XRP (Ripple) has seen significant price volatility, leaving investors wondering about its future trajectory. This analysis dives into the key factors influencing XRP’s price, examining both potential bullish and bearish scenarios. We’ll consider technical indicators, whale activity, and broader market trends to provide a comprehensive outlook.

Key Factors Influencing XRP Price

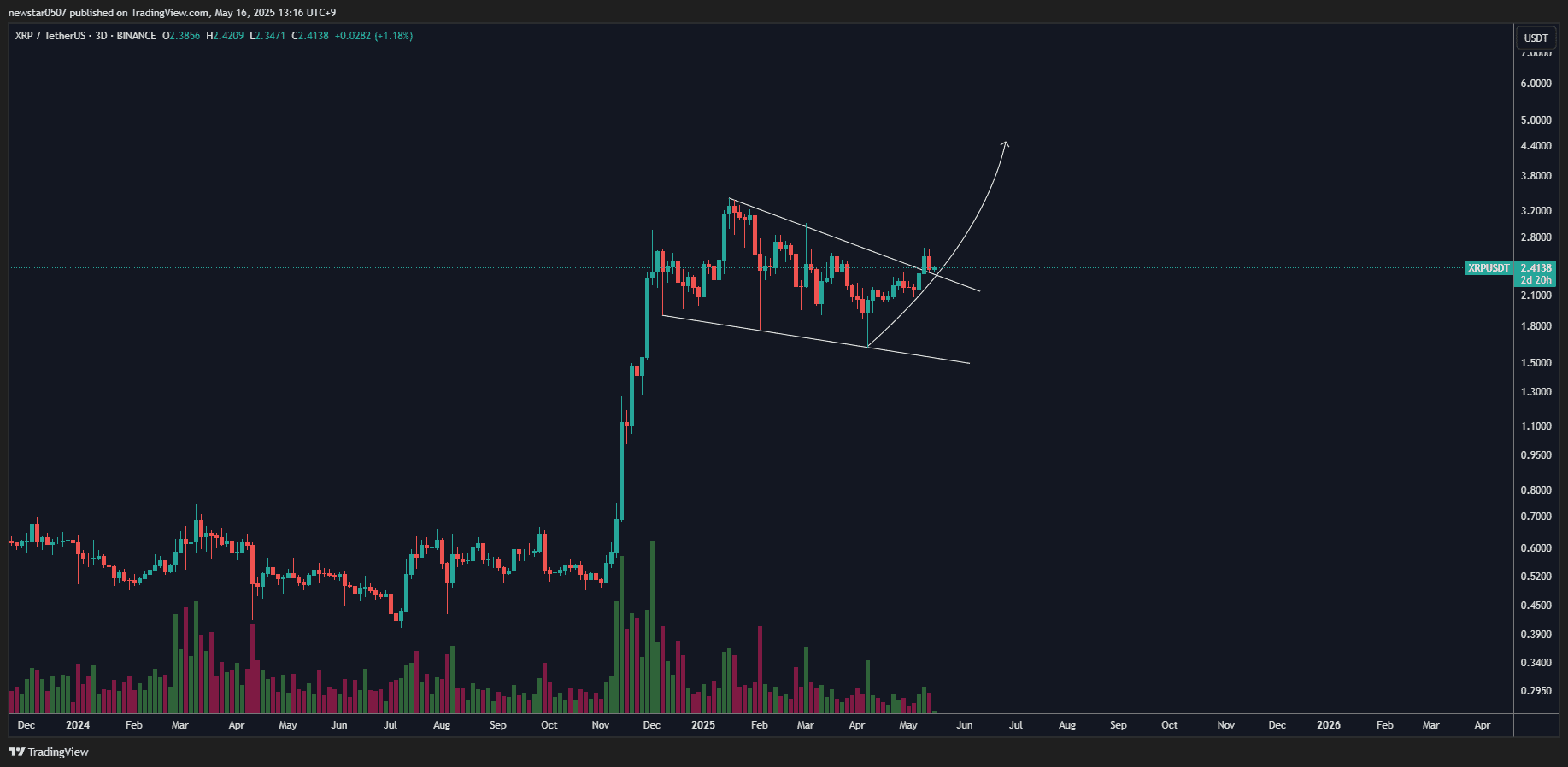

- Falling Wedge Breakout: XRP is currently retesting a falling wedge breakout pattern. A successful retest, where the price bounces off the upper trendline, could signal a strong bullish move towards $3.60.

