What is VanEck’s Onchain Economy ETF ($NODE)?

VanEck’s Onchain Economy ETF ($NODE) offers investors exposure to companies at the forefront of blockchain technology and its real-world applications. Scheduled to begin trading on May 14, 2025, after its inception on May 13, 2025, this actively managed ETF focuses on companies that are integral to the digital asset ecosystem, but it doesn’t invest directly in cryptocurrencies like Bitcoin or Ether.

Instead, $NODE strategically invests in businesses that are leveraging blockchain for various applications, making it a compelling option for those seeking to participate in the growth of the blockchain economy without directly holding digital assets.

Key Features of the $NODE ETF:

- Actively Managed: A portfolio manager selects stocks based on their contribution to the blockchain economy.

- Diversified Exposure: Invests in a range of sectors, including data centers, cryptocurrency exchanges, and more.

- Indirect Crypto Exposure: Can allocate up to 25% of its assets to crypto-linked ETPs through a Cayman Islands subsidiary.

- Focus on Real-World Applications: Emphasizes companies using blockchain for tangible business solutions.

How Does the $NODE ETF Build Its Portfolio?

The $NODE ETF aims to hold between 30 and 60 stocks, selected from a pool of over 130 publicly traded companies. These companies are chosen for their involvement in the blockchain and digital asset space.

Sectors Covered by $NODE:

- Data Centers: Providing the infrastructure for blockchain networks.

- Cryptocurrency Exchanges: Platforms for trading digital assets (e.g., Coinbase).

- Miners: Verifying Bitcoin transactions.

- Crypto-Holding Companies: Businesses holding Bitcoin or other cryptocurrencies as part of their treasury.

- Traditional Financial Institutions: Integrating blockchain solutions into their services.

- Consumer and Gaming Enterprises: Using blockchain in consumer apps and gaming.

- Asset Managers: Developing investment vehicles tied to digital asset markets.

- Energy Infrastructure Providers: Supporting crypto mining operations.

- Semiconductor and Hardware Firms: Manufacturing chips for mining (e.g., Nvidia).

To further diversify, $NODE may allocate up to 25% to cryptocurrency ETPs, managed through a Cayman Islands subsidiary to navigate US tax regulations. This allows the ETF to gain exposure to digital assets indirectly.

Using Blockchain and Bitcoin Cycle Metrics

Unlike ETFs that track cryptocurrency prices, $NODE invests in companies that leverage blockchain for real-world applications. These applications span various sectors, including fintech, supply chain management, gaming, and digital identity.

VanEck uses Bitcoin cycle indicators, which are based on historical BTC price patterns, to dynamically adjust the ETF’s risk exposure. This strategy aims to optimize performance by aligning the portfolio with market sentiment and crypto-economic cycles.

By investing in $NODE, investors can tap into the broader influence of blockchain beyond speculative assets. The ETF offers a forward-thinking strategy that reflects the transformative potential of blockchain across the global economy.

