What is the 10-Year Treasury Yield?

The 10-year Treasury yield represents the annual return an investor receives for lending money to the U.S. government for a decade. It’s a benchmark for “risk-free” returns and is influenced by factors like demand for bonds, inflation expectations, and the overall economic climate.

Why Does the 10-Year Treasury Yield Matter for Crypto?

The 10-year Treasury yield impacts crypto yields and stablecoins by influencing investor behavior and market dynamics. It serves as a key indicator of risk appetite and the attractiveness of alternative investments.

Impact on Global Financial Markets

The 10-year Treasury yield has wide-ranging effects on global financial markets:

- Stock Markets: Higher yields can lead to money flowing out of stocks, particularly growth stocks like tech companies, as investors seek safer returns in bonds.

- Borrowing Costs: The 10-year yield influences interest rates globally, impacting borrowing costs for companies and governments. Rising yields can slow economic growth.

- Currency Markets: A higher yield strengthens the U.S. dollar, potentially making cryptocurrencies more expensive for international investors.

- Emerging Markets: Rising Treasury yields can cause capital to flow out of riskier emerging markets into U.S. bonds, creating volatility.

- Inflation and Monetary Policy: The 10-year yield reflects inflation expectations. Higher yields may prompt central banks to raise interest rates, reducing speculative investment in assets like crypto.

