Trump Media and Technology Group (TMTG), the parent company of Donald Trump’s Truth Social, has confirmed plans to raise $2.5 billion to purchase Bitcoin (BTC) for its treasury. This move, initially met with skepticism, signals a significant shift in TMTG’s financial strategy and aligns with a growing trend of corporate Bitcoin adoption.

Key Takeaways

- Confirmed Capital Raise: TMTG will raise $2.5 billion through a combination of stock sales and convertible bonds to acquire Bitcoin.

- Strategic Bitcoin Acquisition: The company views Bitcoin as a key asset for financial freedom and protection against institutional harassment.

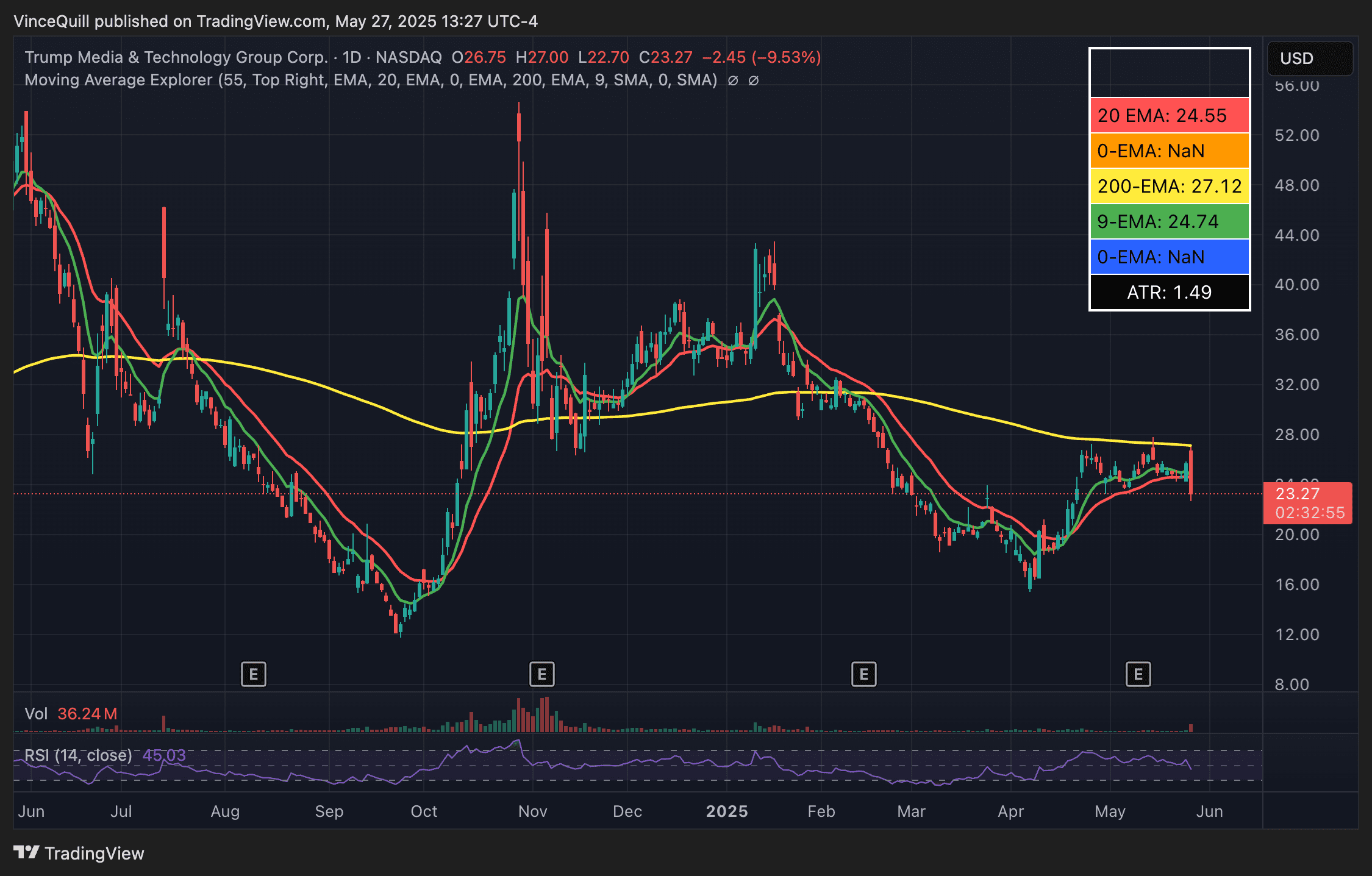

- Market Reaction: Following the announcement, TMTG shares experienced a decline.

- Broader Trend: TMTG joins a growing list of corporations and countries adopting Bitcoin treasury strategies.

The $2.5 Billion Deal: A Closer Look

According to the official announcement, the $2.5 billion will be raised through a $1.5 billion stock sale and $1 billion in convertible senior secured bonds with a 0% coupon. The deal is expected to close soon. TMTG CEO Devin Nunes expressed strong support for Bitcoin, stating it will be a crucial part of the company’s assets.

“We view Bitcoin as an apex instrument of financial freedom, and now Trump Media will hold cryptocurrency as a crucial part of our assets. This investment will help defend our Company against harassment and discrimination by financial institutions.”

Why Bitcoin? TMTG’s Rationale

TMTG’s decision to invest in Bitcoin reflects a belief in its potential as a hedge against traditional financial systems and a tool for financial independence. In a statement, the company indicated that it views Bitcoin as a means of protecting itself from perceived biases and discrimination from financial institutions.

Market Reaction and TMTG Stock Performance

The announcement of the Bitcoin investment was met with a negative market reaction, with TMTG shares falling by over 12%. This could be attributed to investor uncertainty regarding the company’s foray into cryptocurrency and the potential risks associated with Bitcoin’s volatility.

Corporate Bitcoin Adoption: A Growing Trend

TMTG’s decision to add Bitcoin to its treasury aligns with a growing trend of companies embracing cryptocurrency as a strategic asset. Other notable examples include:

- MicroStrategy: Known for its significant Bitcoin holdings, MicroStrategy continues to accumulate BTC.

- Semler Scientific: Recently acquired $50 million worth of Bitcoin for its treasury.

- MetaPlanet: A Japanese investment firm that has been actively purchasing Bitcoin.

The Future of Bitcoin Treasuries

The increasing adoption of Bitcoin by corporations and countries suggests a growing recognition of its potential as a store of value and a hedge against inflation. Market analysts predict that institutional holdings of Bitcoin will continue to rise, potentially leading to a significant portion of the total supply being held by large entities in the coming years. This trend is driven by a search for stability amidst the volatility of fiat currencies and traditional asset classes.

Analyst Jesse Myers predicts that at the current rate of institutional accumulation, large entities will own 50% of the total Bitcoin supply by 2045. This growth in institutional adoption is driven by a flight to safety from traditional asset classes.