XRP Price Prediction: Can XRP Reach $4 in May? Key Levels and Expert Analysis

XRP is showing signs of strength, sparking debate among analysts about its potential to reach $4 in May. This article dives deep into the factors influencing XRP’s price, including key support levels, whale accumulation trends, and expert opinions, to provide a comprehensive outlook.

Key Takeaways:

- XRP price saw a 2% increase on May 7, fueled by optimism surrounding potential US-China trade talks.

- Holding above the critical support level of $2.08 is essential for a sustained recovery.

- Whale accumulation suggests underlying strength in XRP’s price.

- Analysts emphasize the importance of XRP maintaining support between $1.83 and $2.00 to sustain its upward momentum.

As of the latest update, XRP remains above $2.00. Analysts are closely monitoring several key support levels that the asset needs to maintain for a sustainable climb toward new all-time highs.

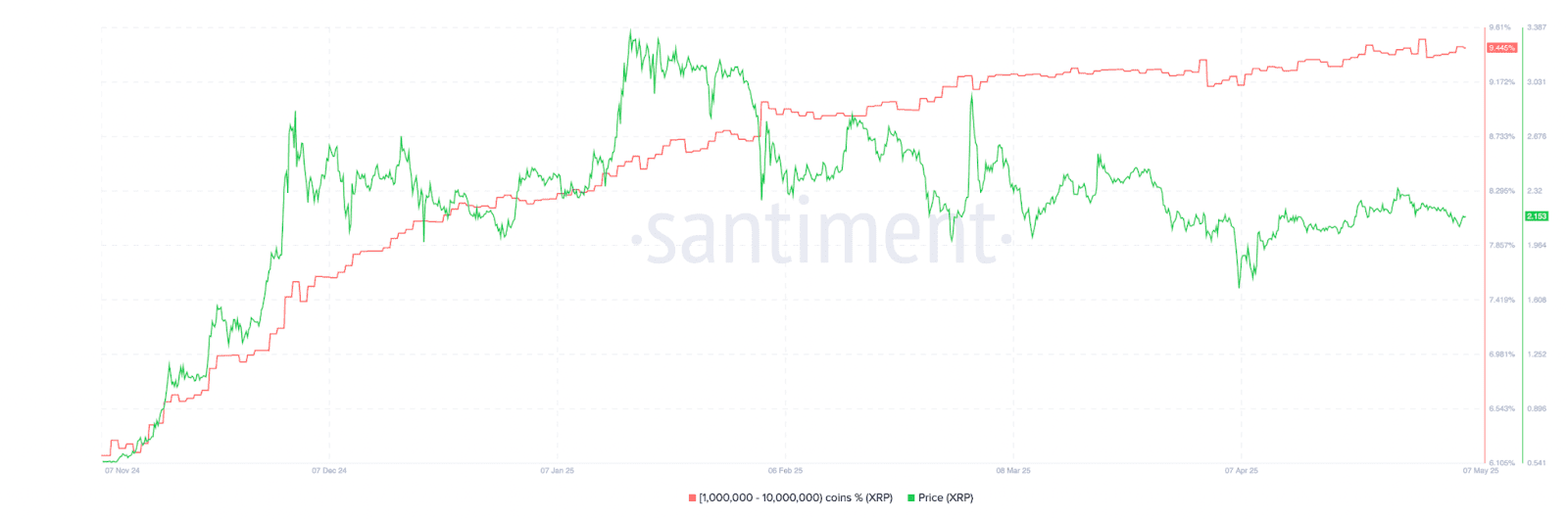

Whale Accumulation: A Bullish Indicator

Several indicators point towards a potentially significant price rise for XRP, extending beyond a short-term reaction to macroeconomic news.

Data from Santiment’s Supply Distribution metric shows a consistent increase in XRP holdings among entities with balances between 1 million and 10 million tokens. These addresses currently hold 9.44% of the total XRP supply, marking a 1.2% increase since January 1. This suggests that larger entities are accumulating XRP, potentially signaling confidence in future price appreciation.

This accumulation during price dips reduces selling pressure and establishes a price floor, potentially encouraging smaller investors to follow suit.