Rising Treasury Yields and Crypto’s Yield Appeal

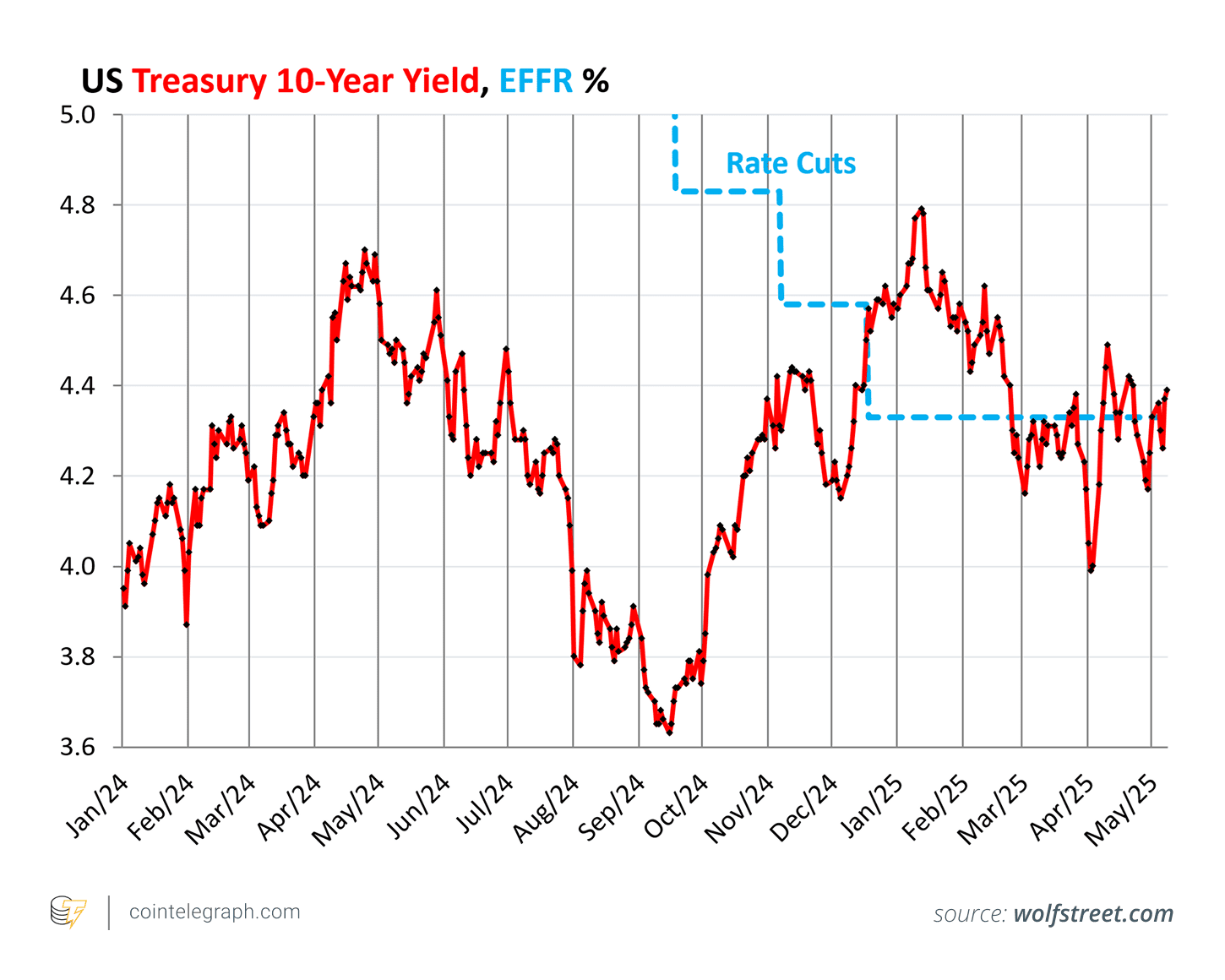

In periods of rising Treasury yields, safer returns can reduce demand for riskier crypto yields. Investors might prefer the stability of Treasurys, potentially leading to lower participation in crypto lending platforms and affecting overall market activity. For instance, in 2025, the 10-year Treasury yield reached approximately 4.37%-4.39%.

