XRP Futures: A Beginner’s Guide to Trading and Investing

XRP futures contracts allow you to speculate on the future price of XRP without owning the underlying asset. Platforms like Coinbase Derivatives offer regulated access to these contracts, providing new avenues for investors to engage with XRP. This guide explains XRP futures, their benefits, risks, and how to get started.

What are XRP Futures?

XRP futures are agreements to buy or sell XRP at a predetermined price on a specific future date. Instead of trading the actual XRP token, you trade a contract that mirrors its price movements. These contracts are typically regulated, offering a structured environment for trading.

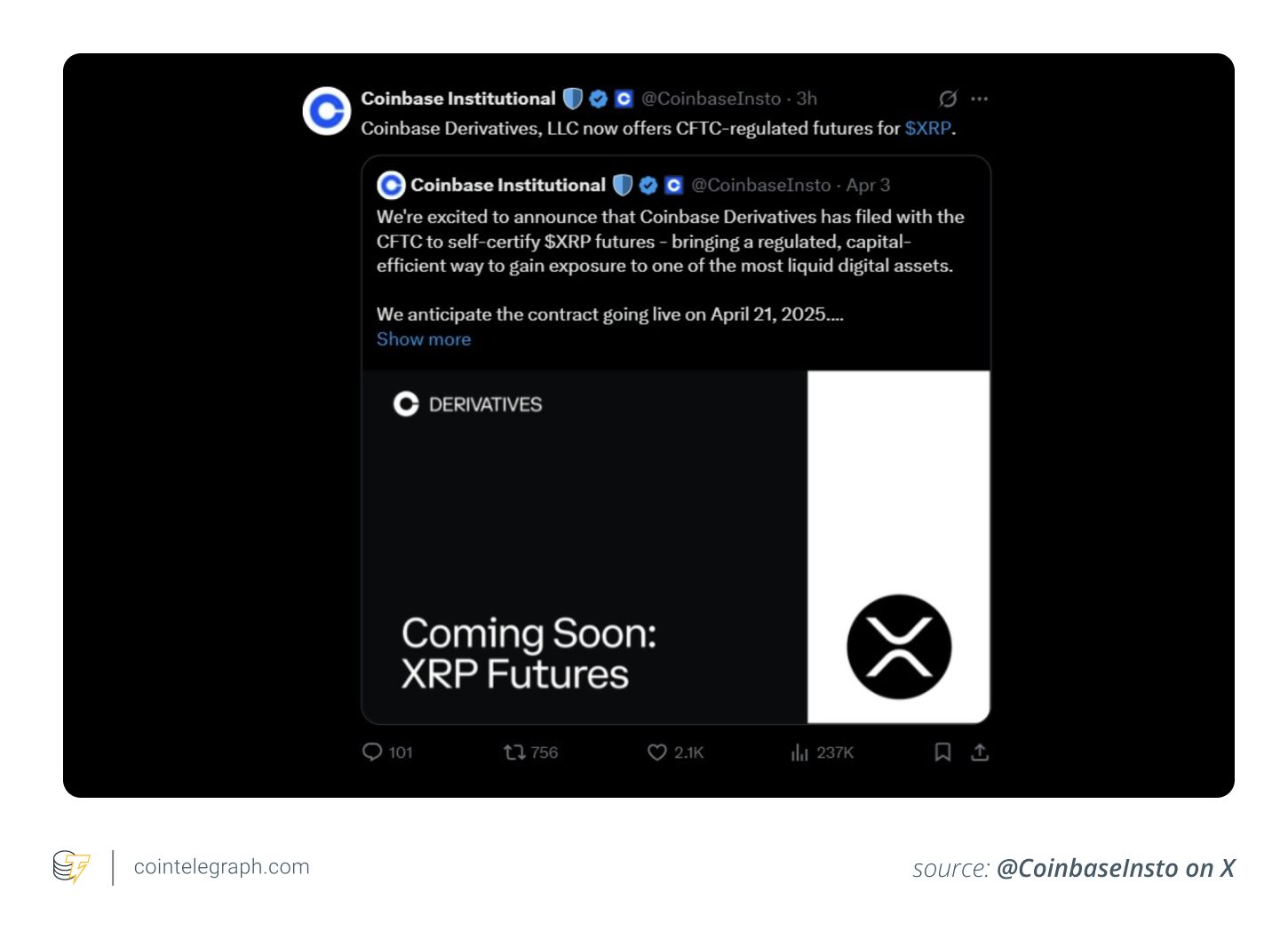

Coinbase Derivatives, for example, offers CFTC-regulated XRP futures contracts. These contracts allow traders to profit from both rising and falling XRP prices without holding the asset directly.

