodes requires a blend of data analysis, disciplined research, and a keen eye for genuine signals. This guide provides insights into how to identify potential winners early by examining on-chain metrics, tokenomics, developer activity, and community engagement, while also highlighting common pitfalls such as hype-driven pumps and projects with red flags.

In the dynamic and crowded crypto space, successful investors consistently identify promising projects that are still under the radar. Their approach involves more than just following the hype; it requires a deep understanding of on-chain data, tokenomics, and developer activity.

This article will teach you how to find crypto projects with real potential by drawing lessons from successful examples like Solana, Arbitrum, Chainlink, and even meme coins like Pepe. It emphasizes the use of essential tools, recognition of red flags, and distinguishing between organic growth and artificial buzz.

Past Success Stories

Solana

Solana, launched in 2020, gained prominence due to its high speed. Its proof-of-history technology quickly attracted developers, particularly in the DeFi and NFT spaces. By 2021, its ecosystem flourished with applications like Serum and Magic Eden.

Early adopters who monitored on-chain growth, such as wallet activity and DEX volume, recognized the potential. SOL’s price surged from under $1 to over $50 in less than a year.

Arbitrum

Arbitrum, an Ethereum layer 2 solution launched in 2021, gained significant traction with its ARB token airdrop in March 2023. Even before the token launch, Arbitrum was processing more transactions than many layer 1 blockchains and boasted billions in total value locked (TVL) in decentralized applications (DApps).

Investors who observed user activity, rising liquidity, and increasing app adoption were well-positioned when the ARB token was released.

Chainlink

Chainlink is a project known for its long-term utility. Despite lacking flashy marketing, it excels at feeding real-world data into smart contracts. By 2024, it became a fundamental component of DeFi, gaming, and tokenized real-world assets.

Observing Chainlink’s integration across various platforms in 2019-2020 revealed its potential, which eventually translated into significant price appreciation.

PEPE Coin

PEPE, a meme coin launched in 2023, achieved a billion-dollar market cap within weeks despite having no roadmap or utility. Its success was driven by viral internet popularity.

Traders who tracked social sentiment, wallet distribution, and community activity recognized the early signals. PEPE’s success demonstrates the power of viral moments in crypto.

How to Find Promising Crypto Projects Early

To distinguish the next Solana from a potential rug pull, consider the following approaches:

1. On-Chain Metrics

Utilize the transparency of public blockchains to analyze:

- Daily active wallets

- Transaction volume

- Token holder growth

- Liquidity on decentralized exchanges (DEXs)

- TVL (for DeFi projects)

