Key Takeaways:

- XRP’s current rally is driven by strong spot market demand, indicating genuine buying interest.

- The number of XRP addresses holding at least 10,000 tokens is steadily increasing, showing long-term investor confidence.

- A falling wedge pattern suggests a potential breakout toward $3 to $3.78, representing up to 70% upside if confirmed.

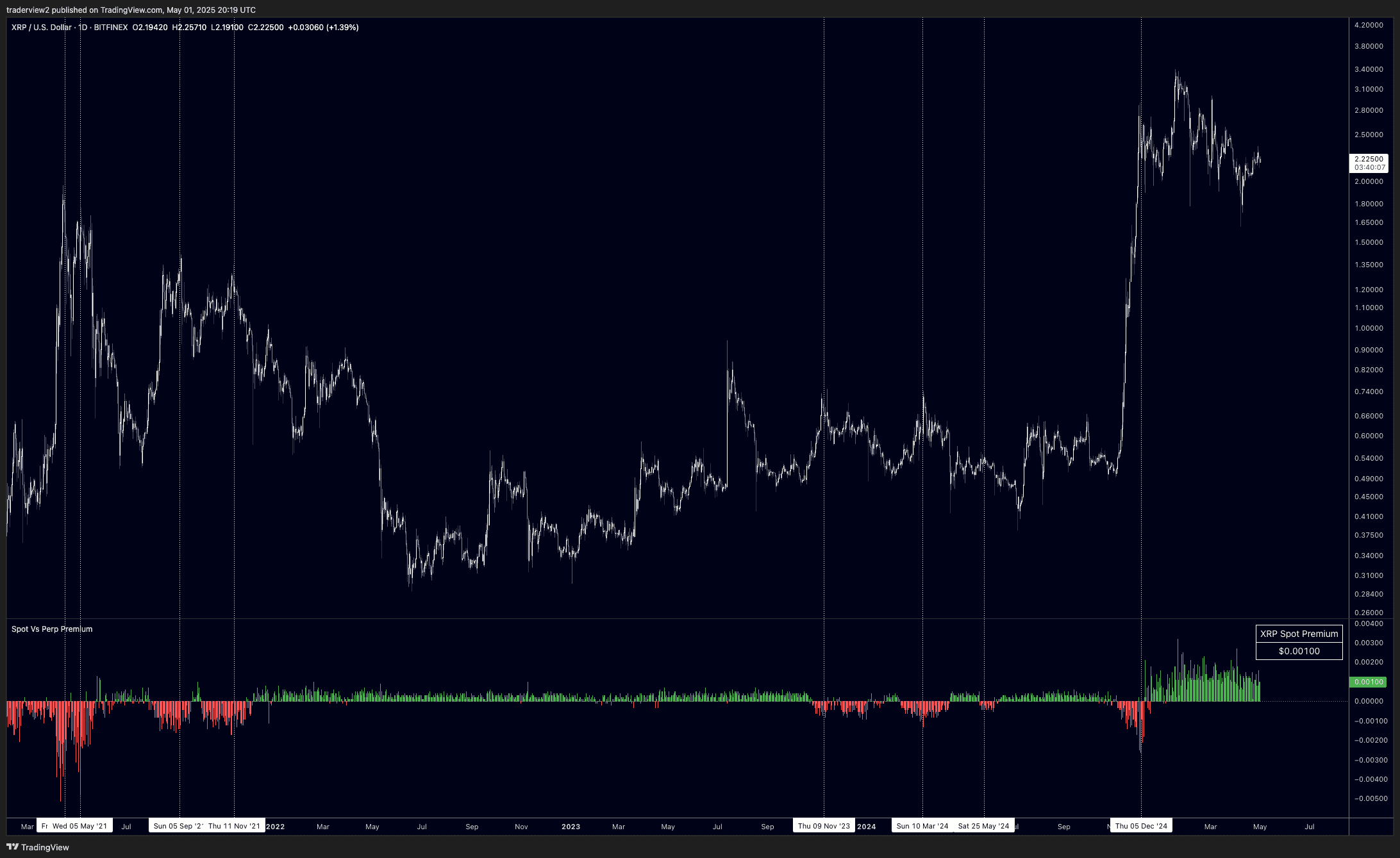

XRP (Ripple) is experiencing a significant surge, with its spot market consistently trading at a premium compared to perpetual futures. This unusual trend suggests that the current price action is supported by actual buying demand rather than speculative futures trading, marking a departure from previous rallies.

