XRP traders are increasingly optimistic about the cryptocurrency’s future, fueled by rising expectations of a spot XRP ETF approval in the United States. This sentiment comes despite a recent 5% dip in XRP’s price, which analysts attribute to broader economic concerns. Let’s delve into the key factors influencing XRP’s potential resurgence.

Key Takeaways

- ETF Approval Odds Soar: Following changes at the SEC, analysts now estimate an 85% chance of an XRP ETF approval by 2025.

- Technical Indicators Bullish: XRP is currently trading within a falling wedge pattern, a bullish reversal signal. A breakout above $2.40 could propel it to $3.74.

- Analyst Predictions: Several analysts predict XRP will reach new all-time highs, with some projecting targets as high as $19.27.

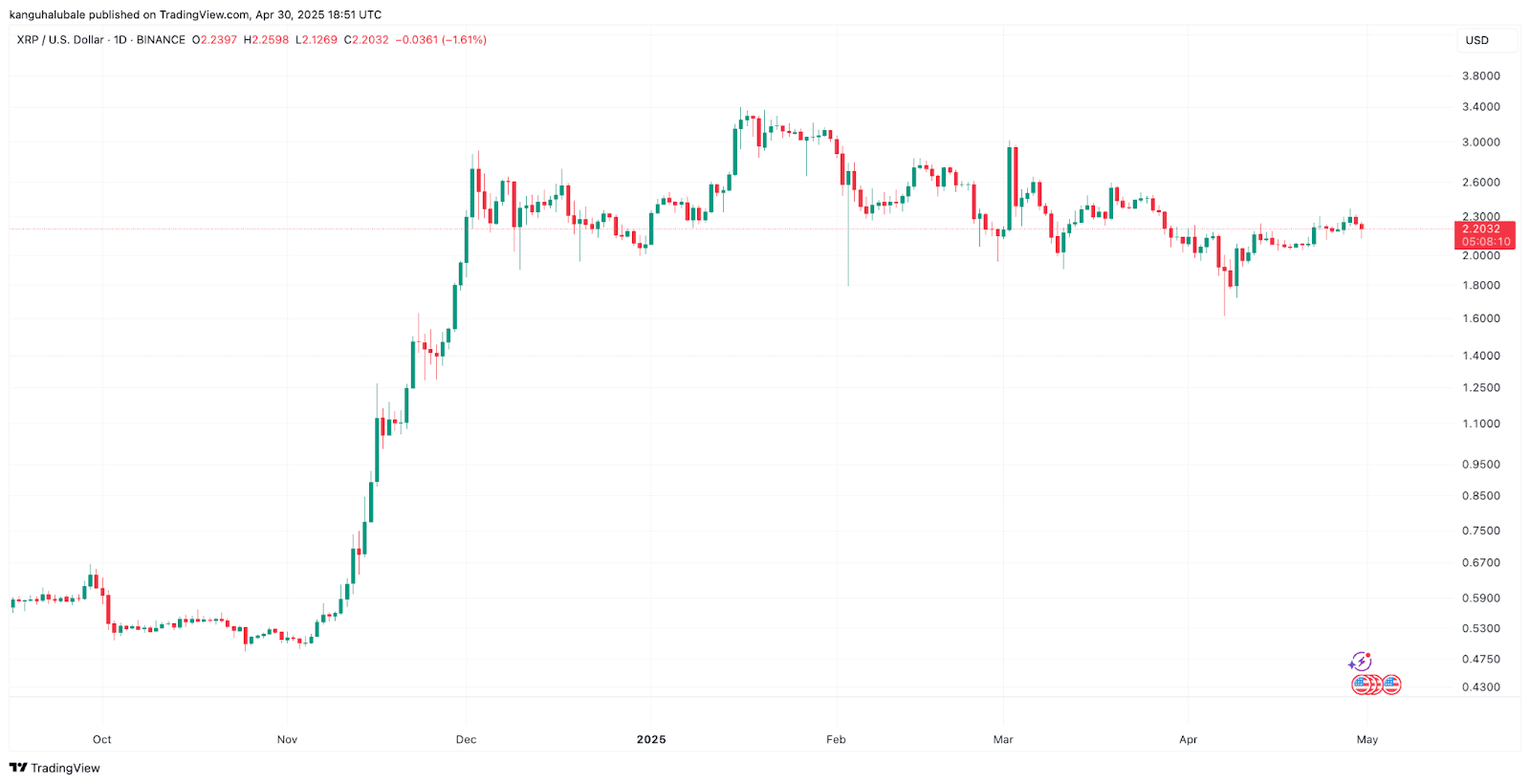

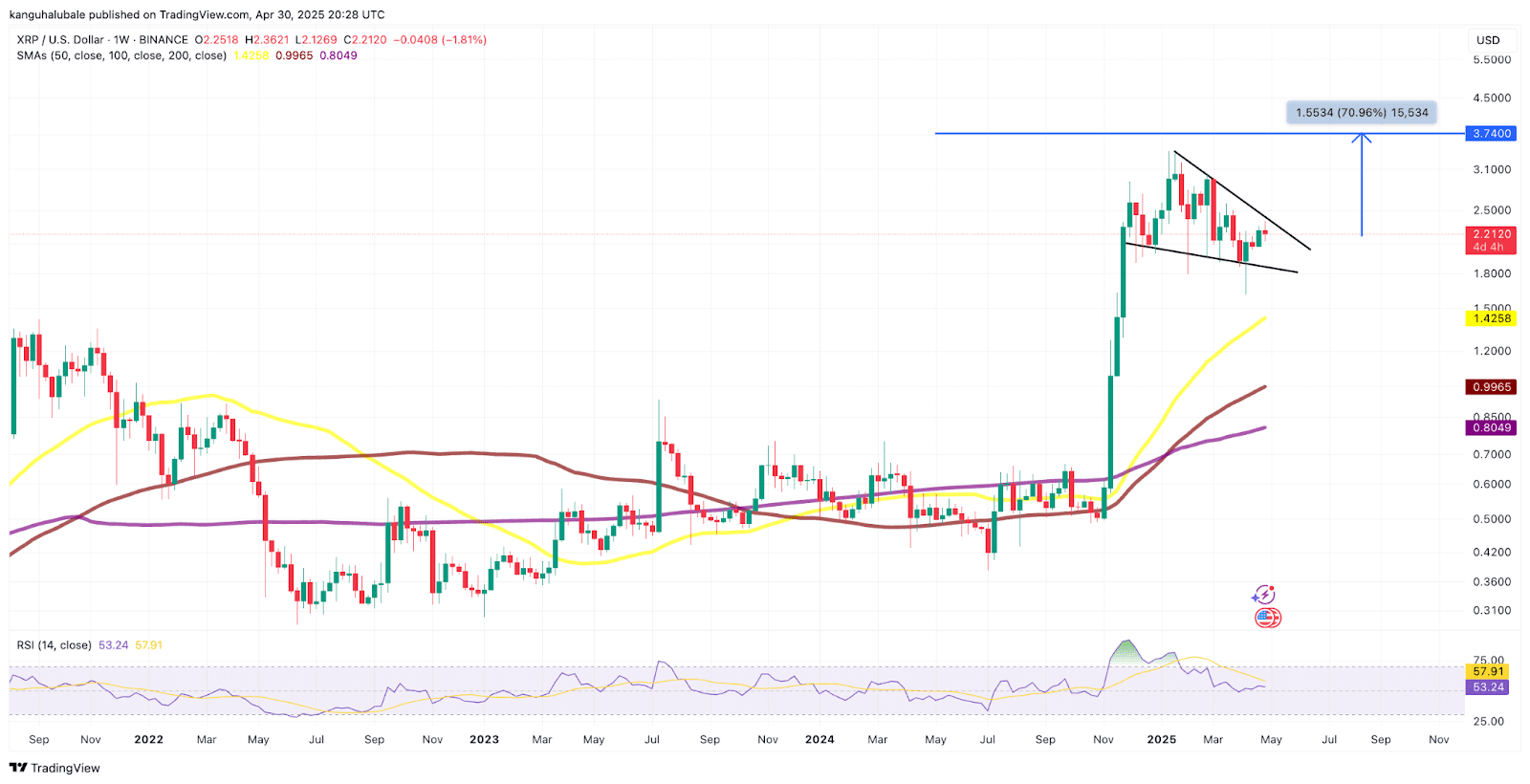

XRP Technical Analysis: Falling Wedge Pattern

Technical charts reveal that XRP is trading within a falling wedge pattern. This pattern typically signals a weakening downward momentum and often precedes a bullish reversal. A definitive breakout above the upper trendline, currently around $2.40, could trigger a significant upward move. If this occurs, buyers may target $3.74, a substantial 71% increase from current levels.

The Relative Strength Index (RSI) is currently above the midline, further reinforcing the bullish sentiment. However, XRP needs to maintain support at $2.20 and overcome resistance between $2.80 and $3.00 to sustain its upward momentum.

Analyst Sentiment: Bullish Projections for XRP

Despite recent price fluctuations, several analysts remain optimistic about XRP’s potential. Dark Defender believes that the current correction is part of an Elliott Wave pattern, which will ultimately drive XRP to new heights. Allincrypto predicts XRP could reach $19.27 based on a breakout from the falling wedge pattern.

XRP ETF Approval: A Game Changer?