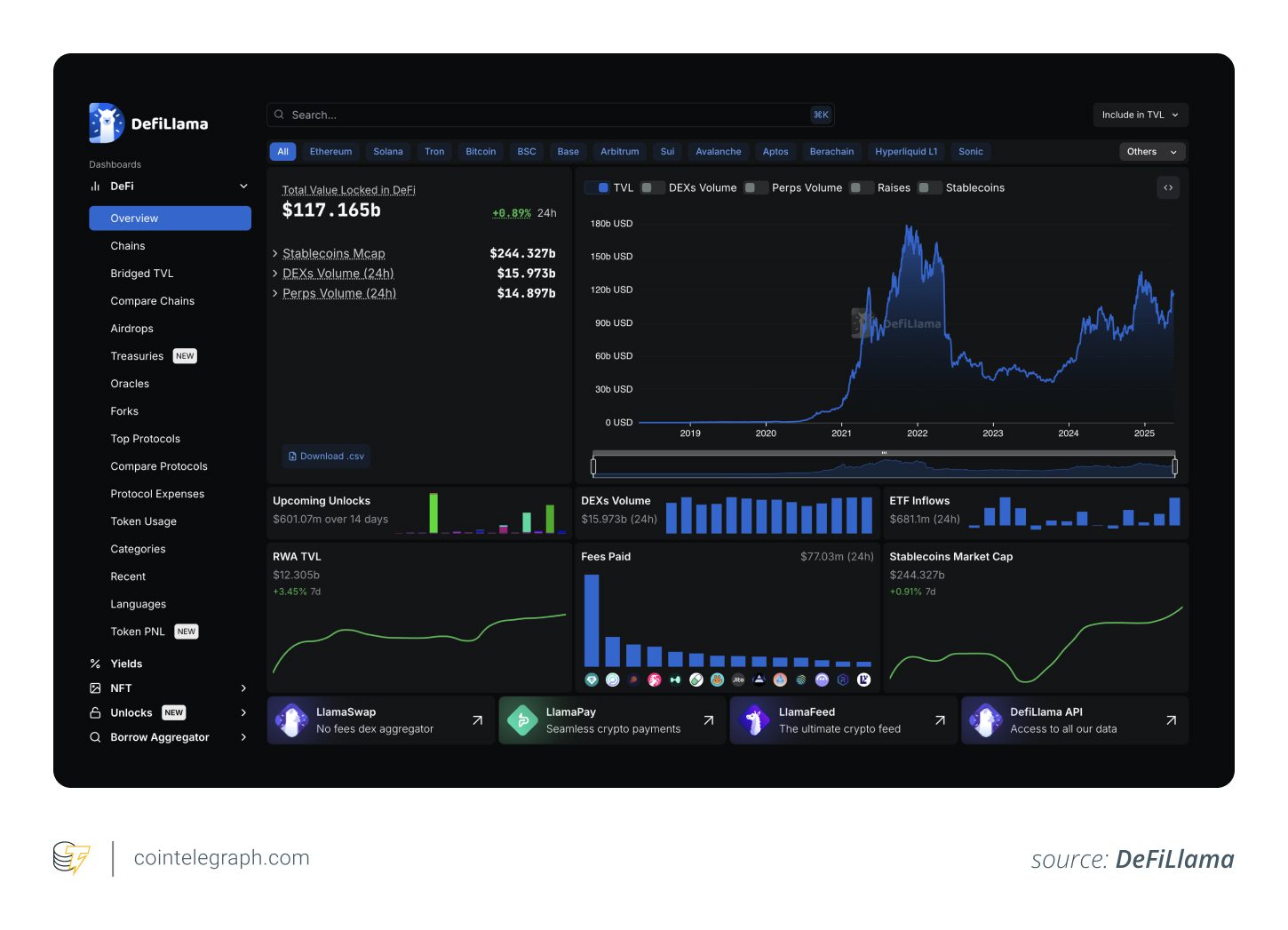

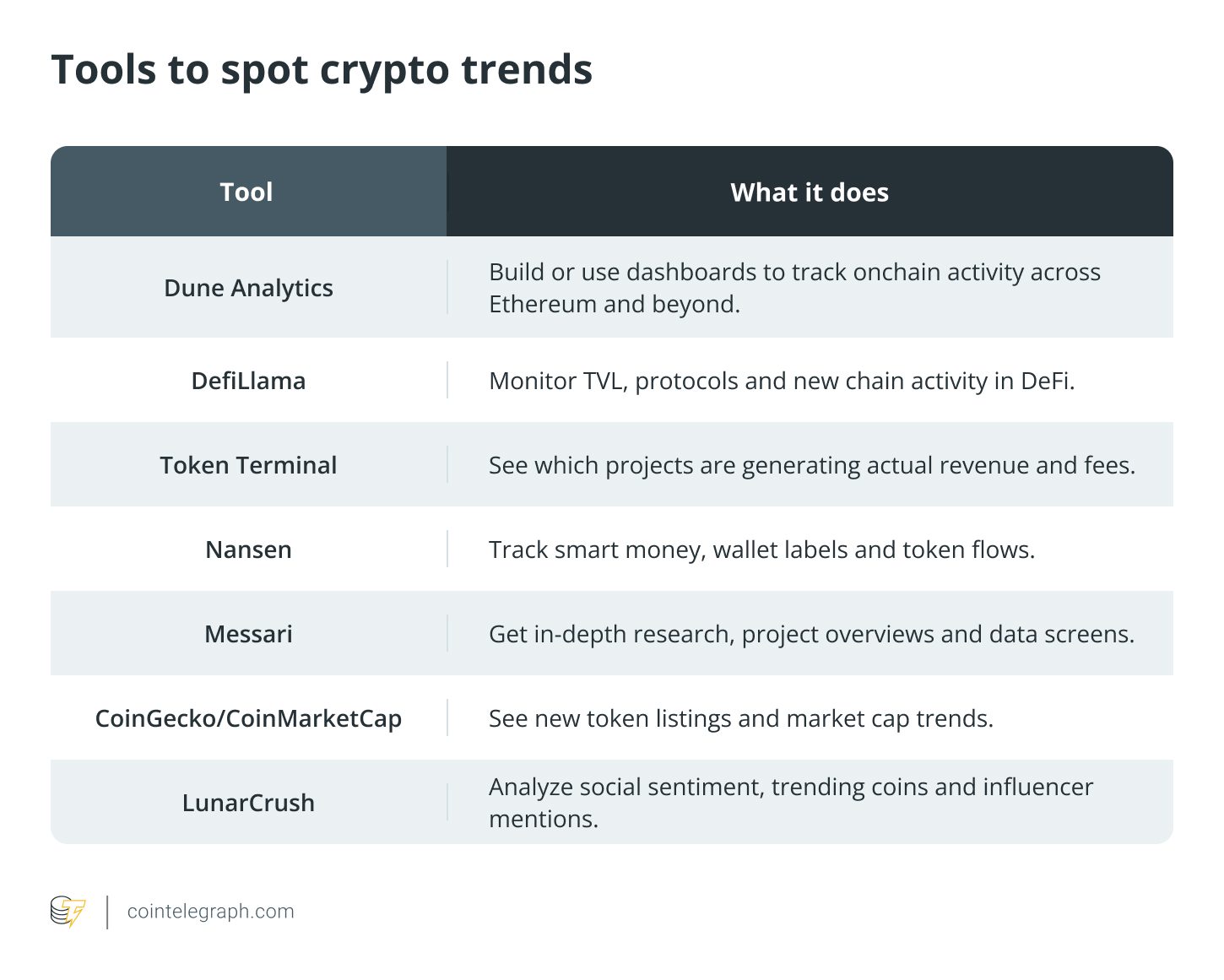

Increasing user and capital inflows before a token’s price surge are positive indicators. Tools like Dune Analytics, Nansen, and DefiLlama can be helpful.

2. Tokenomics

Investigate:

- Total and circulating supply

- Upcoming token unlocks or vesting cliffs

- Distribution of tokens among top wallets

- Token utility

Tokens with capped supply, incentives like staking, and fair distribution models tend to perform better.

3. Developer Activity

Assess whether the development team is actively building. GitHub is a valuable resource for tracking code commits, active contributors, and the overall activity of the project’s repository. Lack of updates is a significant red flag.

4. Ecosystem Signals

Determine if other developers are building on top of the project, if DApps are launching, if liquidity is growing, and if users are consistently returning.

