The United Kingdom is taking a significant step toward becoming a global leader in the digital asset space with its newly proposed crypto regulations. Unveiled by UK Finance Minister Rachel Reeves, these draft rules aim to create a comprehensive regulatory regime that fosters innovation while ensuring consumer protection and market stability.

Key Highlights of the UK’s Crypto Regulations

- Comprehensive Regulatory Regime: The UK is implementing a thorough regulatory framework for crypto exchanges, dealers, and agents, similar to traditional financial institutions.

- Financial Services and Markets Act 2000 (Cryptoassets) Order 2025: This order introduces six new regulated activities, including crypto trading, custody, and staking.

- Securities Regulation: Unlike the EU’s MiCA, the UK is applying the full weight of securities regulation to crypto, encompassing capital requirements, governance standards, market abuse rules, and disclosure obligations.

- Stablecoin Reclassification: The regulations reclassify stablecoins as securities, not e-money. UK-issued fiat-backed tokens must meet prospectus-style disclosures and redemption protocols.

- FCA Approval for Foreign Firms: Non-UK platforms serving UK retail clients will need authorization from the Financial Conduct Authority (FCA).

Expert Opinions and Industry Impact

Industry experts have expressed optimism about the new regulations, viewing them as a positive step toward providing clarity and fostering responsible innovation.

Dante Disparte, chief strategy officer and head of global policy at Circle, noted that the UK’s willingness to provide regulatory clarity positions it as a safe harbor for responsible innovation. He believes this framework will provide the predictability needed to scale responsible digital financial infrastructure in the UK.

Vugar Usi Zade, COO at Bitget exchange, highlighted that the clear definitions of “qualifying crypto assets” and the specific activities requiring FCA authorization will help companies plan product roll-outs and invest in local infrastructure.

Detailed Breakdown of the Regulations

The proposed rules cover various aspects of the crypto industry:

1. Crypto Trading, Custody, and Staking

These activities are now regulated similarly to traditional financial services. Exchanges must obtain full approval from the FCA to offer these services to UK users. This includes adhering to transparency, consumer protection, and operational resilience requirements.

2. Stablecoins as Securities

Reclassifying stablecoins as securities rather than e-money brings them under stricter regulatory scrutiny. UK-issued fiat-backed stablecoins must comply with prospectus-style disclosures and adhere to redemption protocols. While non-UK stablecoins can still circulate, they can only do so via authorized venues.

3. Territorial Reach and FCA Authorization

The new rules extend to non-UK platforms serving UK retail clients, requiring them to obtain FCA authorization. This aims to protect UK consumers by ensuring that all platforms operating within the UK adhere to the same standards.

4. Crypto Staking

Liquid and delegated staking services must now register with the FCA. However, solo stakers and purely interface-based providers are exempt. New custody rules extend to any setup granting unilateral transfer rights, impacting certain lending and MPC arrangements.

Potential Challenges and Considerations

While the new regulations are largely seen as positive, some potential challenges and considerations have been raised:

- Stablecoin Use for Payment: Excluding stablecoins from the Electronic Money Regulations 2011 (EMRs) could potentially slow their adoption for payment purposes.

- DeFi Nuances: Some aspects of DeFi models, particularly non-custodial setups, may require further clarification to ensure efficient and tailored compliance.

- Retail Participation: Proposed credit-card purchase restrictions, while aimed at high-risk use, could potentially dampen retail participation in token launches.

- Bank-Grade Segregation: Bank-grade segregation rules for client assets could burden smaller DeFi projects, necessitating tweaks to mitigate these side effects.