Types of XRP Futures Contracts

Coinbase offers two main types of XRP futures contracts:

- Nano XRP Futures: Represent 500 XRP per contract, settled in USD. Designed for retail traders with lower capital requirements.

- Standard XRP Futures: Cover 10,000 XRP per contract, also settled in USD. Aimed at larger institutions and active traders.

Both types are cash-settled, meaning that profits or losses are paid out in USD, not XRP itself. This simplifies the trading process by removing the need for XRP custody.

Why Choose XRP Futures Over Buying XRP?

Trading XRP futures offers several advantages over buying XRP directly:

- Leverage: Control a large position with a smaller amount of capital.

- Hedging: Protect your existing XRP holdings from potential price drops.

- Speculation: Profit from both rising (long) and falling (short) XRP prices.

- No Wallet Required: Avoid the need for crypto wallets and private key management.

- Liquidity: Access high liquidity markets, making it easier to enter and exit positions.

- Cash Settlement: Settle profits and losses in USD without handling XRP.

When to Choose Futures:

- You want to trade XRP price movements with leverage.

- You prefer not to deal with crypto wallets.

- You’re hedging an existing XRP position.

- You’re comfortable with the risks of derivatives.

When to Buy XRP:

- You believe in XRP’s long-term value.

- You plan to use XRP for transactions.

- You want to avoid the risks of leverage.

Where to Invest in XRP Futures

Several platforms offer XRP futures trading, including:

- Coinbase Derivatives: Offers regulated XRP futures in the US.

- Kraken Futures: Provides XRP futures with leverage. Availability varies by region.

- Binance: Offers XRP/USDT perpetual futures contracts.

- OKX: Provides XRP/USDT perpetual swaps.

- Bitget: Globally accessible platform with XRP futures options.

- KuCoin Futures: Supports XRP perpetual contracts (XRP/USDT) with leverage.

- MEXC: Offers XRP futures in USDt-margined and coin-margined formats.

- Delta Exchange: Lists XRP perpetual futures with leverage up to 100x.

- Bitfinex: Offers XRP futures as part of its broader derivatives portfolio.

How to Invest in XRP Futures

Here’s a step-by-step guide to trading XRP futures:

- Choose a Platform: Select a regulated exchange offering XRP futures. Create an account and verify your identity.

- Understand the Product: Research how XRP futures contracts work, including contract sizes, margin requirements, and fees.

- Fund Your Account: Deposit USD or another accepted currency to use as collateral.

- Place Your Trade: Use the platform’s trading interface to select XRP futures contracts. Decide whether to go long or short, and set your position size.

- Practice Risk Management: Set stop-loss orders and limit position sizes.

- Monitor the Market: Track XRP’s price, market sentiment, and external factors.

Risk Management

XRP futures trading involves substantial risk. It’s essential to understand and manage these risks:

- Leverage Risk: Amplifies both gains and losses.

- Volatility: XRP price swings can impact your position.

- Funding Rates: Can reduce profits if held long-term.

- Liquidation: Your position can be automatically closed at a loss.

Consider starting with a demo account or nano contracts to reduce your exposure while learning. Always trade responsibly and within your risk tolerance.

Regulatory Landscape and Legal Challenges

The regulatory landscape surrounding XRP remains dynamic. For example, Oregon’s Attorney General has sued Coinbase, alleging the exchange offered unregistered securities, including XRP. Such legal challenges underscore the importance of staying informed about regulatory developments and their potential impact on XRP trading.

SEC vs. Ripple Lawsuit: In March 2025, Ripple Labs settled its long-standing legal dispute with the SEC, agreeing to pay a reduced fine of $50 million without admitting wrongdoing. This settlement highlights the ongoing scrutiny of XRP and other cryptocurrencies by regulatory bodies.

How Risky are Crypto Futures?

Futures trading can be risky, so keep these points in mind:

- Leverage risk: Leverage increases returns, but also losses.

- Volatility: XRP is very volatile, so futures contracts can magnify its impact.

- Funding rates: Perpetual contracts charge periodic funding fees, which can eat away at your profits if held long-term.

- Liquidation: Positions can be closed automatically if the market goes against you.

- Complexity: Futures are complicated, so you need to understand the terminology and keep a track of expiry dates.

- Market liquidity: XRP needs high participation for effective futures trading.

- Emotional pressure: Fast trading can lead to the wrong decisions. Discipline is important.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.