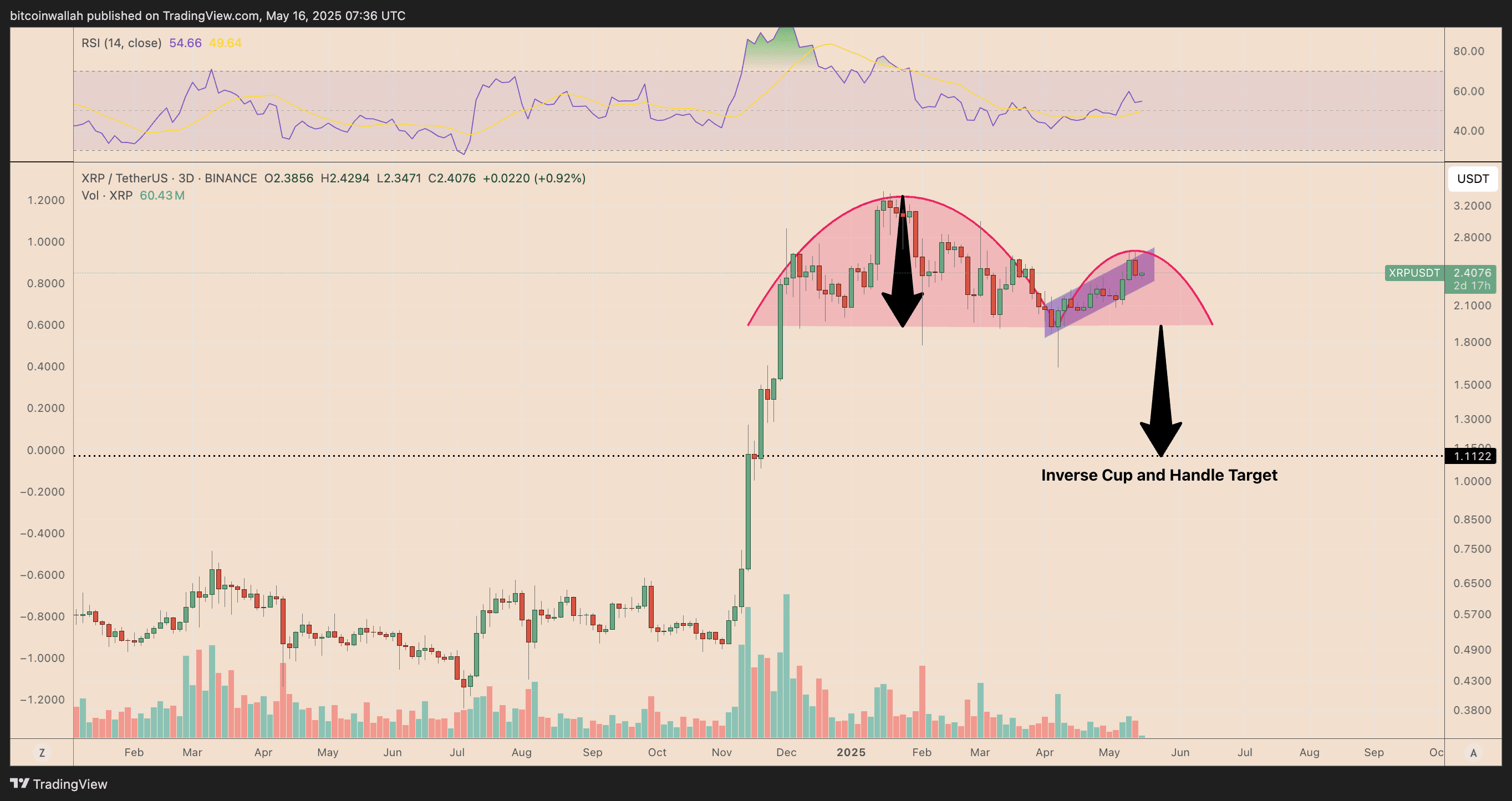

- Inverse Cup-and-Handle Pattern: Conversely, XRP may be forming a bearish inverse cup-and-handle pattern. A breakdown below the neckline support at $1.11 could trigger a sharp decline, potentially reaching $0.50.