Spot Premium Indicates Real Demand

Historically, XRP price peaks have coincided with futures market leadership, often leading to subsequent price corrections. This time, the sustained spot premium indicates that genuine demand from XRP buyers is driving the rally, fostering a more stable and sustainable price increase.

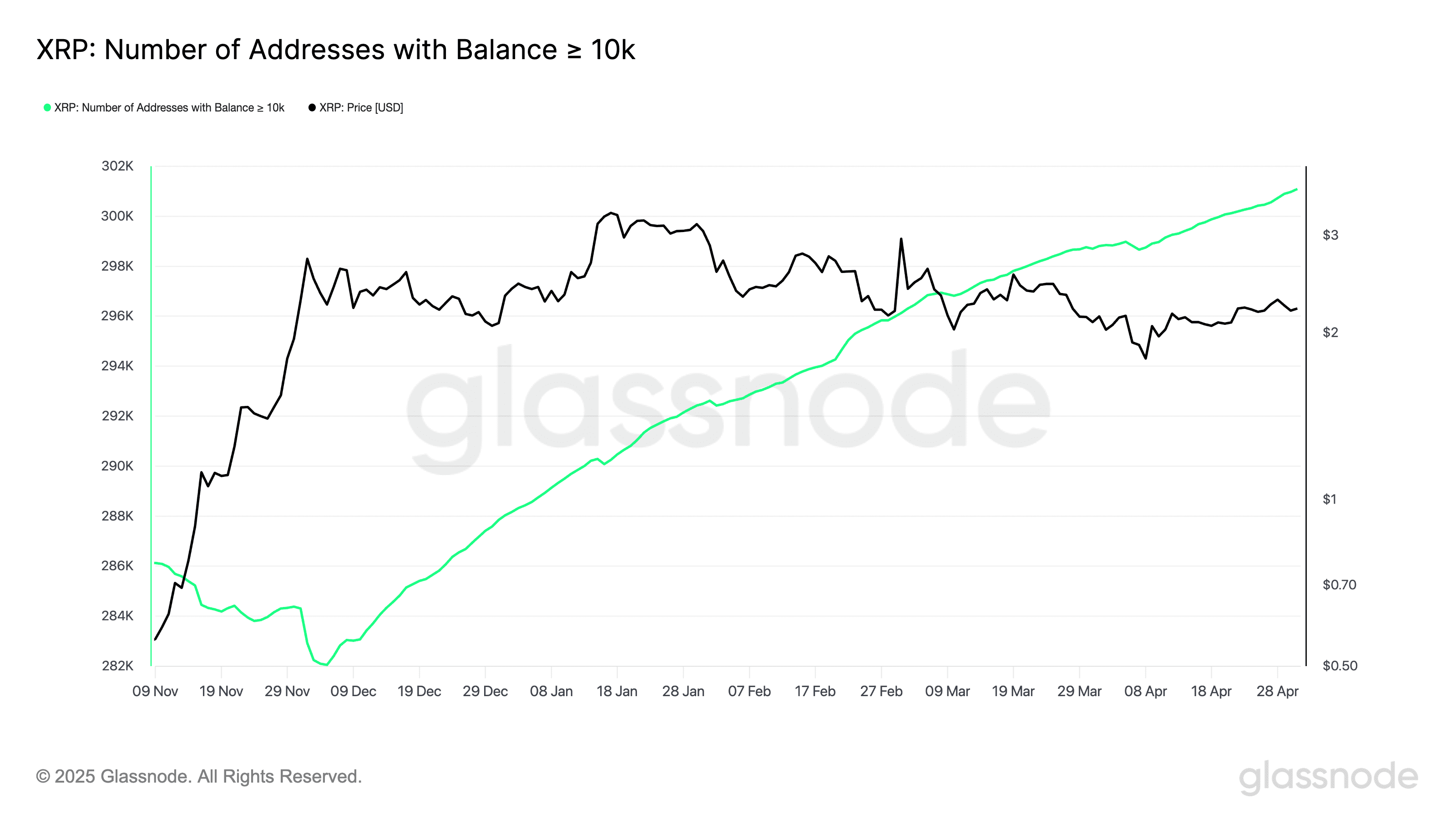

Whale Accumulation Further Supports Bullish Outlook

Data reveals a consistent increase in the number of XRP addresses holding at least 10,000 XRP since late November 2024. This accumulation trend has persisted even during recent price pullbacks, signaling that larger investors are steadily accumulating XRP in anticipation of further gains.

