VanEck has launched the Onchain Economy ETF (NODE), an actively managed fund focused on companies involved in the blockchain ecosystem. This ETF offers investors exposure to the growing digital economy without directly holding cryptocurrencies.

What is the VanEck Onchain Economy ETF (NODE)?

The NODE ETF, listed on the Cboe exchange, aims to invest in companies operating within the blockchain space. This includes:

- Crypto miners

- Exchanges

- Infrastructure providers

- Crypto-oriented financial technology platforms

VanEck will also consider companies that have publicly communicated plans to engage in the blockchain space through filings, earnings calls, or investor materials.

The fund is actively managed, allowing for adjustments to its portfolio based on market conditions and emerging opportunities within the onchain economy.

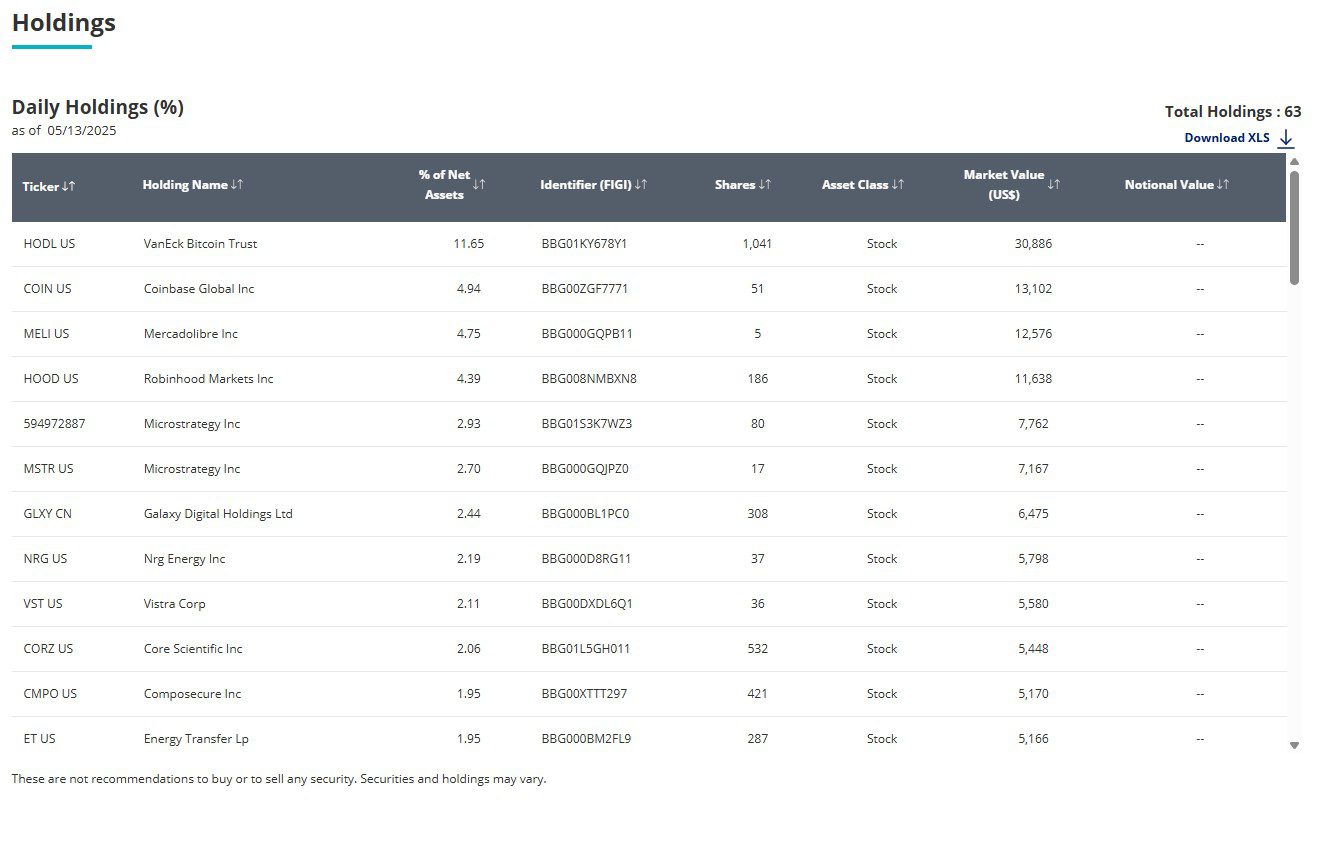

NODE ETF Strategy and Holdings

According to Matthew Sigel, VanEck’s head of digital asset research and the NODE ETF’s portfolio manager, the fund will continuously update its investable universe as new companies enter the space. The strategy involves adjusting beta and volatility to maintain responsible exposure to Bitcoin and businesses driving the onchain economy’s growth. This approach aims to avoid over-allocation to high-beta names during frothy markets and preserve buying power for future opportunities.

Key Features of the NODE ETF

- Actively Managed: Allows for dynamic adjustments based on market trends and emerging opportunities.

- Broad Exposure: Includes various companies within the blockchain ecosystem.

- No Direct Crypto Holdings: Invests in companies and crypto-related financial instruments, not the cryptocurrencies themselves.

- Dynamic Investment Universe: Continuously updated to include new companies and adapt to market changes.

Other VanEck Crypto-Related ETF Filings

VanEck has been actively involved in launching ETFs related to the digital asset space. In addition to the NODE ETF, they have also launched the VanEck Digital Transformation ETF (DAPP).

VanEck Digital Transformation ETF (DAPP)

The DAPP ETF invests in a passive index of companies operating in the digital asset space. As of May 14, it has $185 million in net assets.

Other ETF Filings

VanEck, along with other asset managers, has been seeking approval from the U.S. Securities and Exchange Commission (SEC) to list numerous crypto ETFs. The increasing number of filings reflects a growing interest in providing investors with regulated and accessible exposure to the cryptocurrency market.

Recently, VanEck filed for a BNB ETF, which would hold the BNB Chain’s native token.

The Growing Trend of Crypto ETFs

The launch of the NODE ETF and other similar funds highlights the increasing interest in providing investors with exposure to the blockchain and cryptocurrency space through traditional investment vehicles. These ETFs offer a regulated and diversified way to participate in the growth of the digital economy without directly holding cryptocurrencies.

The approval and launch of more crypto-related ETFs could further legitimize the cryptocurrency market and attract more institutional and retail investors.