Asset manager VanEck has submitted a filing to US regulators to list an exchange-traded fund (ETF) holding BNB, the native token of Binance’s BNB Chain. This marks the first time a company has sought approval for a BNB ETF in the United States. Let’s dive into the details of this proposed ETF and its potential implications for the crypto market.

What is the VanEck BNB ETF?

The proposed ETF aims to accumulate spot BNB tokens. According to the S-1 prospectus filed with the SEC, VanEck may also stake a portion of the fund’s assets through trusted staking providers to generate yield. This staking activity could offer additional returns to ETF investors.

Here’s a breakdown of key aspects:

- Objective: To provide investors with exposure to BNB without directly holding the token.

- Holdings: Primarily spot BNB tokens.

- Staking: Potential for staking a portion of the assets to generate yield.

- First-of-its-Kind: The first BNB ETF filing in the US.

BNB currently has a market capitalization of approximately $84 billion. Staking BNB currently yields around 2.5%.

BNB Chain: A Leading Smart Contract Network

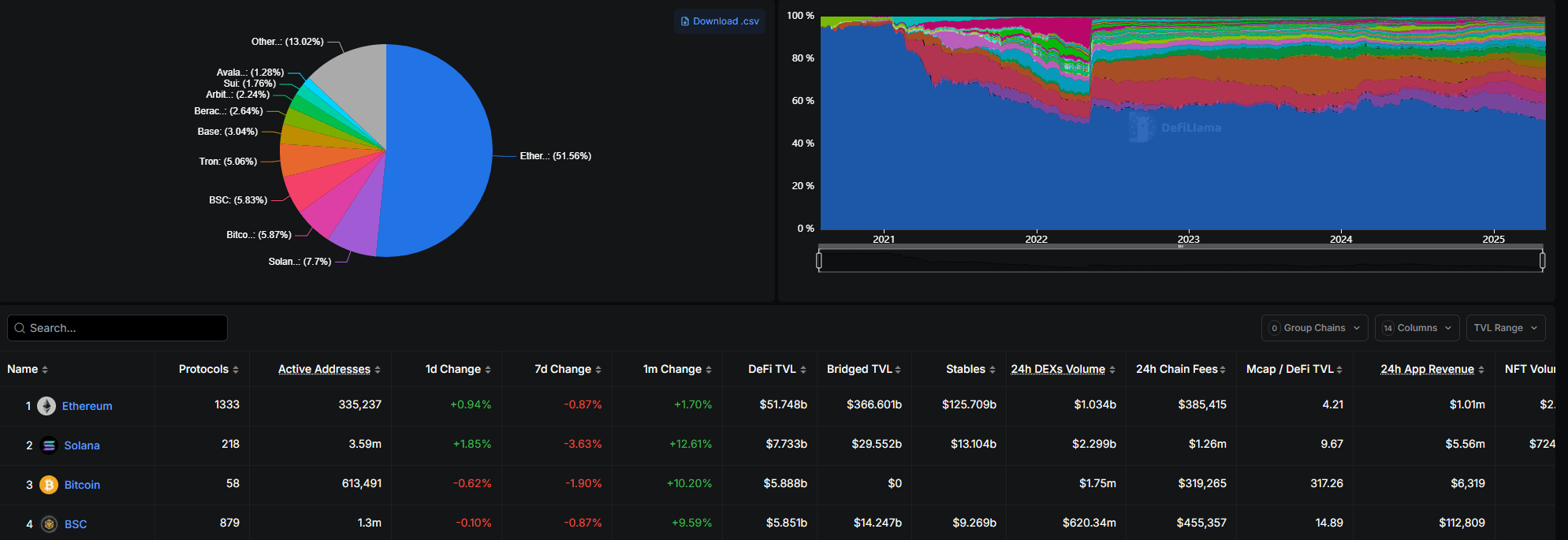

Binance’s BNB Chain is a prominent smart contract network, with a total value locked (TVL) of nearly $6 billion. This indicates significant activity and adoption within the BNB Chain ecosystem. The BNB chain boasts lower fees and faster transaction times than Ethereum, which has contributed to its popularity.