The fact that whale counts have increased despite a 35% price correction between January and April indicates strong conviction among these strategic investors. This sustained accumulation strengthens the case for a long-term bullish outlook for XRP.

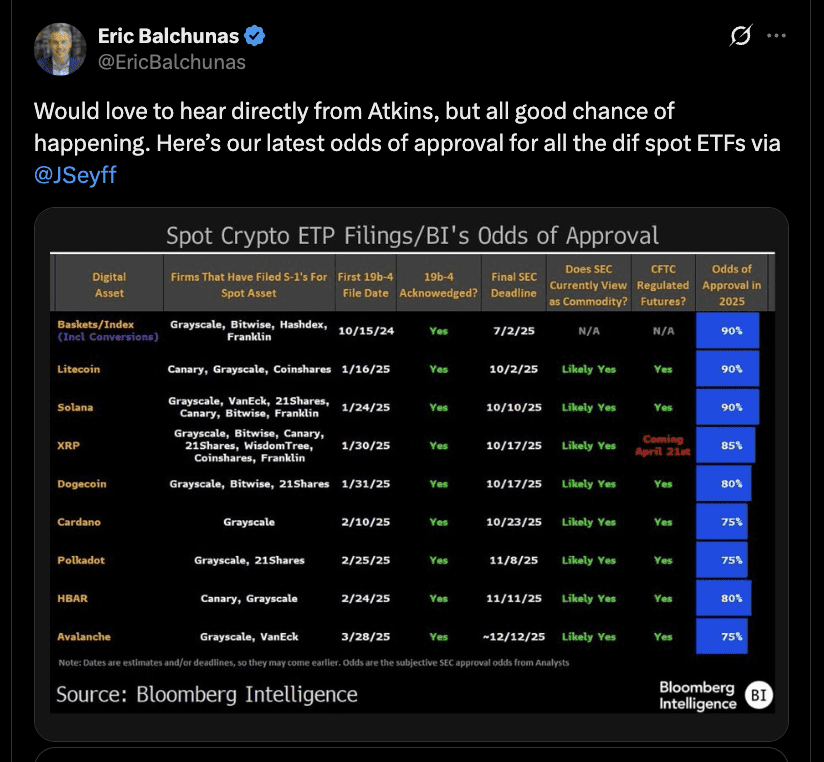

XRP ETF Approval Odds Rise

Optimism surrounding XRP has been further boosted by increasing expectations of a spot XRP ETF approval in the United States. The SEC’s decision to drop its lawsuit against Ripple has improved market sentiment and significantly reduced regulatory uncertainty. The market speculates that this positive regulatory landscape will pave the way for XRP ETFs.

