Trump Media and Technology Group (TMTG), the organization behind the Truth Social platform, has publicly refuted a recent report suggesting plans to raise $3 billion to invest in Bitcoin and other cryptocurrencies. The report, initially published by the Financial Times, cited anonymous sources claiming TMTG intended to secure funding through a combination of equity and convertible bonds.

TMTG responded to the Financial Times report with a statement, dismissing the claims. While they didn’t elaborate on specific details, the denial casts doubt on the immediate prospect of a large-scale crypto acquisition by the company.

The Financial Times report suggested that TMTG was considering issuing $2 billion in equity and $1 billion in convertible bonds. Convertible bonds are a type of debt security that can be converted into a predetermined amount of the issuer’s equity at a specific price and date. This financial strategy would align TMTG with companies like Strategy and Metaplanet that have previously invested in Bitcoin as part of their corporate treasury strategy.

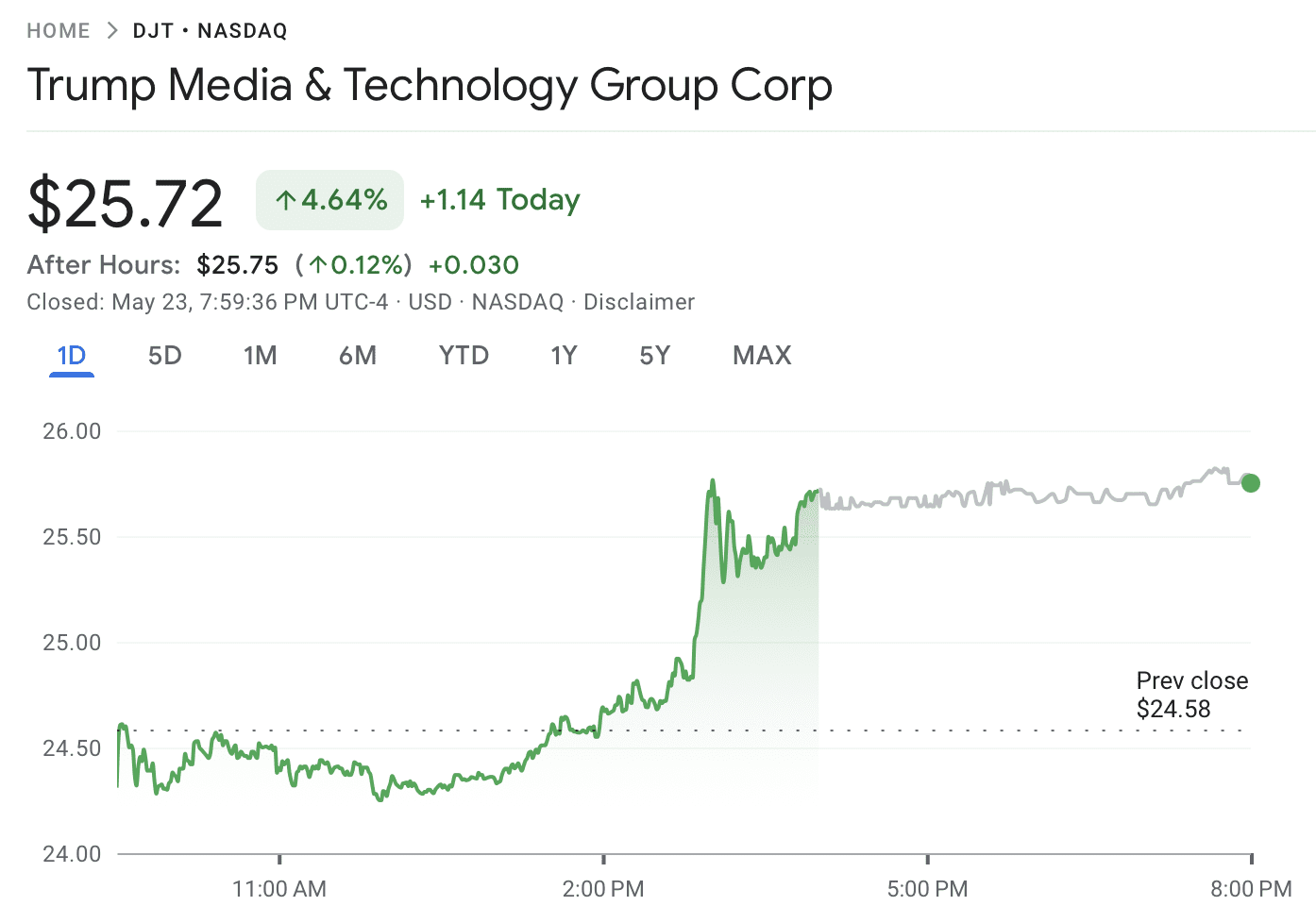

On May 23, the day preceding the report, shares of Trump Media (DJT) closed at $25.72, reflecting a 4.6% increase for the day. The company’s market capitalization stood at $5.7 billion as of that date.

Investing in cryptocurrencies like Bitcoin is a strategy some companies have adopted as a hedge against inflation and as a way to avoid becoming “zombie companies,” according to their statements.

Implications and Scrutiny

Even without this particular investment, the Trump family’s involvement in the crypto space has attracted increasing scrutiny. Democratic lawmakers have voiced concerns regarding potential conflicts of interest arising from Trump’s association with various crypto ventures. These ventures include:

- Non-Fungible Token (NFT) Collections: Trump has launched multiple NFT collections, tapping into the digital collectibles market.

- Memecoins: The ecosystem includes memecoins like Official Trump (TRUMP) and Melania (MELANIA).

- World Liberty Financial: A decentralized finance (DeFi) platform.

- Dollar-Pegged Stablecoin: Ventures into the stablecoin market.

Critics argue that these ventures create potential conflicts of interest, particularly given Trump’s potential influence over the regulatory landscape governing the crypto industry. The concern is that he could benefit personally from decisions made regarding crypto regulation.

Adding to the complexity, reports indicate that Trump has transferred his 53% stake in TMTG to a revocable trust managed by his son, Donald Trump Jr.

Understanding the Context: Crypto Investments by Public Companies

While TMTG’s potential foray into Bitcoin garnered headlines, it’s crucial to understand the broader trend of publicly traded companies adding Bitcoin to their balance sheets. Companies like MicroStrategy and others have pioneered this strategy, citing various reasons:

- Hedge Against Inflation: Bitcoin’s limited supply is seen as a potential hedge against the devaluation of fiat currencies due to inflation.

- Diversification: Adding Bitcoin to a company’s treasury can diversify its holdings beyond traditional assets like cash and bonds.

- Potential for Appreciation: Companies believe in Bitcoin’s long-term potential for price appreciation.

- Marketing and Branding: Investing in Bitcoin can attract attention and align a company with the innovative world of cryptocurrency.

However, this strategy also carries risks, including the volatility of Bitcoin’s price and the potential for regulatory uncertainty.

The Future of TMTG and Crypto

Whether TMTG ultimately decides to invest in Bitcoin or other cryptocurrencies remains to be seen. However, the company’s initial consideration of this strategy, coupled with the Trump family’s broader involvement in the crypto space, highlights the growing convergence of traditional business and the digital asset world. The scrutiny surrounding these activities underscores the need for clear regulatory guidelines and ethical considerations as the crypto industry continues to evolve.