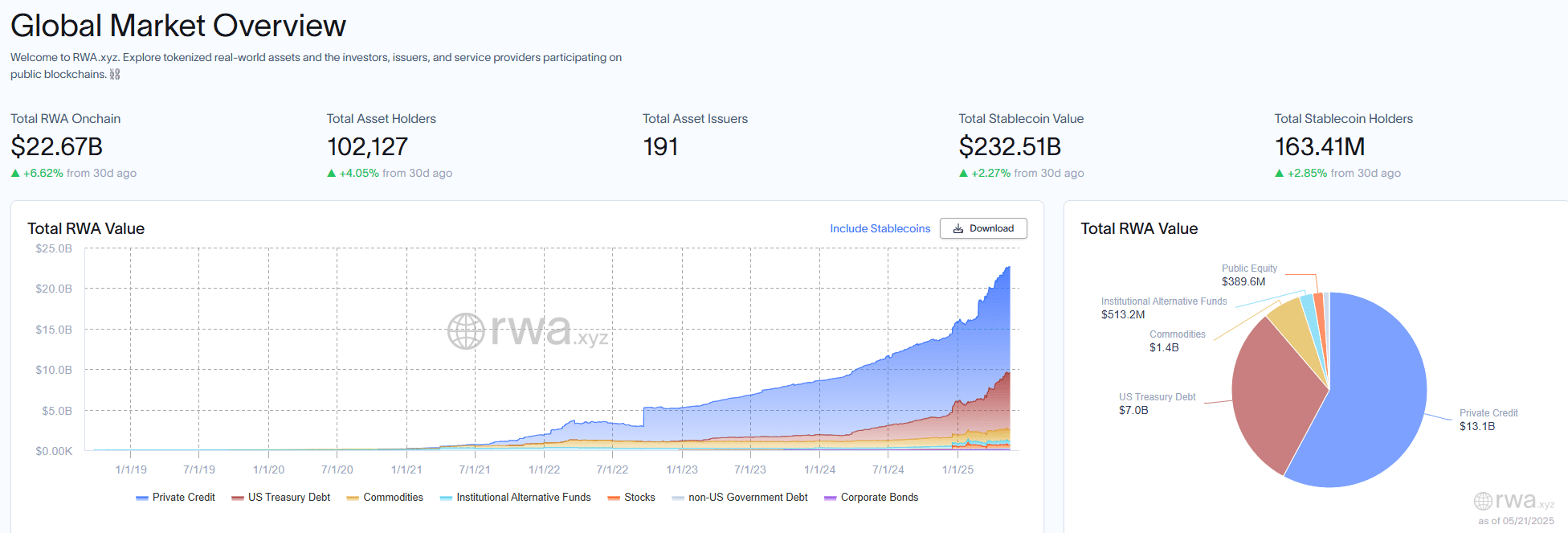

VanEck, a prominent asset manager, is set to launch the VanEck PurposeBuilt Fund in June, a private digital assets fund strategically aimed at tokenized Web3 projects developed on the Avalanche blockchain network. This move underscores VanEck’s belief in the potential of real-world asset (RWA) tokenization and the burgeoning Avalanche ecosystem.

The VanEck PurposeBuilt Fund will be exclusively available to accredited investors and will focus its investments on both liquid tokens and venture-backed projects within diverse Web3 sectors. Key areas of interest include gaming, financial services, payments, and the rapidly evolving field of artificial intelligence. The fund aims to strategically deploy idle capital into Avalanche (AVAX) based real-world asset (RWA) products, specifically targeting tokenized money market funds.

The fund’s management will be overseen by the experienced team behind VanEck’s Digital Assets Alpha Fund (DAAF), which currently manages over $100 million in net assets as of May 21. This ensures a robust and knowledgeable approach to investment within the digital asset space.

“The next wave of value in crypto will come from real businesses, not more infrastructure,” stated Pranav Kanade, portfolio manager for DAAF, highlighting the fund’s focus on tangible applications of blockchain technology.

Thematic Crypto Funds: Capitalizing on Web3 Growth

VanEck’s PurposeBuilt Fund is part of a growing trend of thematic funds designed to provide investors with targeted exposure to fast-growing segments within the Web3 landscape. This includes other recent initiatives by VanEck themselves.

On May 14, VanEck launched a new actively managed exchange-traded fund (ETF) focused on investing in stocks and financial instruments linked to the digital economy. Furthermore, in April, VanEck introduced another ETF that tracks a passive index of companies operating within the broader crypto space. These moves signify a growing commitment to providing diverse investment opportunities within the digital asset market.

These ETF filings are partially driven by a perceived shift in regulatory sentiment towards crypto, potentially influenced by the US President Donald Trump softening the agency’s regulatory stance.