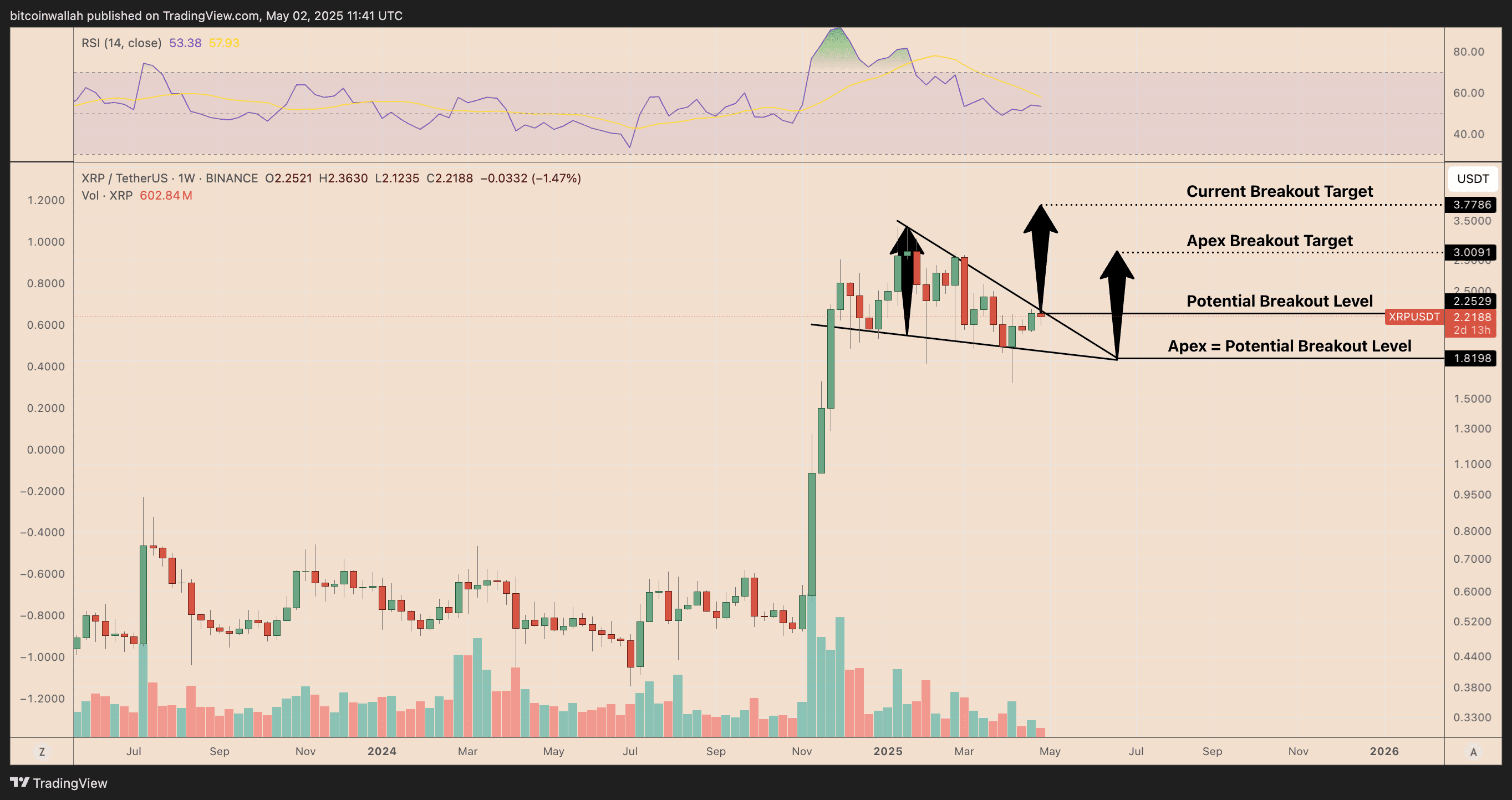

Technical Analysis: Falling Wedge Pattern Suggests Potential Breakout

From a technical analysis perspective, XRP has been consolidating within a falling wedge pattern on the weekly chart. This pattern, characterized by downward-sloping, converging trendlines, is typically considered a bullish reversal signal. The wedge pattern suggests that XRP is poised for a potential breakout and a subsequent rally.

A confirmed breakout requires XRP to decisively break above the wedge’s upper resistance level, currently near $2.52. If XRP successfully breaches this level, the measured move of the pattern – calculated from the wedge’s maximum height – suggests a potential rally toward $3.78 by June. This represents a substantial upside of approximately 70% from current price levels.

Conversely, failure to break above the $2.52 resistance could lead to a pullback towards the wedge’s lower trendline. The apex of the pattern near $1.81 may serve as the final potential breakout point. A breakout from this level would still maintain the pattern’s bullish structure, with a potential upside target around $3 by June or July – roughly 35% above current levels.

Potential XRP Price Targets:

- Bullish Scenario: Breakout above $2.52, targeting $3.78 (70% upside).

- Alternative Bullish Scenario: Breakout from $1.81 apex, targeting $3 (35% upside).

Summary

In conclusion, XRP’s current price action is supported by strong fundamentals, including robust spot market demand and increasing whale accumulation. Furthermore, increasing expectations for an XRP ETF approval and the emergence of a bullish falling wedge pattern on the weekly chart suggest that XRP may be well-positioned for a significant rally in the coming months. Investors should closely monitor key resistance levels and potential breakout points to capitalize on potential upside opportunities.