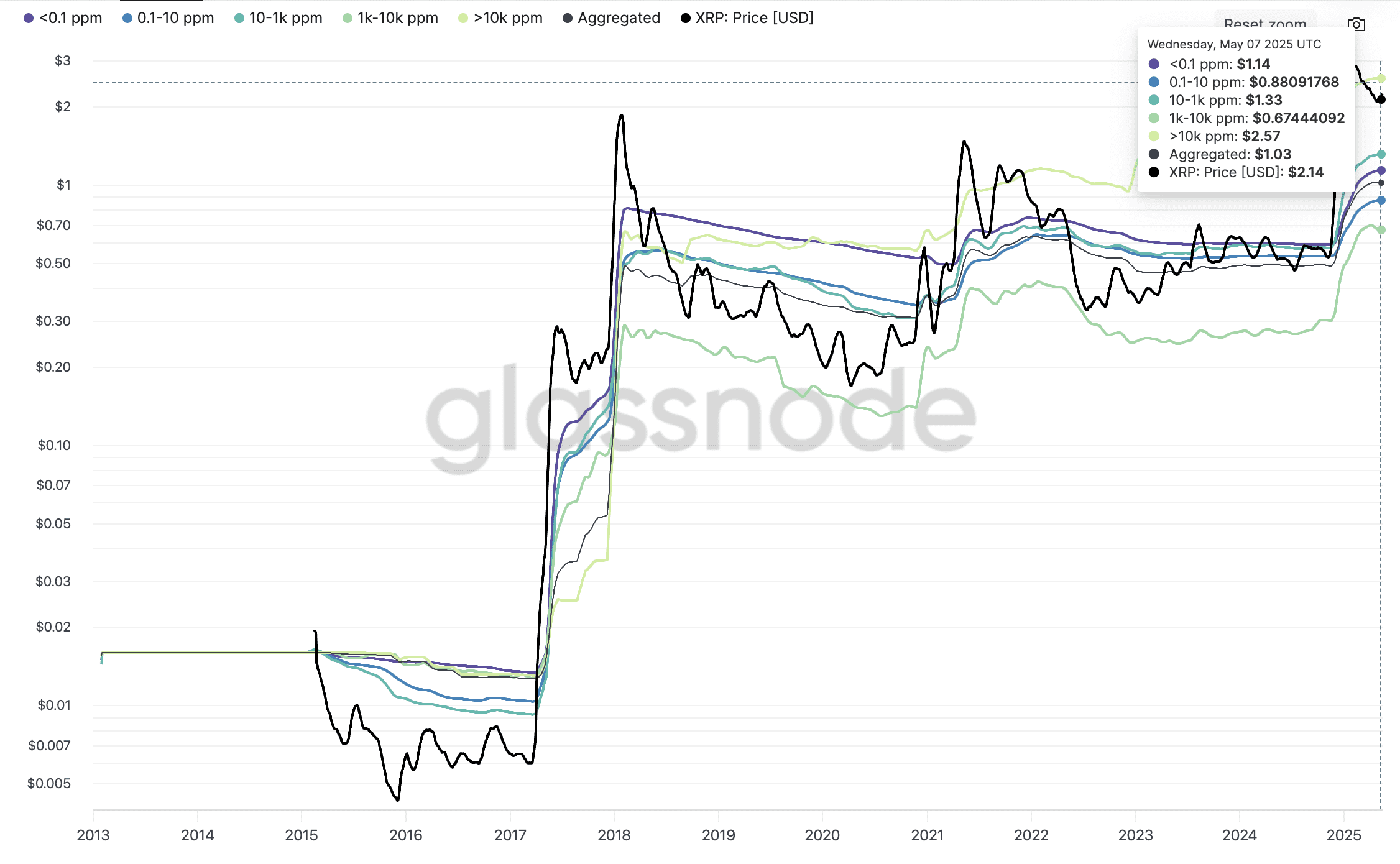

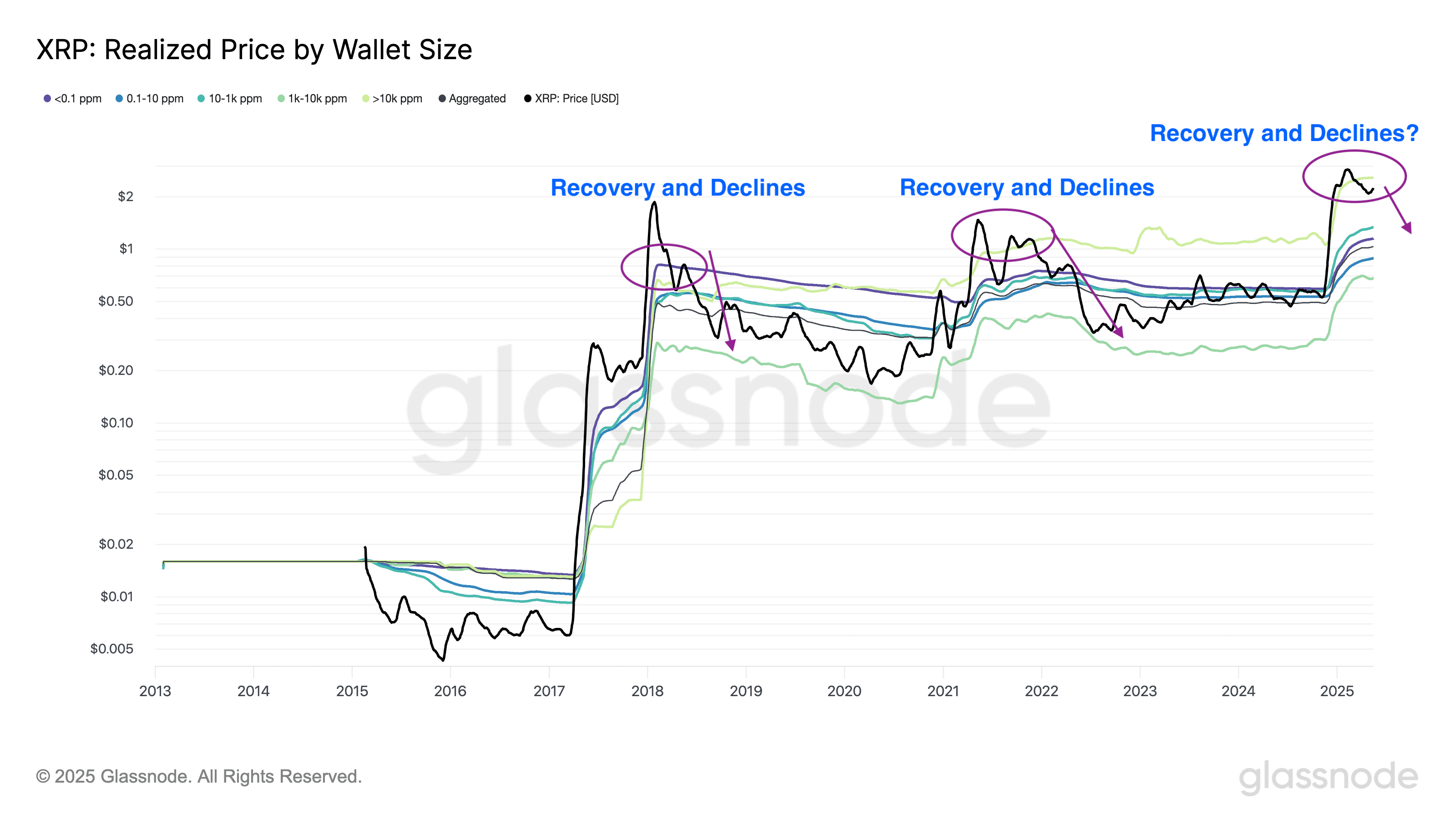

- Whale Activity: The behavior of large XRP holders (whales) provides crucial insights. Currently, whales are in the red, with an average buy price above the current market price. Historically, this situation has often led to a price rebound followed by a broader pullback.

Bullish Scenario: Retesting the Falling Wedge

Chart analysts suggest XRP is in the process of retesting its falling wedge breakout. This pattern is characterized by a converging price range that eventually breaks out upwards. A successful retest confirms the breakout, indicating strong buying pressure. If XRP holds above the wedge’s upper trendline, the target price is approximately $3.60, calculated by adding the wedge’s maximum height to the breakout point.

Bearish Scenario: Inverse Cup-and-Handle Formation

A more concerning scenario involves the formation of an inverse cup-and-handle pattern. This bearish reversal pattern suggests a potential price decline. The “cup” formed over several months, followed by a consolidation phase forming the “handle.” The critical level to watch is the neckline support around $1.11. A break below this level could validate the pattern, triggering a significant correction towards $0.50. Declining volume during the handle formation further supports this bearish outlook.

Whale Activity and Its Impact on XRP Price

