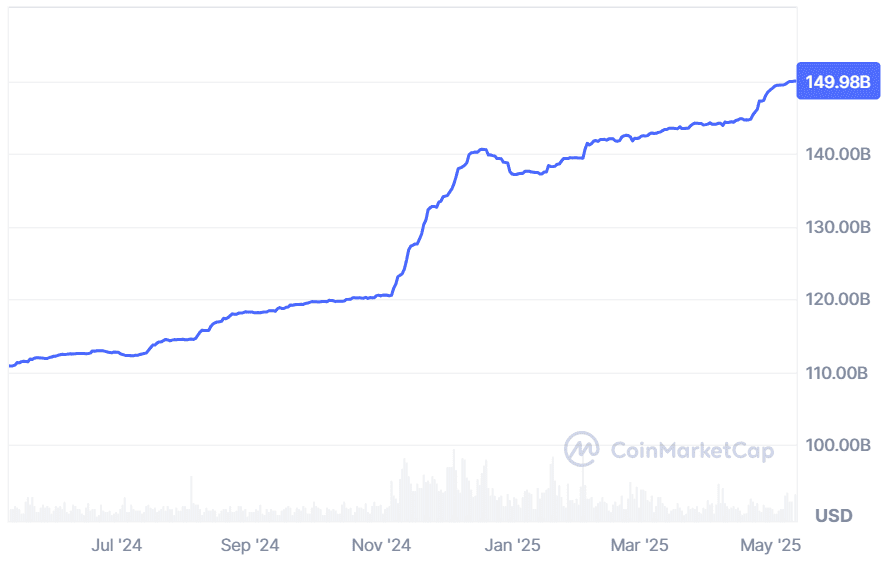

Tether’s USDt (USDT), the world’s largest stablecoin, has achieved a significant milestone, exceeding a $150 billion market capitalization for the first time on May 12, 2025. This surge reflects the increasing adoption of stablecoins within the cryptocurrency ecosystem. This article provides a comprehensive overview of Tether’s growth, its strategic move towards US expansion, and the broader implications for the stablecoin market.

The circulating supply of USDt has grown by over 36% in the past year, with accelerated growth observed since November. This expansion highlights USDt’s pivotal role in providing liquidity and facilitating crypto trading.

USDt’s Dominance in the Stablecoin Market

Tether currently commands approximately 61% of the global stablecoin market, solidifying its position as the dominant player. Circle’s USDC follows with nearly 25% market share. This dominance underscores USDt’s importance as a barometer for overall cryptocurrency demand.

Key Factors Driving USDt Growth

- Increased Stablecoin Adoption: The overall growth of stablecoins indicates a rising demand for digital assets pegged to fiat currencies.

- Liquidity Provision: USDt serves as a crucial source of liquidity for cryptocurrency exchanges, facilitating seamless trading.

- Market Confidence: Despite regulatory scrutiny, USDt has maintained its peg, bolstering investor confidence.

Tether’s US Expansion Plans

Despite its global presence, Tether’s operations are currently restricted in the United States. However, the company is actively planning to launch a new dollar-backed stablecoin specifically for the US market.

Tether’s CEO, Paolo Ardoino, stated that this domestic stablecoin would operate differently from the existing international version. This move signals Tether’s commitment to complying with US regulations and capitalizing on the growing crypto-friendly legislative landscape.

Lobbying Efforts and Regulatory Landscape

Tether is increasing its lobbying efforts in Washington as US lawmakers consider various stablecoin-related bills. One prominent example is the STABLE Act, introduced by House Financial Services Committee members. However, the STABLE Act has faced criticism, with concerns raised about its potential for weak state standards and inadequate federal supervision.

Challenges and Criticisms

- Regulatory Scrutiny: Stablecoins, including USDt, face increasing regulatory scrutiny due to concerns about transparency and financial stability.

- Reserve Transparency: Tether has faced criticism regarding the transparency of its reserves backing USDt.

- Competition: The stablecoin market is becoming increasingly competitive, with the emergence of new players and central bank digital currencies (CBDCs).

The Future of Stablecoins and Tether

The future of stablecoins is intertwined with regulatory developments and technological advancements. As governments worldwide explore digital currencies, the role of stablecoins like USDt is likely to evolve. Tether’s ability to adapt to changing regulations and maintain its market position will be crucial for its long-term success.

Potential Impact of US Expansion

- Increased Adoption: A US-compliant stablecoin could significantly boost stablecoin adoption within the US market.

- Market Competition: The entry of a new USDt variant could intensify competition among stablecoin issuers.

- Regulatory Clarity: Tether’s US expansion could contribute to greater regulatory clarity for the stablecoin industry.

Conclusion

Tether’s USDt reaching a $150 billion market cap is a testament to the growing importance of stablecoins in the cryptocurrency market. As Tether pursues its US expansion plans, it faces both opportunities and challenges. The regulatory landscape, competition, and the need for transparency will shape its future trajectory. Understanding these factors is crucial for anyone involved in the cryptocurrency space.