XRP (Ripple) has experienced a notable recovery, climbing 55% since April, and current data points towards a possible continuation of this upward trend. This analysis delves into the factors influencing XRP’s price, including whale activity and technical formations, to assess the potential for further gains.

Key Takeaways:

- Price Increase: XRP has risen 55% since April, indicating positive momentum.

- Whale Activity: Whale flows (large XRP holders’ transactions) have turned positive for the first time since November 2024, often a precursor to trend reversals.

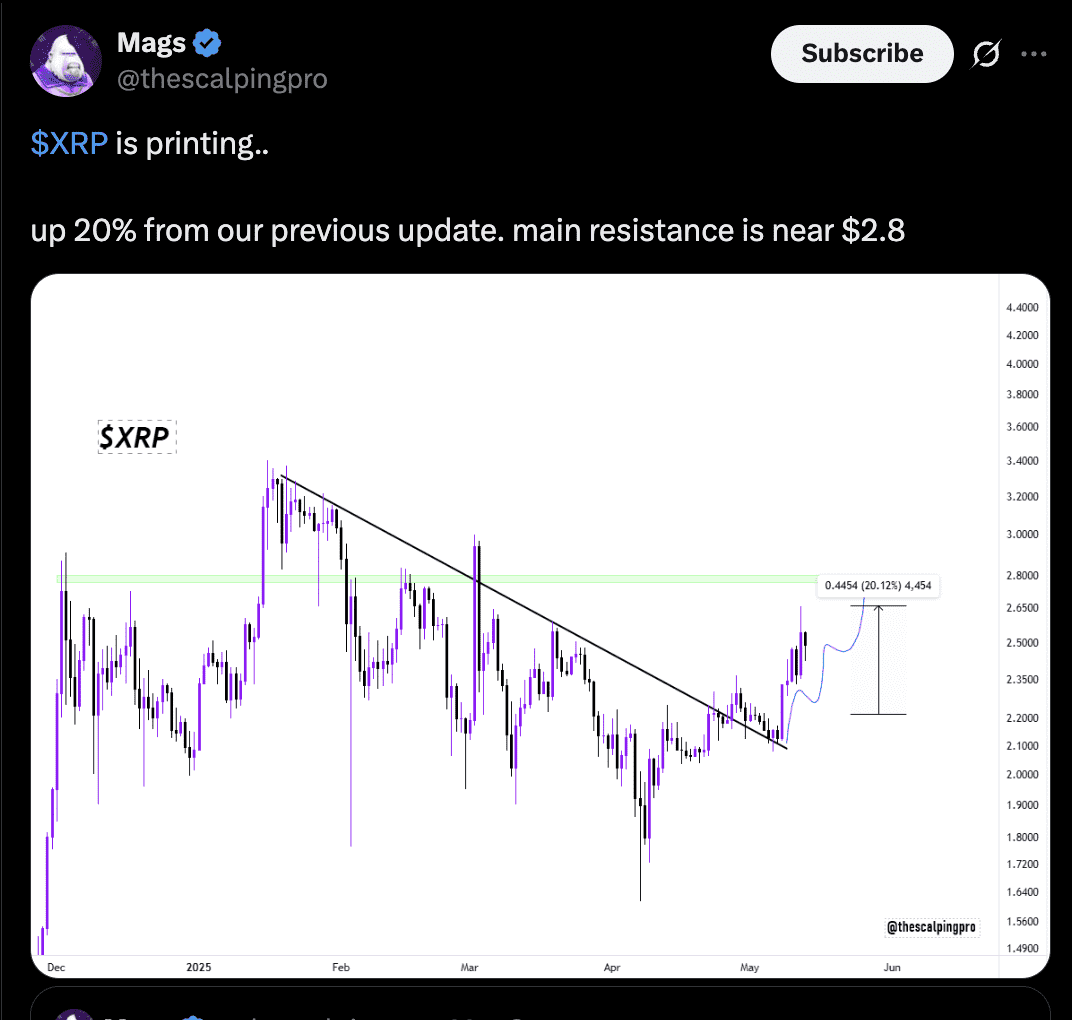

- Technical Breakout: A falling wedge breakout suggests a potential 40% price increase, with $2.80 as a possible resistance level.