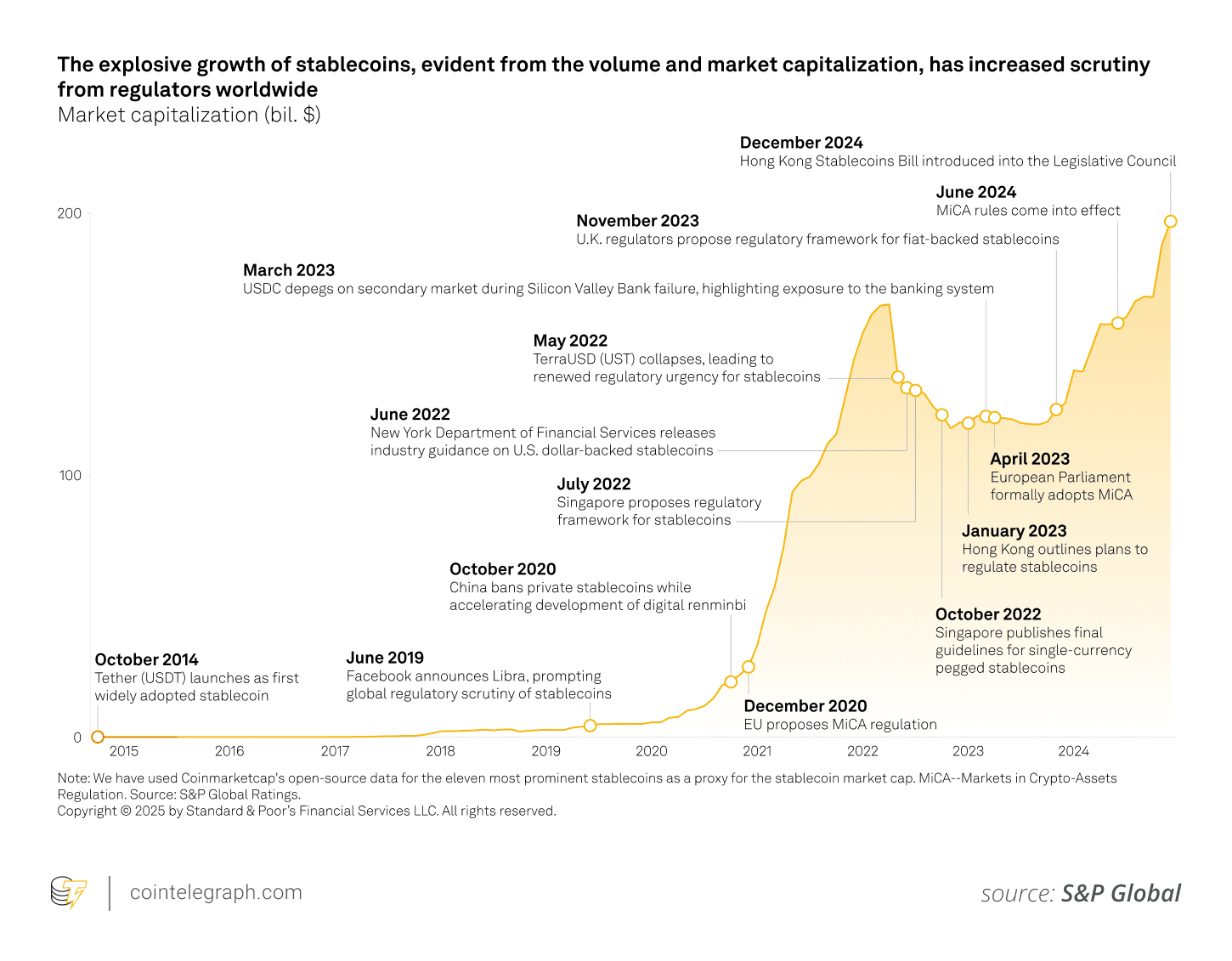

The Impact on Stablecoins

Stablecoins are closely tied to traditional finance, as their value is often backed by assets like cash, bonds, or Treasury notes. The 10-year yield affects stablecoins in several ways:

- Backing Assets: Many stablecoins hold U.S. Treasurys in their reserves. Higher yields mean reserves earn more income.

- Regulatory Complexity: Regulations like MiCA in the EU may restrict stablecoin issuers from offering interest.

- Opportunity Cost: High Treasury yields can make holding stablecoins less appealing compared to buying Treasurys directly.

- Market Sentiment: Rising Treasury yields can signal tighter monetary policy, creating caution in crypto markets.

- DeFi Dynamics: In DeFi, stablecoins are crucial for lending and trading. Higher Treasury yields can reduce activity and potentially lower stablecoin pool yields.