5. Community Engagement

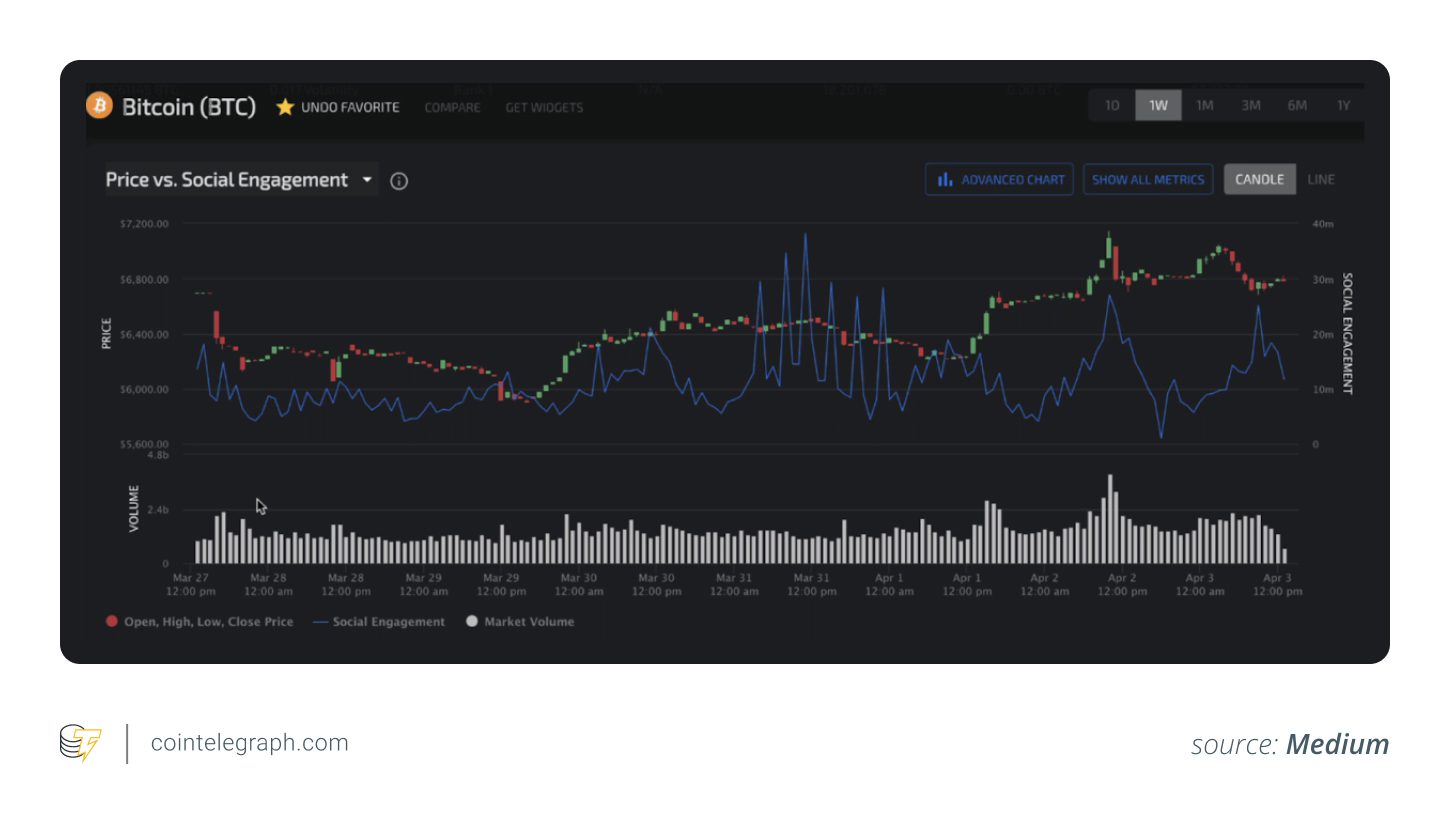

Monitor platforms like X, Discord, Telegram, and Reddit to gauge community sentiment. Look beyond price discussions and assess whether users are actively using the product, if developers are responsive, and if the overall tone is constructive.

Key Tools for Crypto Trendspotting

Top platforms used by crypto trendspotters include:

- Dune Analytics: For on-chain data analysis

- Nansen: For advanced wallet tracking and smart money analysis

- DefiLlama: For comprehensive DeFi data

- LunarCrush: For social sentiment analysis

- GitHub: For tracking developer activity

It’s beneficial to cross-reference data from multiple tools to ensure accuracy.

Identifying Real Traction vs. Manufactured Hype

Distinguishing between genuine user engagement and artificial hype is crucial for making informed investment decisions.

Signs of Real Traction

- Steady user growth and TVL over time

- Consistent code commits and product updates

- Increasing token holders with less whale control

- New integrations and ecosystem activity

- Gradual liquidity growth

Signs of Manufactured Hype

- Sudden spikes in social mentions or trading volume without news

- Influencer spam and recycled talking points

- Lack of developer activity or a clear roadmap

- Anonymous team with unrealistic promises

Red Flags to Watch Out For

- High holder concentration

- Unverified token contracts

- Absence of liquidity lock or audit

- Upcoming large token unlocks

Conclusion

Successful early crypto investors analyze token structures, monitor community signals, and follow developers. They cross-check on-chain data, social sentiment, developer activity, and liquidity to distinguish between noise and substance.

By thinking independently, digging deeper, and acting before the crowd, investors can identify promising projects early and increase their chances of success in the crypto market.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.