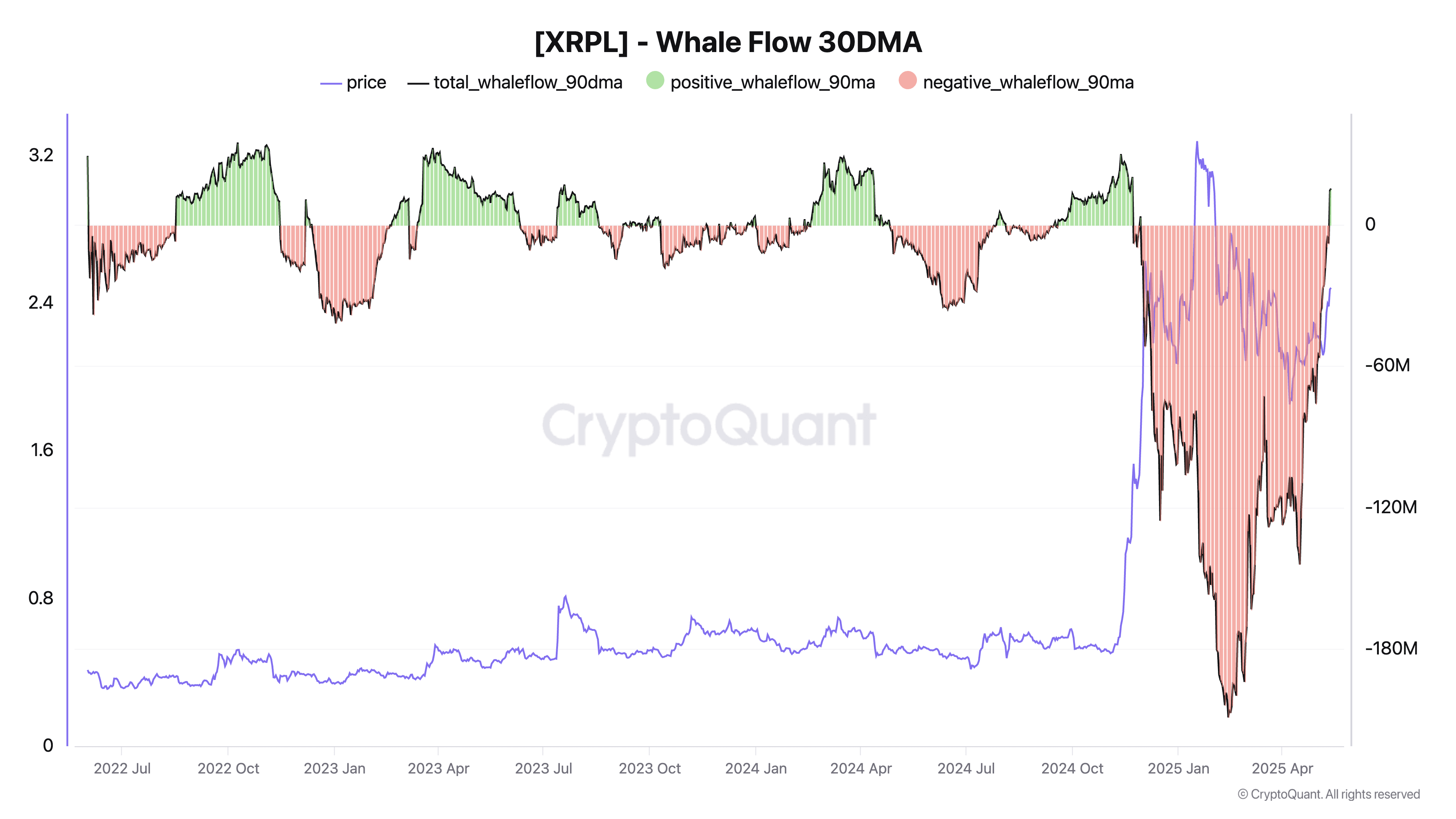

Whale Flows Suggesting Potential Trend Reversal

Historically, significant movements in XRP price have been correlated with the activity of large XRP holders, often referred to as whales. Data from CryptoQuant reveals that whale wallets had been reducing their holdings since November 2024, leading to a negative net flow. However, as of mid-May 2025, this trend has reversed, with whale outflows slowing down and the 90-day moving average of net flows turning positive.

This shift in whale activity is significant because similar patterns have preceded major XRP price rallies in the past. A prime example is the surge from approximately $0.43 in July 2024 to $3.55 in January 2025, a gain of around 400%. This rally began as whale outflows decreased and eventually transitioned to net inflows.