Bitcoin ETF Influence and Altcoin ETFs

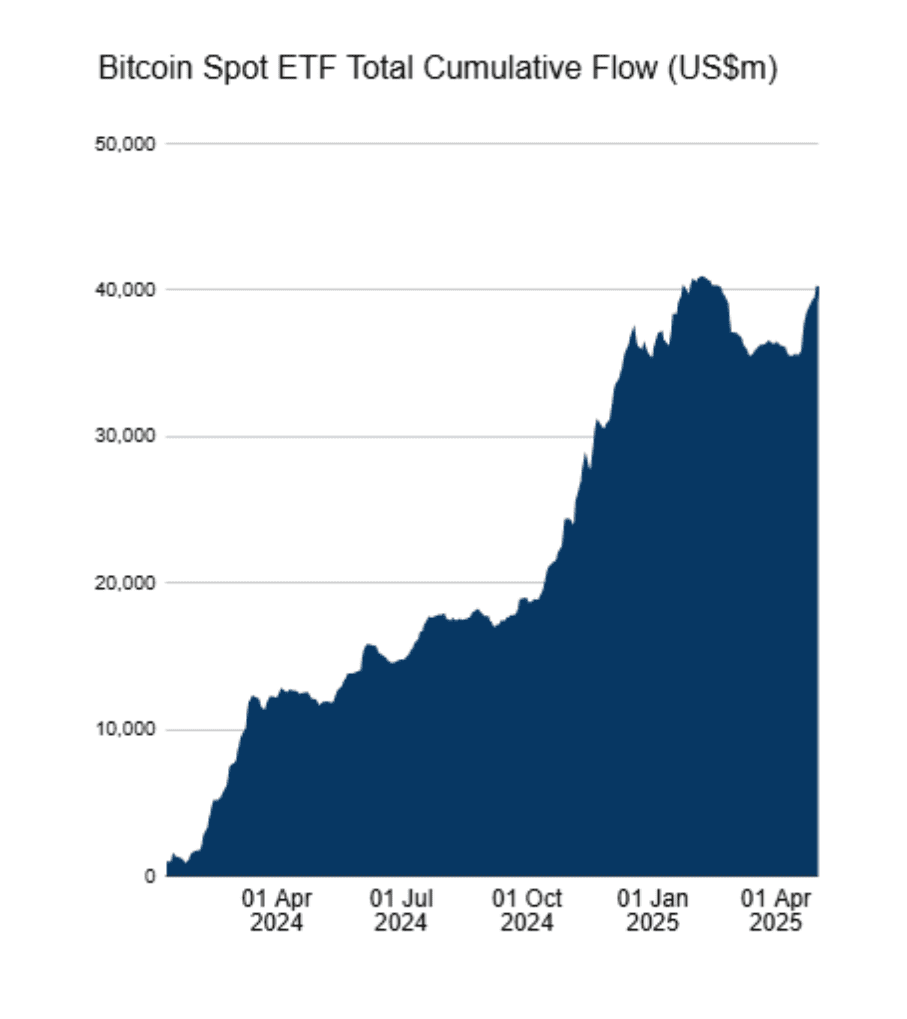

The filing follows comments from Binance co-founder Changpeng “CZ” Zhao, who suggested that the success of Bitcoin ETFs would eventually extend to altcoins. Spot Bitcoin ETFs have seen substantial net inflows since their launch in January 2024, exceeding $40 billion.

CZ’s prediction suggests a potential “spillover” effect, where the increased institutional and retail interest in crypto ETFs could lead to greater demand for ETFs holding other cryptocurrencies like BNB.

This filing is part of a larger trend of companies seeking to list ETFs holding various altcoins. The SEC has received numerous cryptocurrency ETF proposals since January 20. These proposals include ETFs focused on layer-1 tokens like Solana (SOL) and Avalanche (AVAX), as well as meme coins such as Dogecoin (DOGE). VanEck has also filed applications for Solana and Avalanche ETFs.

Potential Benefits of a BNB ETF

A BNB ETF could offer several advantages to investors:

- Simplified Exposure: Provides a regulated and accessible way for investors to gain exposure to BNB without the complexities of direct ownership, such as managing private keys and wallets.

- Increased Liquidity: ETFs are traded on major stock exchanges, offering high liquidity and ease of buying and selling.

- Diversification: Allows investors to diversify their portfolios with cryptocurrency exposure within a traditional investment vehicle.

- Potential Yield: The possibility of yield generation through staking could make the ETF more attractive.

Challenges and Considerations

Despite the potential benefits, a BNB ETF also faces challenges:

- Regulatory Approval: The SEC has historically been cautious about approving cryptocurrency ETFs, and the approval process can be lengthy and uncertain.

- Market Volatility: The cryptocurrency market is known for its volatility, which could impact the ETF’s performance.

- Regulatory Scrutiny of Binance: Binance has faced regulatory scrutiny in the past, which could raise concerns about the stability and compliance of the BNB ecosystem.

Conclusion

VanEck’s filing for a BNB ETF represents a significant step in the evolution of cryptocurrency investment products. If approved, it could provide a new avenue for investors to access the BNB ecosystem and contribute to the broader adoption of cryptocurrencies. The success of the ETF will depend on regulatory approval, market conditions, and investor appetite for exposure to BNB.