Patel Real Estate Holdings (PREH) has launched a $100 million tokenization fund on the Chintai blockchain. This initiative aims to provide accredited investors with access to institutional-grade real estate opportunities.

Key Highlights of the PREH Multifamily Fund

The new PREH Multifamily Fund is designed as a tokenized investment vehicle. It will focus on vintage Class A multifamily units located across the top 20 US growth markets, as confirmed by a PREH spokesperson on May 12.

- Digital-Native Structure: The entire fund structure is digitally native from the outset, ensuring compliant onboarding, reporting, capital calls, and potential secondary market transfers.

- Institutional Backing: The fund is part of a broader $750 million investment vehicle co-developed by PREH and several institutional firms, including Carlyle, DRA Advisors, Walton Street Capital, RPM, and KKR.

- Initial Tokenization: Initially, $25 million of the $100 million allocation will be tokenized on the Chintai blockchain.

According to PREH, this tokenization structure addresses and mitigates many of the transparency and liquidity issues typically encountered by investors in private market placements.

About Patel Real Estate Holdings (PREH)

Founded in 2010, PREH is a national real estate asset manager responsible for overseeing a portfolio of Class A multifamily properties. The company manages the acquisition, financing, and overall management of these properties.

- Real Estate Transactions: Since its inception, PREH has completed real estate transactions valued at over $500 million.

Chintai Blockchain: Powering Real-World Asset Tokenization

Chintai is a layer-1 blockchain focused on tokenization, also powering the R3 Sustainability Fund for environmental, social, and governance (ESG) investing. Its native token, CHEX, has a total market capitalization of $244 million, with a value of $0.24 per token, according to CoinMarketCap.

“We chose Chintai because they offer a fully regulated, institutional-grade platform purpose-built for tokenizing real-world assets,” PREH’s president, Tejas Patel, said, adding:

“Their technology allows us to maintain the highest standards of compliance and investor protections while introducing the efficiencies and access advantages of blockchain.”

The Rise of Real Estate Tokenization

Real estate tokenization is increasingly viewed as a method to modernize property investment, although real-world implementations were initially limited. By early 2025, real estate tokenization gained substantial traction in North America and the United Arab Emirates, with ongoing efforts in Europe to create supportive regulatory frameworks.

Key Benefits of Tokenizing Real Estate

- Eliminating Illiquidity: One of the primary advantages of tokenization is the ability to eliminate the illiquidity discount traditionally associated with real estate investments.

- Secondary Markets: The growth of liquid secondary markets for fractional real estate ownership can significantly enhance this advantage.

This motivation also led RWA platform DigiShares to launch the REX marketplace on Polygon, featuring luxury property listings in Miami, Florida. Blocksquare and Vera Capital have partnered to tokenize commercial real estate, aiming to offer fractional ownership of over $1 billion worth of properties.

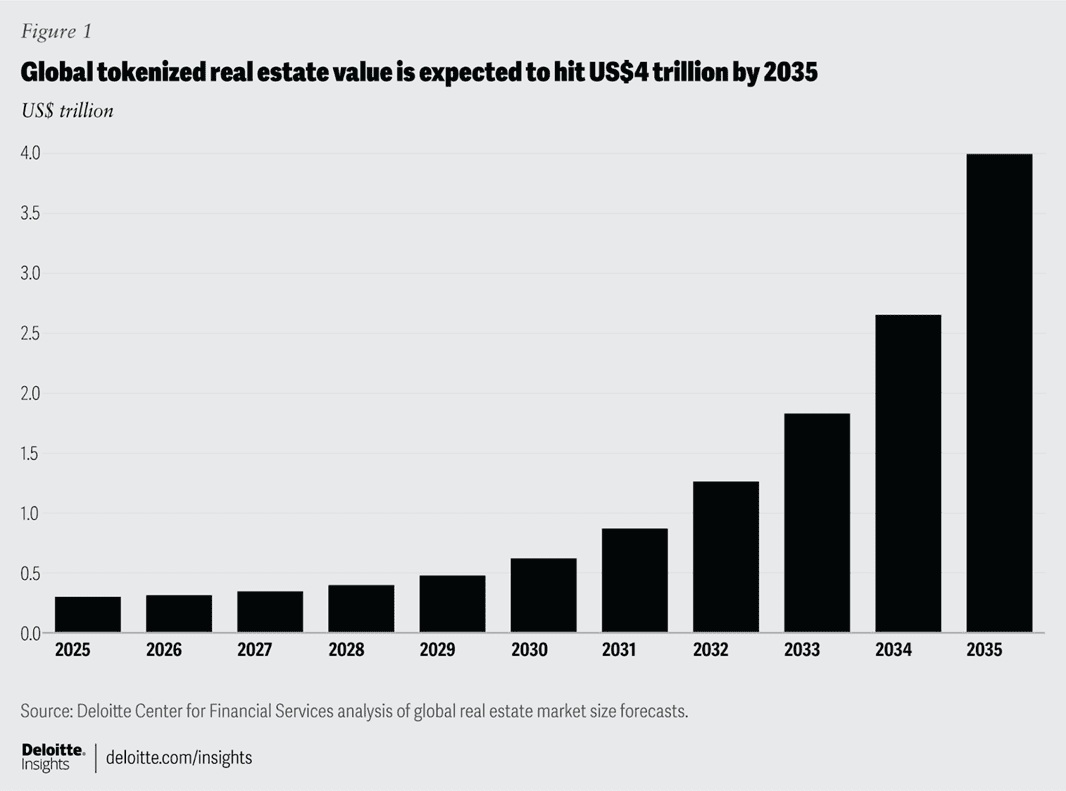

Deloitte forecasts that $4 trillion worth of real estate will be tokenized on the blockchain within the next decade.

Impact and Future Outlook

The tokenization of real estate represents a significant shift in how real estate investments are approached. By fractionalizing ownership and leveraging blockchain technology, investors gain access to previously inaccessible markets with increased liquidity and transparency.

Potential Benefits of Real Estate Tokenization

- Increased Liquidity: Tokenization allows for easier buying and selling of real estate assets compared to traditional methods.

- Greater Accessibility: Smaller investment amounts make real estate investment accessible to a broader range of investors.

- Improved Transparency: Blockchain technology ensures transparent and verifiable transactions.

- Reduced Costs: Streamlined processes and reduced intermediary involvement can lower transaction costs.

As regulatory frameworks continue to evolve and acceptance grows, real estate tokenization is poised to transform the landscape of property investment, bringing new opportunities to both investors and real estate asset managers.