XRP futures contracts offer a way to speculate on the price of XRP without directly owning the cryptocurrency. These contracts, now available on regulated platforms like Coinbase Derivatives and soon on CME Group, provide opportunities for both retail and institutional investors.

What are XRP Futures?

XRP futures are standardized agreements to buy or sell XRP at a predetermined price on a future date. Unlike spot trading, you’re trading a contract that mirrors XRP’s price movements. These contracts are often regulated by bodies like the CFTC in the US, adding a layer of security.

Key Features of XRP Futures:

- Leverage: Control a larger XRP position with less capital.

- Hedging: Protect existing XRP holdings from potential price drops.

- Speculation: Profit from both rising (long) and falling (short) XRP prices.

- Cash Settlement: Profits and losses are settled in USD, avoiding direct XRP custody.

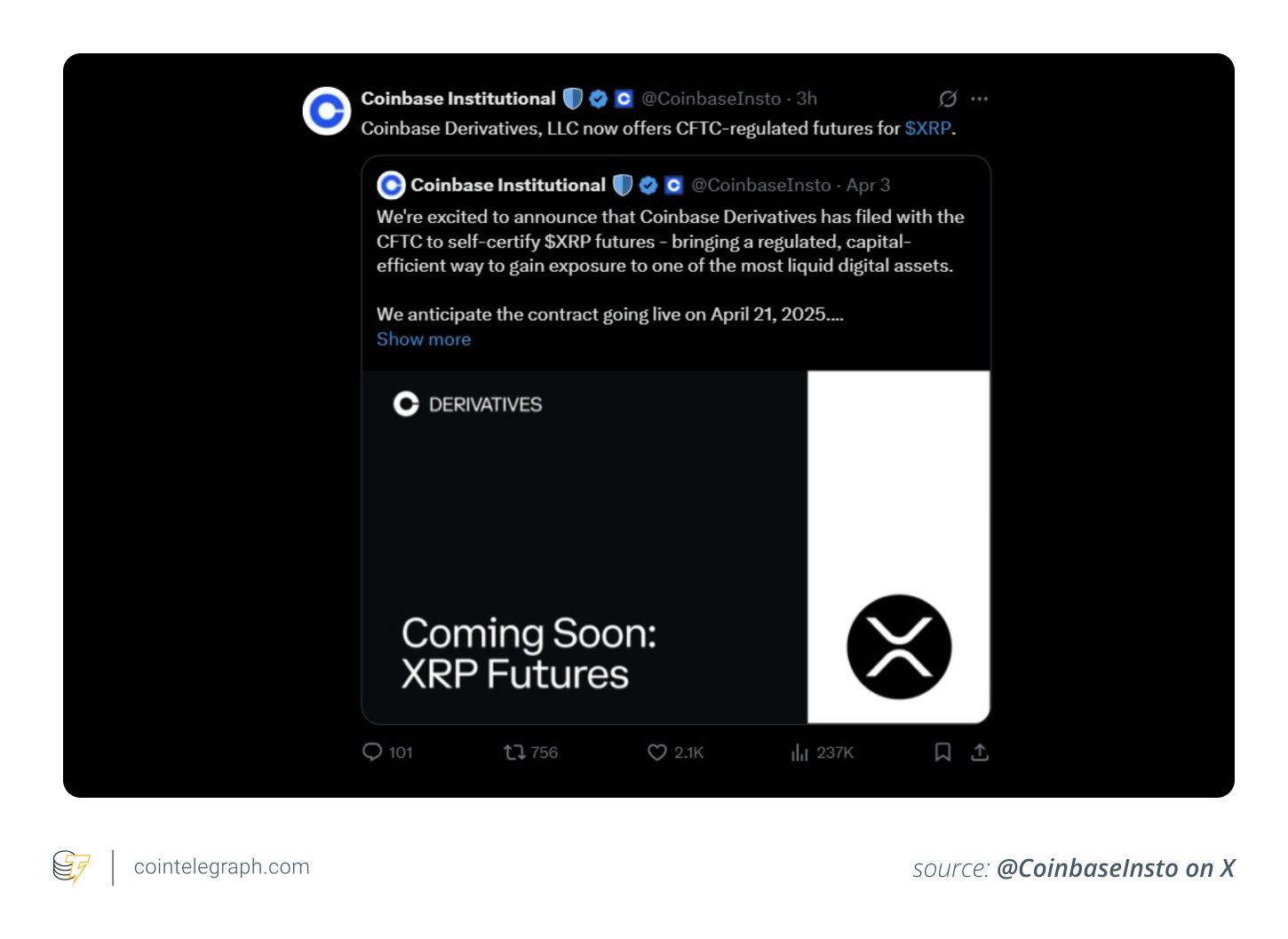

Coinbase’s XRP Futures Offerings

Coinbase Derivatives offers two types of XRP futures:

- Nano XRP Futures: 500 XRP per contract, designed for retail traders.

- Standard XRP Futures: 10,000 XRP per contract, geared towards larger institutions.

Benefits of Trading XRP Futures vs. Buying XRP

- No Crypto Wallet Required: Futures contracts are managed on exchanges.

- Liquidity: Futures markets are generally highly liquid.

When to Choose XRP Futures:

- For leveraged trading or hedging.

- When you prefer not to manage crypto wallets.

When to Buy XRP Directly:

- If you believe in XRP’s long-term value.

- If you intend to use XRP within Ripple’s ecosystem.

Where to Trade XRP Futures

Several platforms offer XRP futures:

- Coinbase Derivatives: Regulated US exchange.

- CME Group (Coming Soon): Established derivatives marketplace.

- Kraken Futures: Offers leveraged XRP futures (restrictions apply in some regions).

- Binance: Provides XRP/USDT perpetual futures.

- OKX: Offers XRP/USDT perpetual swaps.

- Bitget: Globally accessible platform for XRP futures.

- KuCoin Futures: Supports XRP perpetual contracts (XRP/USDT).

- MEXC: Offers both USDt-margined and coin-margined XRP futures.

- Delta Exchange: Lists XRP perpetual futures with high leverage.

- Bitfinex: Offers XRP futures for advanced users.

How to Start Trading XRP Futures:

- Choose a Regulated Platform: Coinbase, CME (when launched), or others listed above.

- Understand Contract Details: Know contract sizes, margin requirements, and fees.

- Fund Your Account: Deposit USD or accepted currency.

- Place Your Trade: Select XRP futures, choose long or short, and set position size.

- Practice Risk Management: Use stop-loss orders and limit leverage.

- Monitor the Market: Stay informed on XRP price movements and news.

Recent Developments:

- CME Group Launch: CME is set to launch XRP futures on May 19, 2025, pending regulatory approval, which opens XRP to institutional trading.

- Oregon Lawsuit Against Coinbase: Oregon’s Attorney General sued Coinbase, alleging securities violations related to XRP.

- Ripple-SEC Settlement: Ripple settled its SEC dispute, agreeing to a reduced fine.

Risks of Trading Crypto Futures:

- Leverage: Amplifies both profits and losses.

- Volatility: XRP is known for price volatility.

- Funding Rates: Perpetual contracts have periodic fees.

- Liquidation: Positions can be automatically closed if margin requirements aren’t met.

- Complexity: Futures trading requires a strong understanding of contract terms.

Disclaimer: Trading futures involves risk. This is not financial advice. Conduct thorough research before trading.