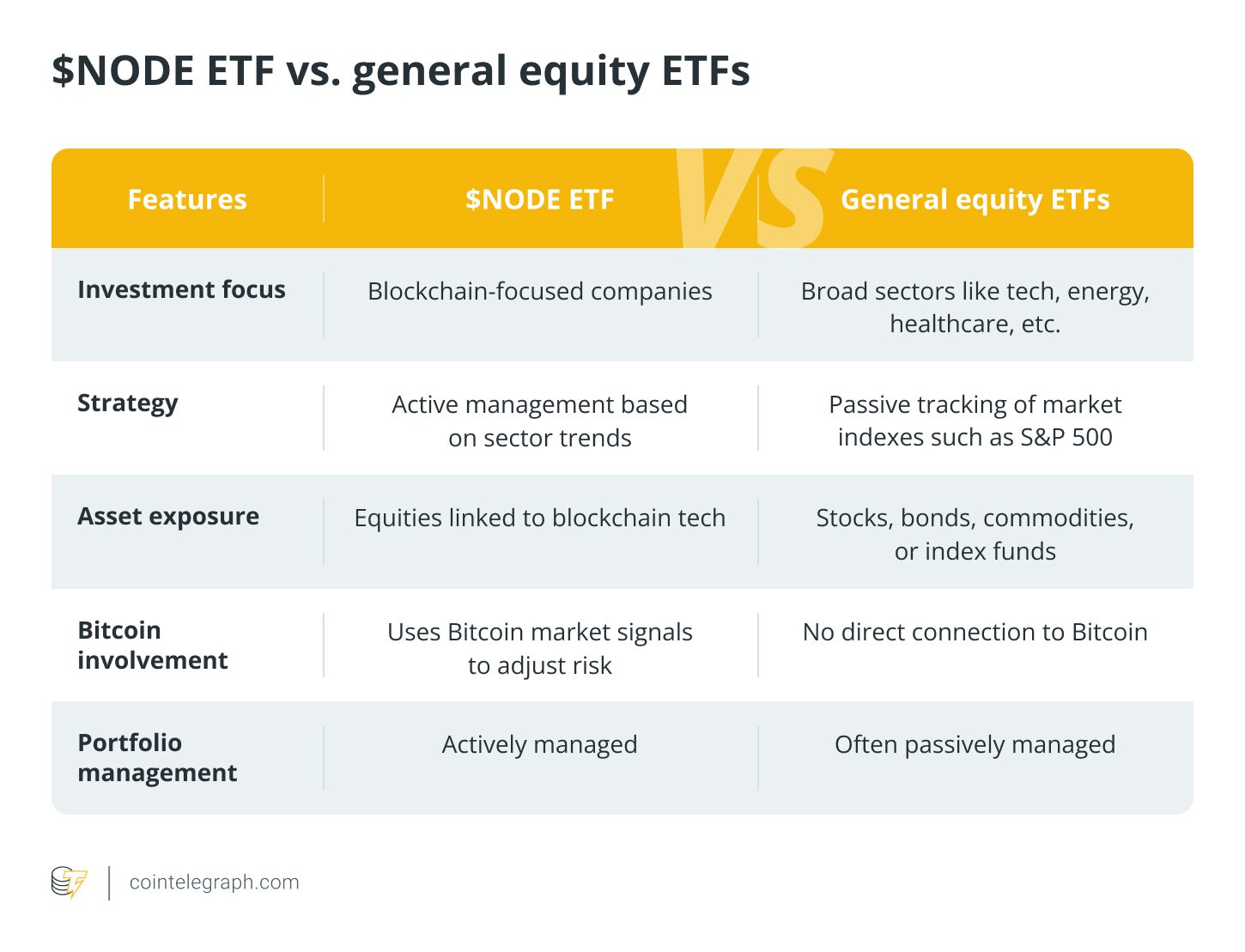

$NODE vs. General Equity ETFs

The $NODE ETF differs significantly from general equity ETFs. While broad-market funds track indexes like the S&P 500, $NODE focuses exclusively on companies involved in blockchain technology. General equity ETFs often use passive strategies, whereas $NODE is actively managed.

VanEck’s fund managers select companies based on their real-world contributions to the blockchain economy. While $NODE doesn’t directly hold Bitcoin or Ether, it uses Bitcoin cycle signals to adjust its risk exposure based on market conditions.

Here’s a comparison:

How to Buy $NODE

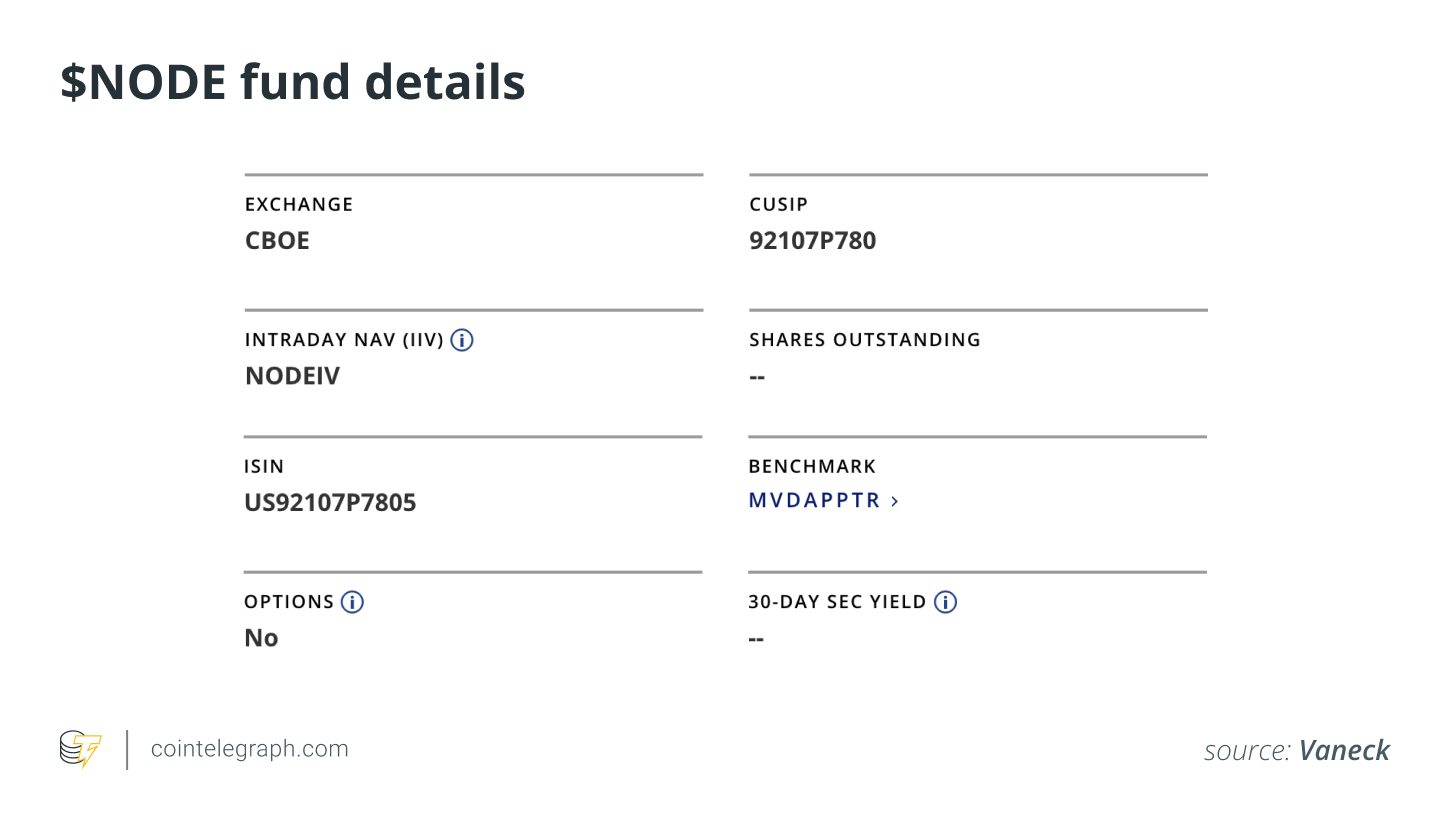

To invest in $NODE, you’ll need a brokerage account that provides access to the Cboe BZX Exchange. Once your account is set up, search for the ticker symbol “NODE.” Before buying, review the ETF’s details, including its management fee (0.69%) and investment strategy.

$NODE trades during regular market hours, like any other stock or ETF. Ensure you understand the fund’s objectives, holdings, and risks to align with your financial goals and risk tolerance.

Institutional Interest and Key Risks

The launch of $NODE coincides with increasing institutional interest in crypto-linked investments and a more supportive regulatory environment. Macro trends are also positive, with Bitcoin’s market dominance rising and public companies adding BTC to their treasuries.

However, $NODE is subject to crypto-sector risks, including market volatility, Bitcoin price fluctuations, and regulatory uncertainties. While it doesn’t hold cryptocurrencies directly, its portfolio is exposed to market shifts. Investors should consider these factors, balancing the ETF’s compliance and VanEck’s reputation with the sector’s inherent vulnerabilities.

Potential Risks of Investing in $NODE:

- Market Volatility: Exposure to fluctuations in the crypto market.

- Regulatory Changes: Potential impact from evolving regulations in the blockchain industry.

- Tech Stock Corrections: Vulnerability to corrections in the tech stock market.