Avalanche: A Hub for Real-World Assets (RWAs)

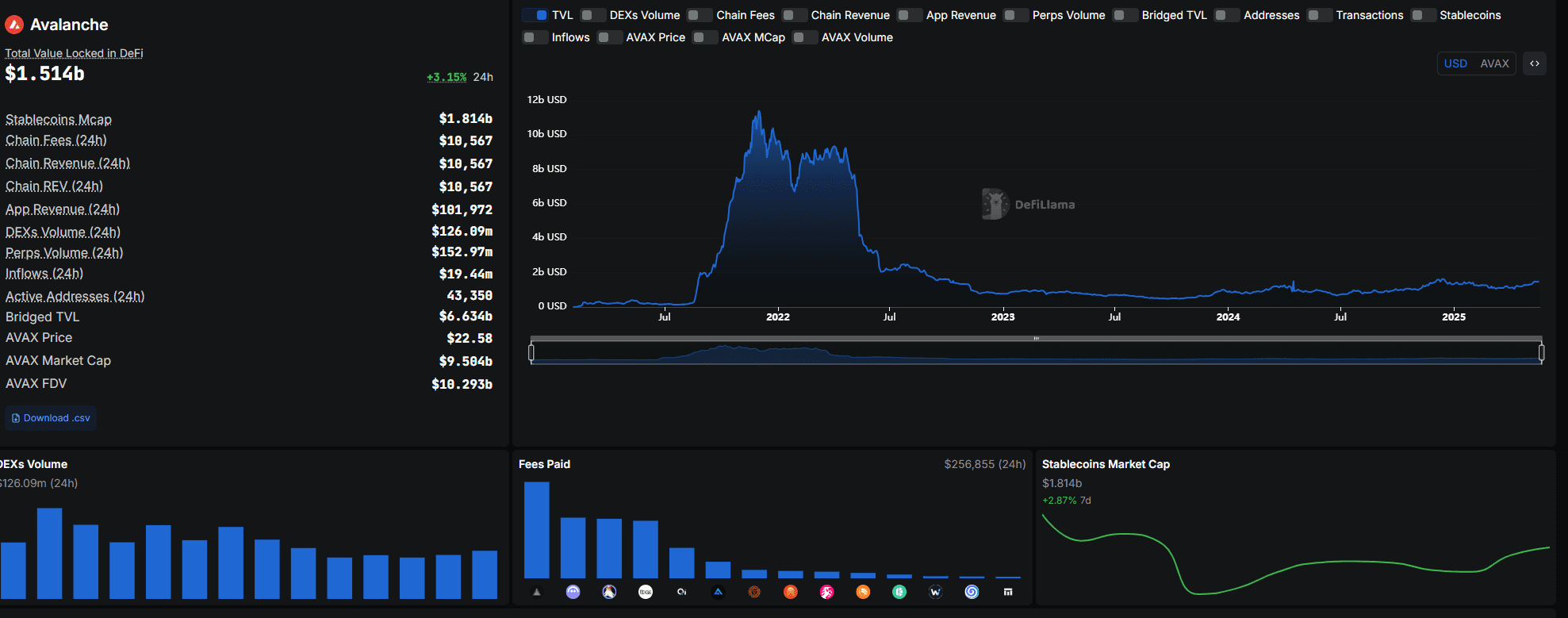

Avalanche has rapidly emerged as a leading blockchain platform for real-world assets (RWAs) and other institutional-oriented crypto projects. Its architecture, featuring interconnected networks called subnets, allows institutions to deploy Ethereum-style smart contracts within a controlled and customizable environment.

A prime example is Solv Protocol, which launched a yield-bearing Bitcoin token on the Avalanche blockchain on May 16, specifically targeting institutional investors. This token offers a yield backed by real-world assets, showcasing the growing potential of RWAs within the Avalanche ecosystem.

As of May 21, Avalanche boasts a Total Value Locked (TVL) of approximately $1.5 billion, according to data from DefiLlama, highlighting the platform’s growing adoption and the value being secured within its ecosystem.

John Nahas, chief business officer at Ava Labs, emphasizes this shift, stating, “We’re seeing a shift away from speculative hype toward real utility and sustainable token economies.”

Key Takeaways: VanEck’s Avalanche Fund

- Focus on Web3 and RWAs: The fund will primarily invest in tokenized Web3 projects and RWA assets built on the Avalanche blockchain.

- Accredited Investors Only: The VanEck PurposeBuilt Fund is a private fund, meaning it’s only available to accredited investors.

- Experienced Management: The fund will be managed by the team behind VanEck’s Digital Assets Alpha Fund (DAAF), bringing established expertise to the table.

- Avalanche Ecosystem Emphasis: The fund reflects VanEck’s positive outlook on the Avalanche blockchain as a key player in the future of Web3 and RWA tokenization.

Why Avalanche? Understanding the Platform’s Appeal

Avalanche’s rise as a preferred platform for RWA tokenization can be attributed to several key factors:

- Subnets for Customization: Avalanche’s subnet architecture allows institutions to create custom blockchains tailored to their specific needs, offering greater control over compliance and security.

- High Throughput and Low Latency: Avalanche is designed for speed and efficiency, enabling fast transaction processing and low latency, crucial for real-world applications.

- Ethereum Compatibility: Avalanche is compatible with the Ethereum Virtual Machine (EVM), making it easier for developers to port existing Ethereum-based applications to the Avalanche platform.

- Growing Ecosystem: The Avalanche ecosystem is rapidly expanding, with a growing number of projects and developers building on the platform.

In conclusion, VanEck’s launch of the PurposeBuilt Fund signals a strong belief in the potential of the Avalanche ecosystem and the tokenization of real-world assets. As the Web3 landscape continues to evolve, such dedicated funds will play a crucial role in driving innovation and adoption.