Looking Ahead

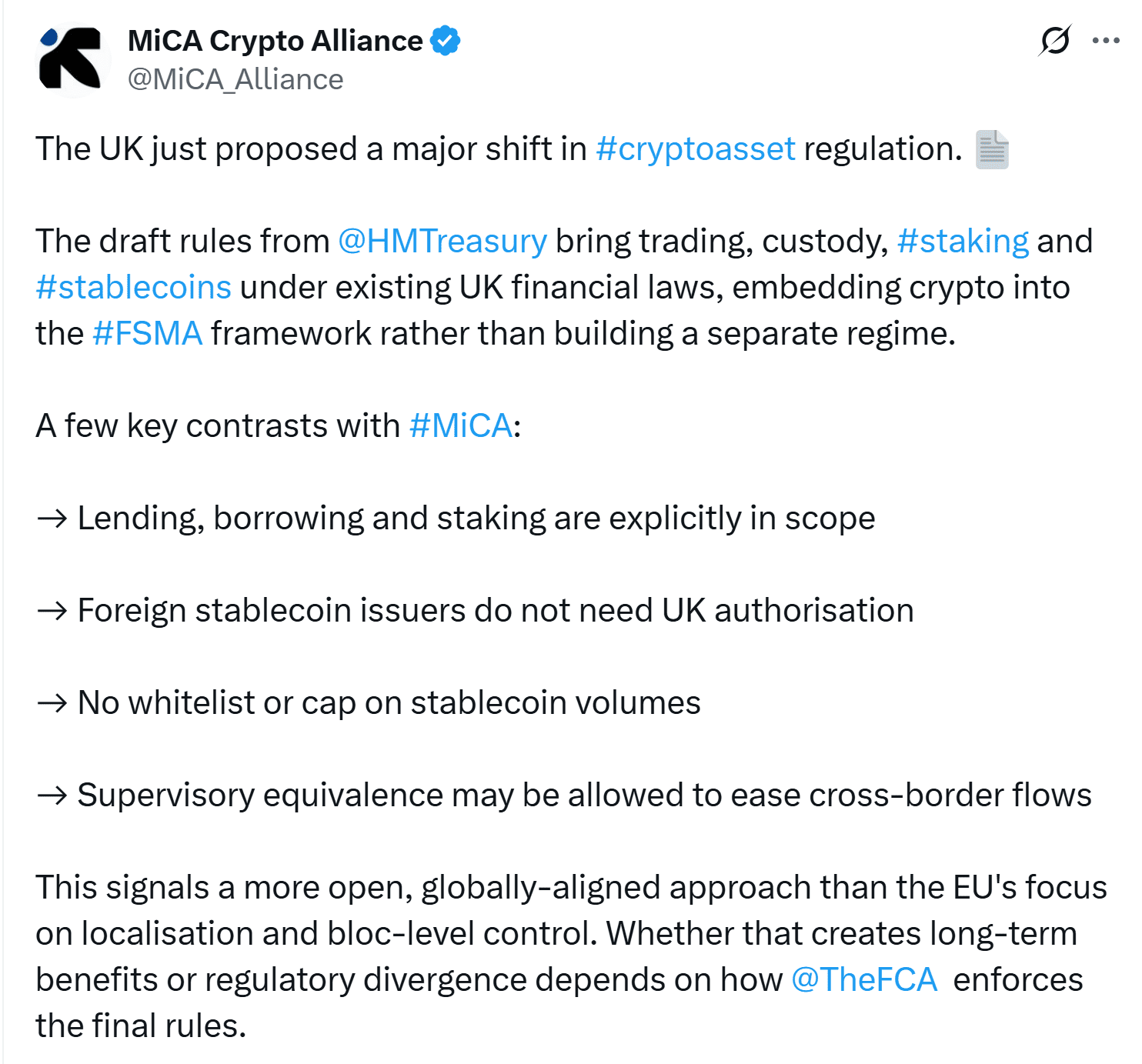

The FCA plans to publish final rules on crypto in 2026, setting the stage for the UK regulatory regime to go live. This roadmap aligns with the European Union’s implementation of its MiCA framework, suggesting a global trend toward greater regulatory clarity in the crypto space.

The UK’s proactive approach aims to strike a balance between fostering innovation and protecting consumers. By providing a clear and comprehensive regulatory framework, the UK seeks to attract crypto businesses and investors, solidifying its position as a leading hub for the digital asset industry. The goal is to create a predictable environment where firms can build, test, and grow responsibly, without fear of arbitrary enforcement or shifting goalposts.