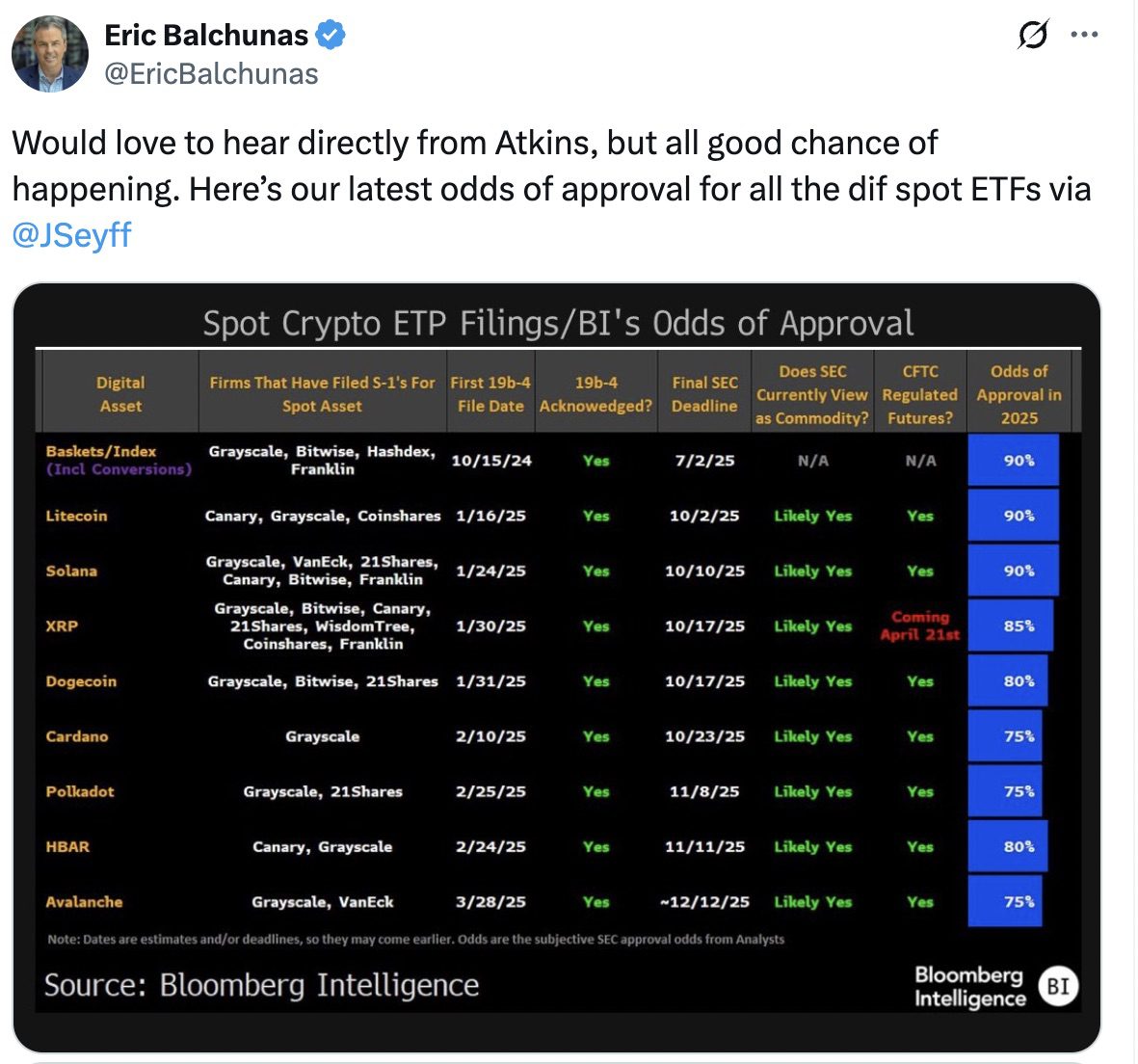

The anticipation surrounding a potential XRP ETF approval is a major catalyst for the current bullish sentiment. Bloomberg senior ETF analysts estimate the odds of approval for the various spot XRP ETF applications at 85%. This is a significant increase from previous estimates.

Several firms, including Grayscale, 21Shares, WisdomTree, Bitwise, Canary, and Franklin Templeton, have filed applications for spot XRP ETFs. The approval of these ETFs would open the door for significant institutional investment in XRP, potentially driving up demand and price.