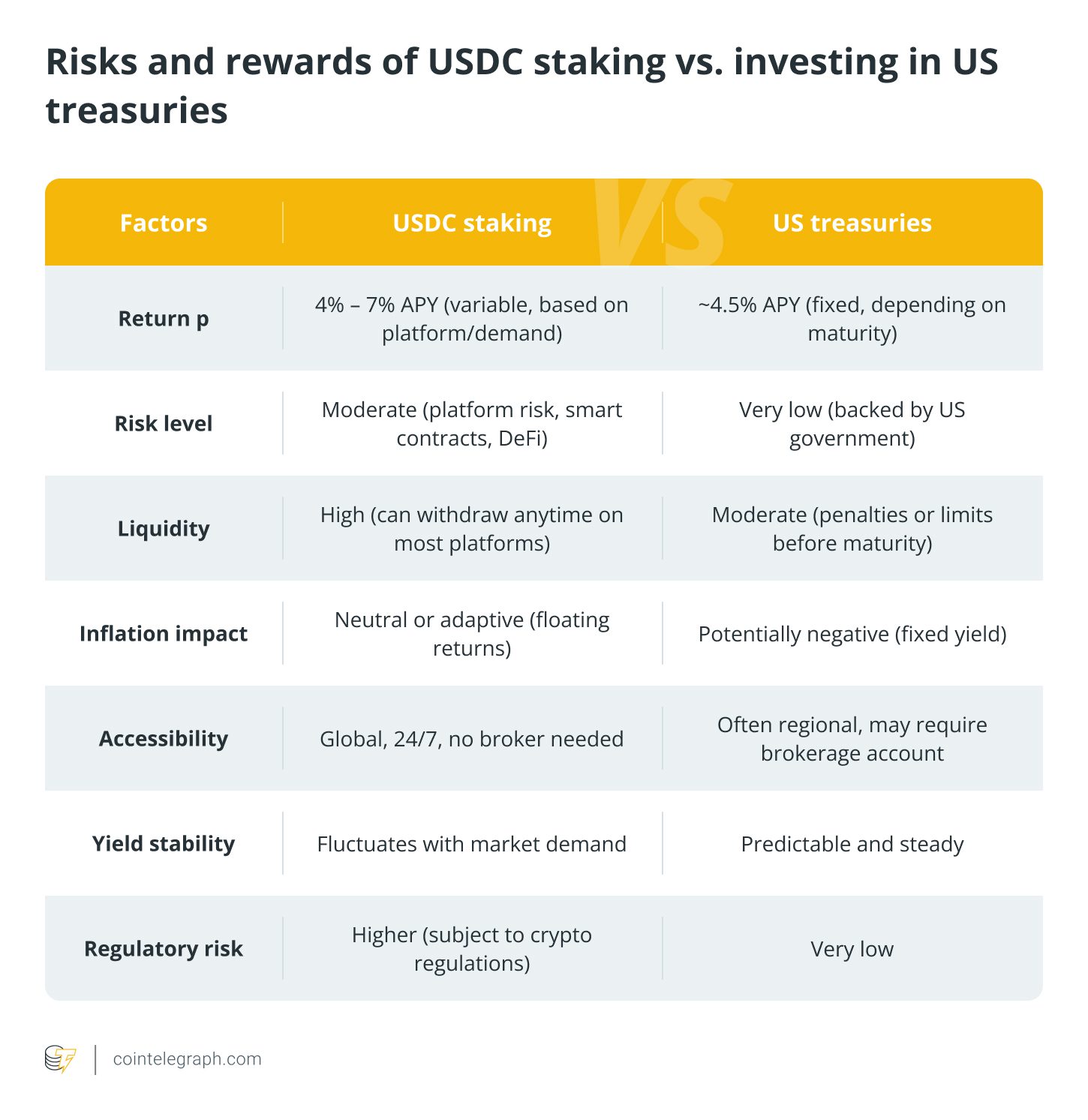

USDC vs. US Treasurys: Where to Invest?

USDC staking offers higher, but variable, yields with moderate risk, while U.S. Treasurys provide stable, low-risk returns backed by the government. USDC staking can yield between 4% and 7% APY, but carries risks like smart contract bugs and platform failures. Treasurys offer a fixed return, currently around 4.37%-4.39%, and are considered one of the safest investments.

Implications for Crypto Investors

Higher Treasury yields may reduce risk appetite among crypto investors. Monitoring Treasury yields can provide insights into potential shifts in crypto yields and market risks. Investors can also explore tokenized Treasurys as a secure alternative.

The Rise of Tokenized Treasurys

Tokenized Treasurys, digital representations of U.S. Treasury bonds on blockchains, are gaining traction. As of May 2025, the total value of tokenized Treasurys reached $6.5 billion, with an average yield to maturity of 4.13%. This trend offers crypto investors a way to earn yields comparable to traditional bonds, mitigating the impact of rising Treasury yields on crypto markets. This also signals the integration of real-world assets (RWAs) into crypto markets.

Additional Considerations for Crypto Investors:

- Market Volatility: The crypto market is known for its volatility. External factors, such as macroeconomic trends, regulations, and technological advancements, can significantly impact crypto prices and yields.

- Regulatory Environment: Regulatory uncertainty surrounding crypto assets can influence investor sentiment and market activity. Stay informed about regulatory developments in your jurisdiction and globally.

- Risk Management: It is essential to assess your risk tolerance and investment goals before investing in crypto assets. Consider diversifying your portfolio and using risk management tools such as stop-loss orders to mitigate potential losses.

- Technological Innovation: The crypto space is continuously evolving, with new technologies and projects emerging regularly. Stay up-to-date on the latest developments and innovations in the crypto space to make informed investment decisions.

- Security Practices: Protect your crypto assets by implementing robust security measures, such as using hardware wallets, enabling two-factor authentication, and being cautious of phishing scams and fraudulent schemes.