May witnessed a slight cooling in crypto venture capital deals compared to the beginning of the year, but substantial funding rounds for tokenization platforms and a Hyperliquid wallet highlight ongoing activity in the space.

A standout event was the continuing momentum of Twenty One Capital, the Bitcoin ( ) treasury company backed by stablecoin issuer Tether, crypto exchange Bitfinex, and Wall Street firm Cantor Fitzgerald. Following their backers exercising the option to purchase additional convertible bonds last month, the company’s total funding soared to $685 million.

) treasury company backed by stablecoin issuer Tether, crypto exchange Bitfinex, and Wall Street firm Cantor Fitzgerald. Following their backers exercising the option to purchase additional convertible bonds last month, the company’s total funding soared to $685 million.

Twenty One Capital Gets a $100M Investment Boost

Twenty One Capital’s backers have exercised their option to acquire an additional $100 million in convertible senior secured notes, bringing the Bitcoin treasury company’s total funding to $685 million.

This news comes a month after Twenty One emerged with ambitious plans to acquire billions of dollars worth of Bitcoin.

Twenty One CEO Jack Mallers also announced the company’s launch of proof of reserves, a public ledger to verify its Bitcoin treasury holdings.

aZen Raises Seed Funds to Expand DePIN Efforts

Decentralized computing layer aZen finalized a $1.2 million seed round led by Waterdrip Capital, with participation from DWF Ventures, Rootz Labs, Mindfulness Capital, and others.

The company is developing decentralized physical infrastructure networks (DePINs) for AI applications, reducing reliance on advanced chips amidst supply chain disruptions from the US-China trade war.

The aZen platform claims to have onboarded over 500,000 users, including more than 80,000 active nodes for its DePIN testnet.

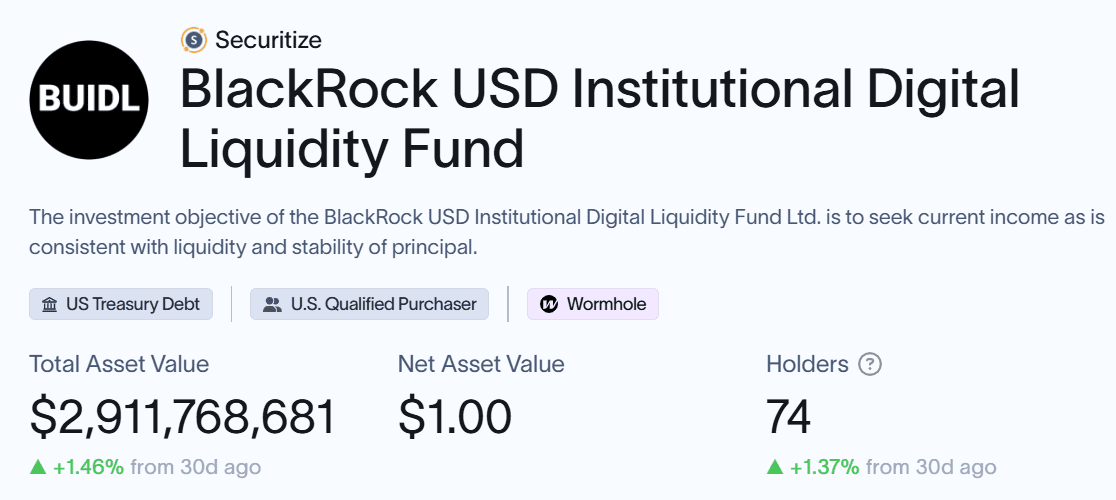

Jump Crypto Makes an Undisclosed Investment in Securitize

Venture capital firm Jump Crypto has made an undisclosed investment in tokenization platform Securitize to support increased institutional adoption of tokenized assets and collateral management solutions.

A Securitize spokesperson revealed that this investment marks the company’s first since BlackRock’s $47 million allocation in 2024.

Securitize has accumulated $4 billion in onchain assets, making it the largest tokenization market. BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL), tokenized by Securitize, accounts for nearly $3 billion in total value locked.

Tokenization Company Savea Raises $2.5M

Savea, a United Kingdom-based tokenization company, raised $2.5 million in seed funding to support its mission of launching tokenized investment products backed by scarce assets like wine, luxury watches, and classic cars.

The investment round was led by venture studio EmergentX, with participation from several unnamed angel investors.

Savea’s platform enables investors to purchase the SAVW token — an ERC-20 token fully backed by physical assets held in reserve. The assets are secured through a partnership with the Decentralized Storage and Tokenization Network (DESAT), also backed by EmergentX.

Hyperliquid-Powered Dexari Closes Seed Round

Self-custodial crypto wallet Dexari closed a $2.3 million seed round co-led by venture firms Prelude and Lemniscap, with additional participation from angel investors across the Hyperliquid ecosystem.

The funding will further develop Dexari’s wallet, which also acts as a mobile trading app, and add resources to its developer team. The company plans to eventually launch on the App Store and Play Store.

Lemniscap’s founder and managing partner, Roderik van der Graaf, described Dexari as “setting a new standard in crypto UX,” moving away from complexity.

Dexari is built on Hyperliquid, a decentralized exchange launched last November.