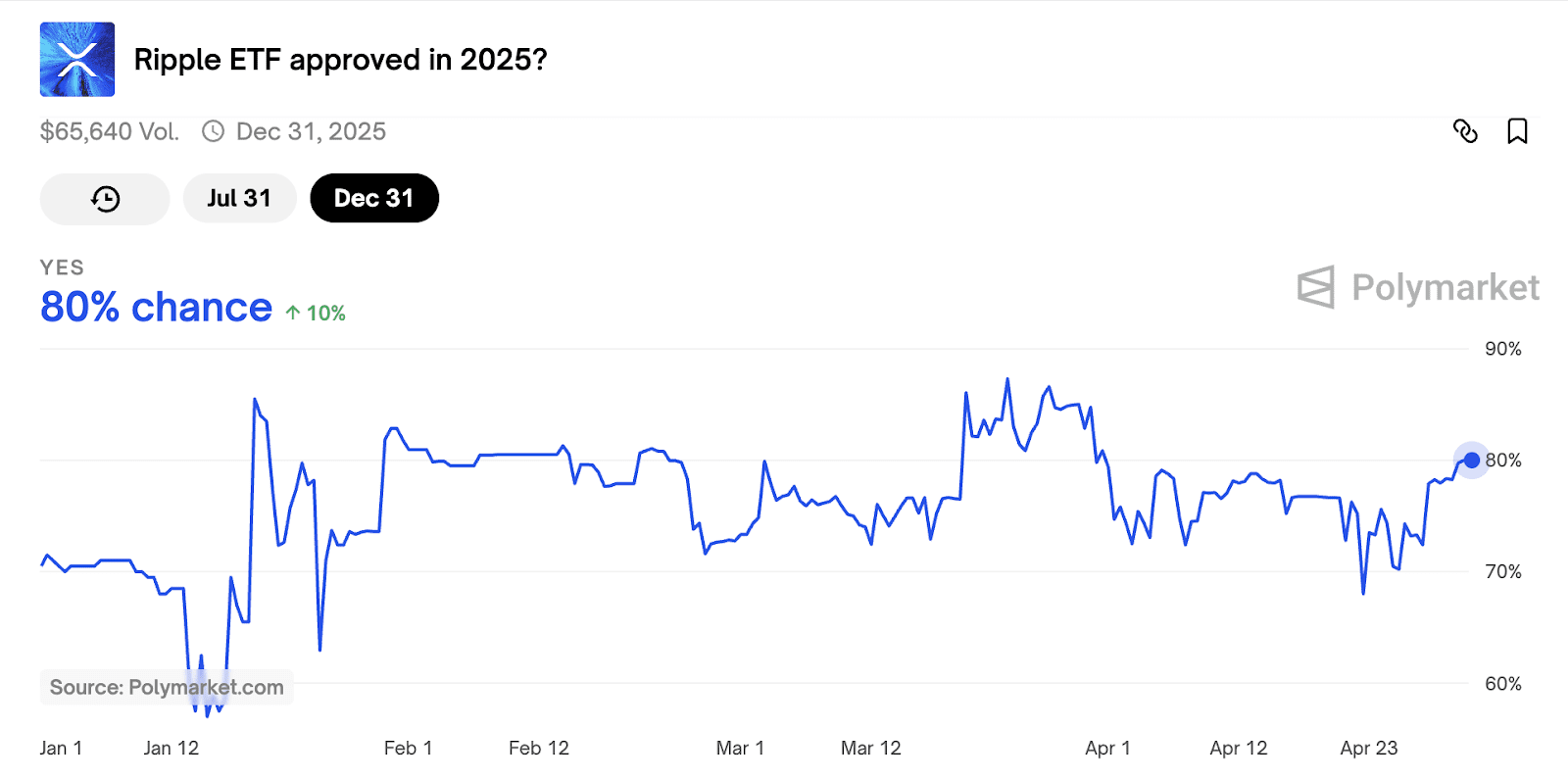

Polymarket, a prediction market platform, currently shows an 80% probability of an XRP ETF approval by the end of the year. This reflects the growing optimism surrounding the possibility of regulatory approval.

SEC Delays Decision on Franklin Templeton XRP ETF

While the overall outlook is positive, the SEC recently postponed its decision on Franklin Templeton’s spot XRP ETF, setting a new review deadline for June 17. This delay highlights the regulatory hurdles that XRP ETFs still face.

Potential Impact of XRP ETF Approval

The approval of an XRP ETF would be a major milestone for the cryptocurrency. It would likely attract significant institutional capital, increase demand for XRP, and potentially drive up its price. It would also represent a significant step towards mainstream adoption of XRP.

Factors Influencing XRP ETF Approval

- SEC Leadership: Changes in leadership at the SEC have contributed to increased optimism regarding XRP ETF approval.

- Legal Clarity: While regulatory uncertainty still exists, ongoing legal developments surrounding XRP may influence the SEC’s decision.

- Market Demand: Growing investor interest in XRP and digital assets, in general, may prompt the SEC to consider approving an XRP ETF.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments are inherently risky, and you should conduct thorough research before making any investment decisions.