Monitoring whale activity provides valuable insights into potential price movements. Currently, XRP is trading below the average purchase price of whales (holders of over 10,000 XRP), which is around $2.58. Historically, when whales are “in the red,” the price tends to rebound towards their average buy-in price. However, this bounce is often followed by a larger pullback, testing the entry prices of smaller holders.

Analyzing realized price levels by wallet size suggests potential support and resistance areas. A short-term rebound towards the whale realized price of $2.58 is possible. However, a worst-case scenario could see XRP dropping to $0.67, the realized price of the 1,000-10,000 XRP balance cohort. The aggregated realized price points to a potential target around $1.04.

Key Takeaways and Future Outlook

- Potential for Rally: A successful retest of the falling wedge breakout could propel XRP towards $3.60.

- Risk of Correction: The inverse cup-and-handle pattern poses a significant risk of a price crash to $0.50 if the $1.11 support is breached.

- Whale Influence: Whale activity continues to play a crucial role in XRP’s price dynamics.

- Spot ETF Impact: The potential launch of spot XRP ETFs in the US could significantly boost bullish sentiment and attract further investment.

In conclusion, XRP’s price outlook remains uncertain, with both bullish and bearish scenarios possible. Monitoring key technical levels, whale activity, and regulatory developments is crucial for investors. While a rally towards $3.60 is conceivable, the risk of a significant correction should not be ignored. Understanding these factors will help investors make informed decisions in the volatile cryptocurrency market.