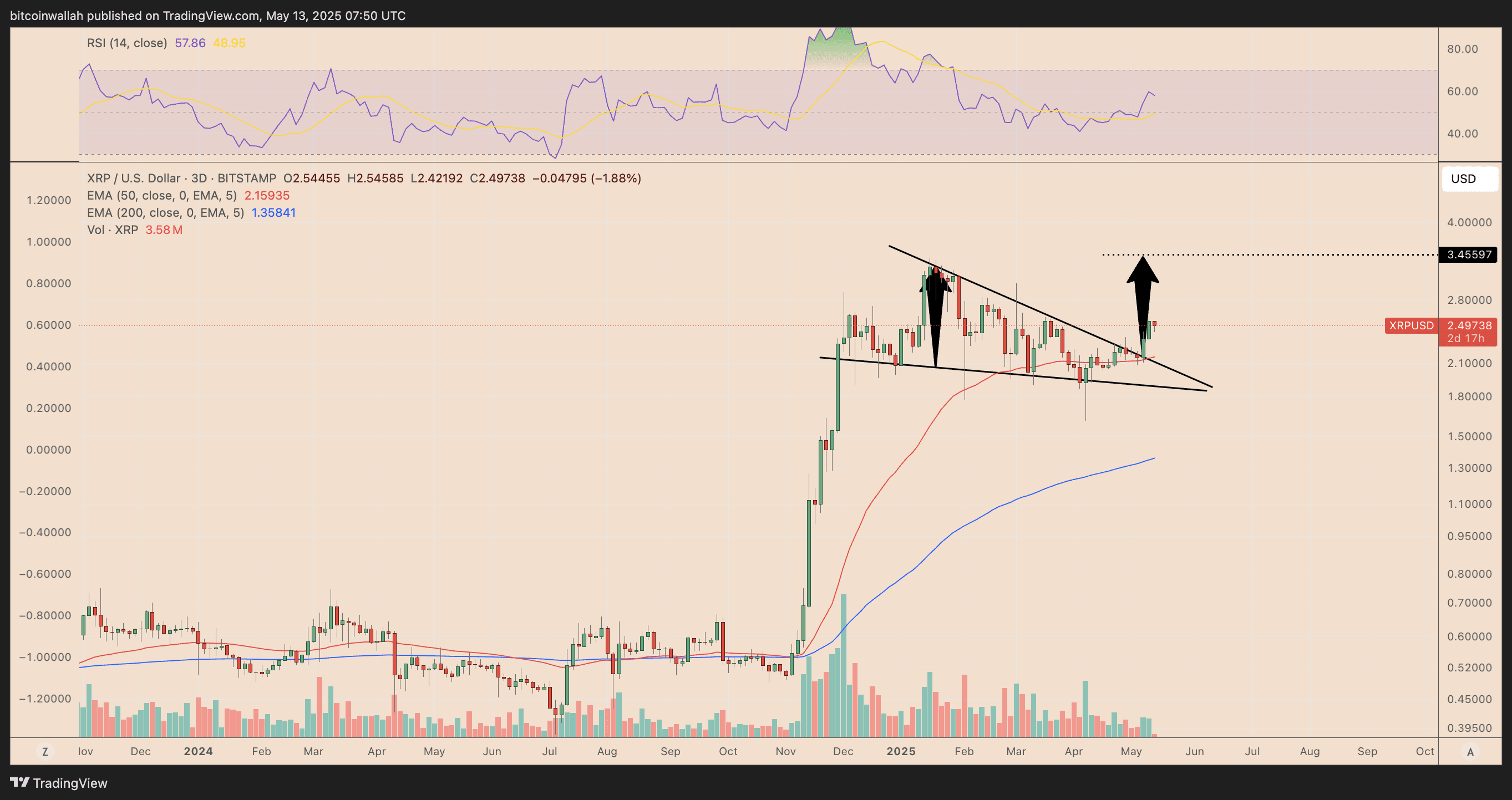

Technical Analysis: Falling Wedge Breakout

From a technical analysis perspective, XRP’s price chart reveals a breakout from a multi-month falling wedge pattern. This pattern, typically considered bullish, is characterized by converging trendlines and decreasing volume, indicating a potential accumulation phase. The breakout occurred in early May 2025 near the $2.25 level, just above the 50-period exponential moving average (EMA), which is now acting as a key support level.

Based on the height of the falling wedge, the breakout projects a price target near $3.45, representing a potential 40% increase from current levels. This target aligns with historical resistance levels and could present a significant profit opportunity for traders.

Potential Resistance and Support Levels

While the technical outlook for XRP appears promising, it’s essential to consider potential resistance levels that could impede the upward trajectory. Analyst Mags has identified a key resistance level near $2.80, which could temporarily halt XRP’s advance. However, a successful break above this level could pave the way for further gains towards the $3.45 target.

In the near term, XRP may consolidate above its 50-day EMA, particularly as whale inflows often signal the start of an accumulation phase before a stronger price breakout. This period of consolidation could provide an opportunity for traders to accumulate XRP before the next leg up.

XRP’s Relative Strength Index

The Relative Strength Index (RSI) for XRP also supports the bullish case. A bounce back above 57 indicates renewed buying momentum, reinforcing the possibility of further price appreciation. This indicator suggests that XRP is not overbought and has room for continued growth.

Analyst Perspective

According to Kripto Mavsimi, an analyst associated with CryptoQuant, “The pace of outflows is slowing, and the bars are curling upward… It’s not full reversal yet — but it’s the first real sign of stabilization in months.” This stabilization could be a precursor to a more significant upward movement.

Conclusion: Cautious Optimism for XRP

In conclusion, XRP’s current market dynamics, including positive whale flows, a bullish technical breakout, and a supportive RSI, suggest the potential for a significant price increase. However, traders should remain cautious and consider potential resistance levels, such as $2.80, before making investment decisions. A period of consolidation above the 50-day EMA could provide an opportunity for accumulation before the next potential rally. As always, conducting thorough research and managing risk appropriately is crucial when investing in cryptocurrencies.