US Congressman Demands Clarity on SEC’s Evolving Ethereum Stance: What’s Next for ETH?

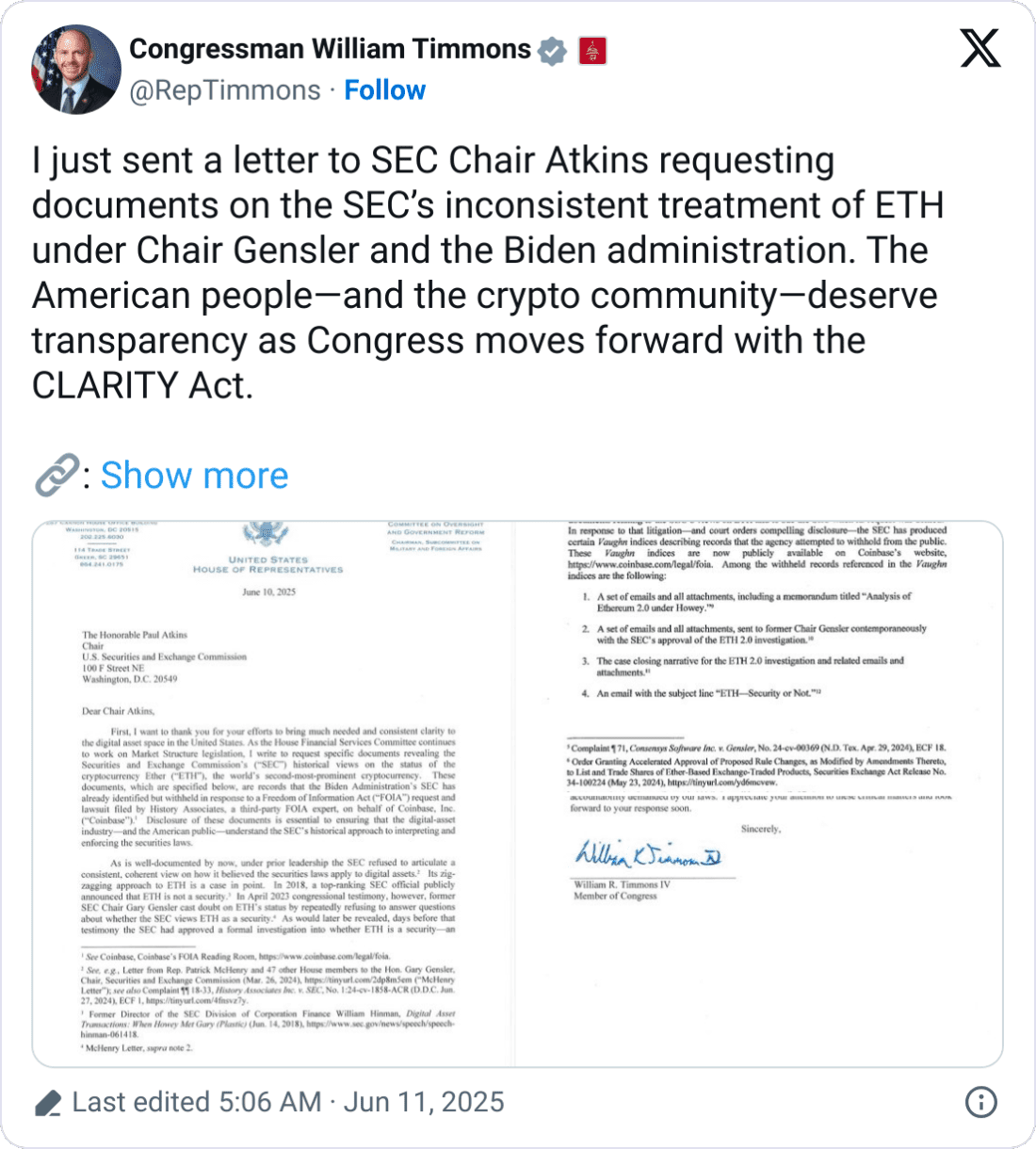

Republican Representative William Timmons has requested US Securities and Exchange Commission (SEC) Chair Paul Atkins to provide documents detailing the agency’s historical treatment of Ether (ETH) under the previous leadership of Gary Gensler. This move intensifies scrutiny on the SEC’s approach to crypto regulation and raises questions about the future classification of ETH.

Quick Summary of the News

- Rep. Timmons sent a letter to SEC Chair Paul Atkins requesting documents on the SEC’s historical views on the status of Ether (ETH).

- The request aims to clarify the SEC’s evolving stance on whether ETH should be classified as a security.

- Timmons highlights inconsistencies in the SEC’s approach, noting that former SEC officials once stated ETH wasn’t a security, while Chair Gensler later cast doubt on this.

- The letter follows a Freedom of Information Act (FOIA) request by Coinbase regarding the SEC’s ETH views, which led to a lawsuit.

- The outcome of this inquiry could impact the regulatory framework for ETH and the broader crypto market.

Why It Matters

The classification of Ethereum as a security or a commodity has significant implications for the crypto market. If ETH is deemed a security, it would be subject to stricter regulations, potentially impacting exchanges, custody providers, and investors. A clear and consistent regulatory framework is crucial for fostering innovation and attracting institutional investment. Timmons’ request underscores the ongoing debate and uncertainty surrounding crypto regulation in the US.

Market Impact

The ongoing uncertainty surrounding ETH’s regulatory status can create market volatility. Here’s a simplified view:

- Positive Scenario (ETH classified as a commodity): Increased institutional investment, price appreciation, and wider adoption.

- Negative Scenario (ETH classified as a security): Stricter regulations, potential delisting from some exchanges, and decreased liquidity.

Expert Take or Personal Insight

The SEC’s evolving stance on Ethereum has been a source of confusion and frustration for the crypto industry. While the approval of ETH ETFs signaled a potential shift towards a more favorable regulatory environment, Timmons’ letter highlights the lingering questions and inconsistencies in the SEC’s approach. I believe that greater transparency and clarity from regulators are essential for fostering a healthy and innovative crypto ecosystem. The pressure from Congress could force the SEC to provide a more definitive and consistent framework, ultimately benefiting the market.

Actionable Insight

Traders and investors should closely monitor the developments surrounding this SEC inquiry. Key things to watch:

- SEC’s response to Timmons’ request: The content of the documents released could provide valuable insights into the SEC’s thinking on ETH.

- Coinbase lawsuit: The outcome of the lawsuit could force the SEC to disclose more information about its internal deliberations.

- Market reaction: Be prepared for potential price volatility in ETH as the regulatory landscape evolves.

Conclusion

Timmons’ demand for transparency from the SEC marks a significant step in the ongoing debate about crypto regulation. The outcome of this inquiry could have far-reaching consequences for Ethereum and the broader digital asset market. Moving forward, increased regulatory clarity is crucial for fostering innovation and attracting institutional investment in the crypto space.