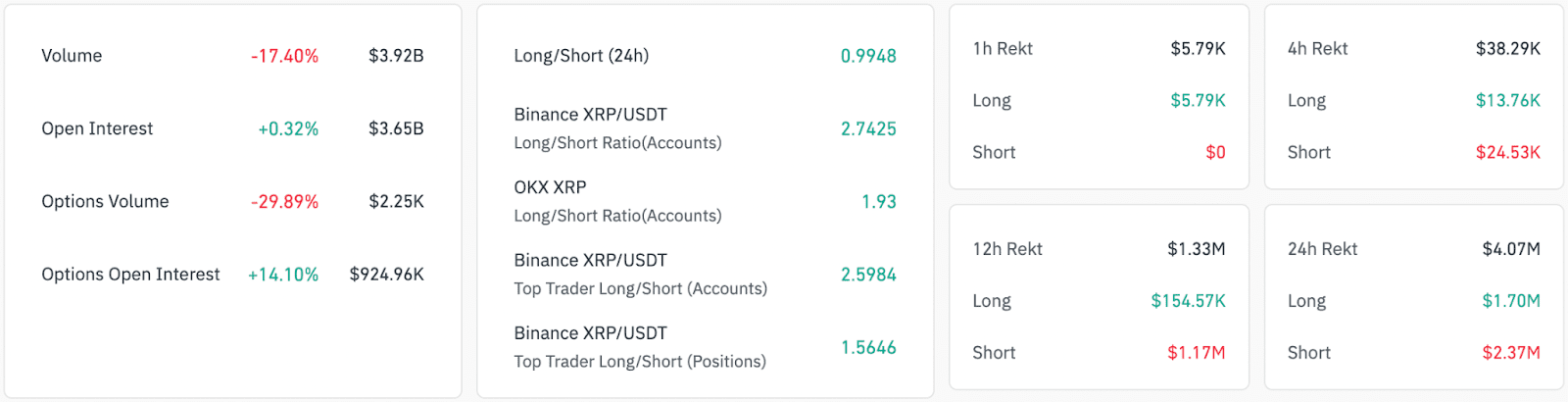

XRP’s open interest (OI) has experienced a slight increase of 0.32% to $3.65 billion, indicating a modest rise in trader confidence and liquidity. However, a 17% drop in trading volume to $3.9 billion raises concerns, suggesting that traders are exhibiting less conviction while waiting for XRP’s price to establish a definitive direction.

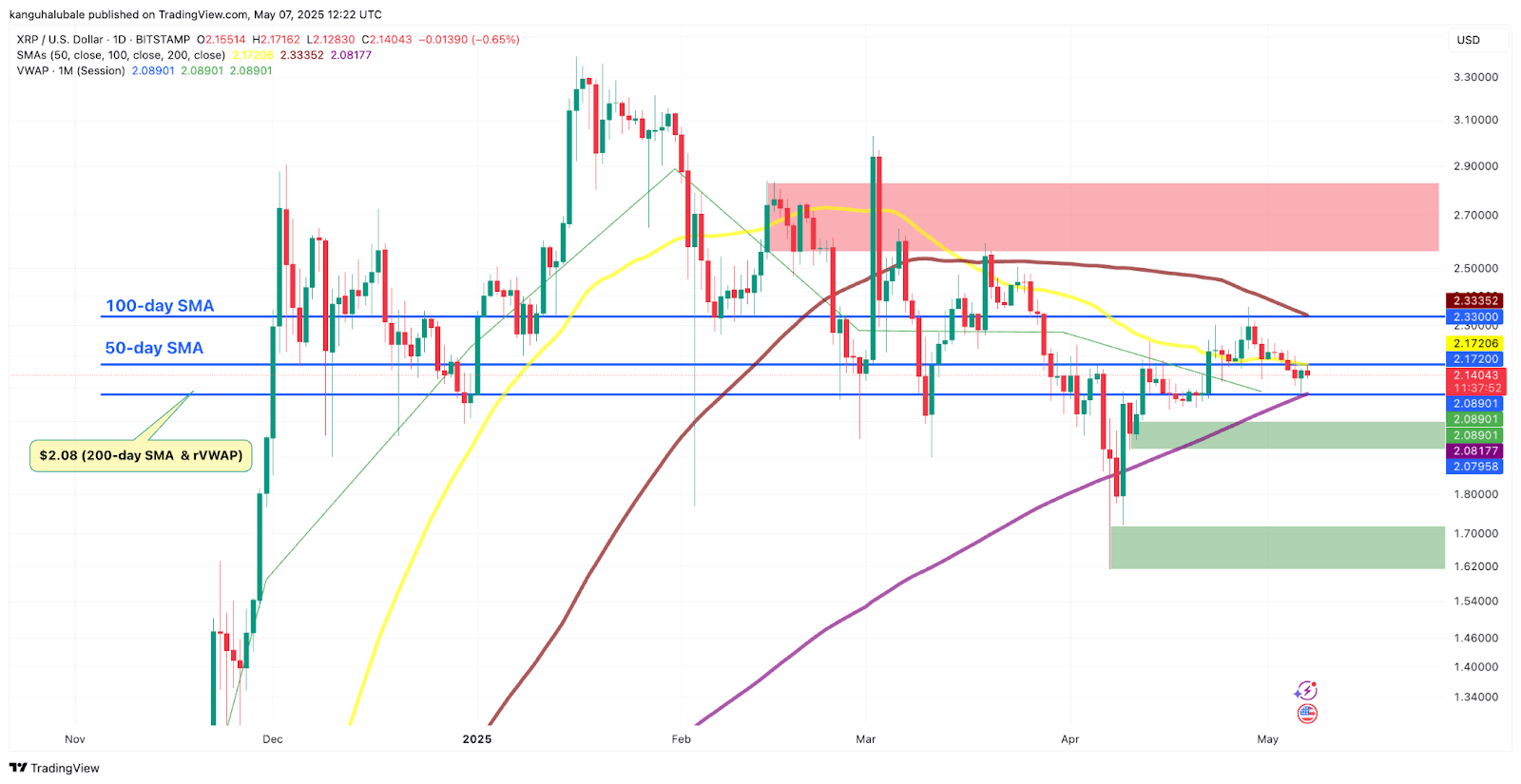

Path to $4: Key Levels to Watch

The potential for XRP to revisit its seven-year highs above $3.40 depends on its ability to maintain key support levels. XRP price has been consolidating recently, making these levels even more crucial.

Data indicates that XRP’s price rebounded off the 200-day SMA at $2.08 on May 6. It subsequently rose by 4.5% to an intraday high of $2.17, which also aligns with the 50-day SMA. Holding above this level is crucial for continued bullish momentum.

Trader and analyst Dom emphasized the importance of defending the $2.08 level, suggesting that a failure to do so could lead to a decline towards $1.90. He stated that regaining $2.12 is necessary for an immediate trend reversal.

Analyst Egrag Crypto has stated that XRP price “should not and cannot close below $1.83.” Maintaining this level is critical to avoiding further downside pressure.

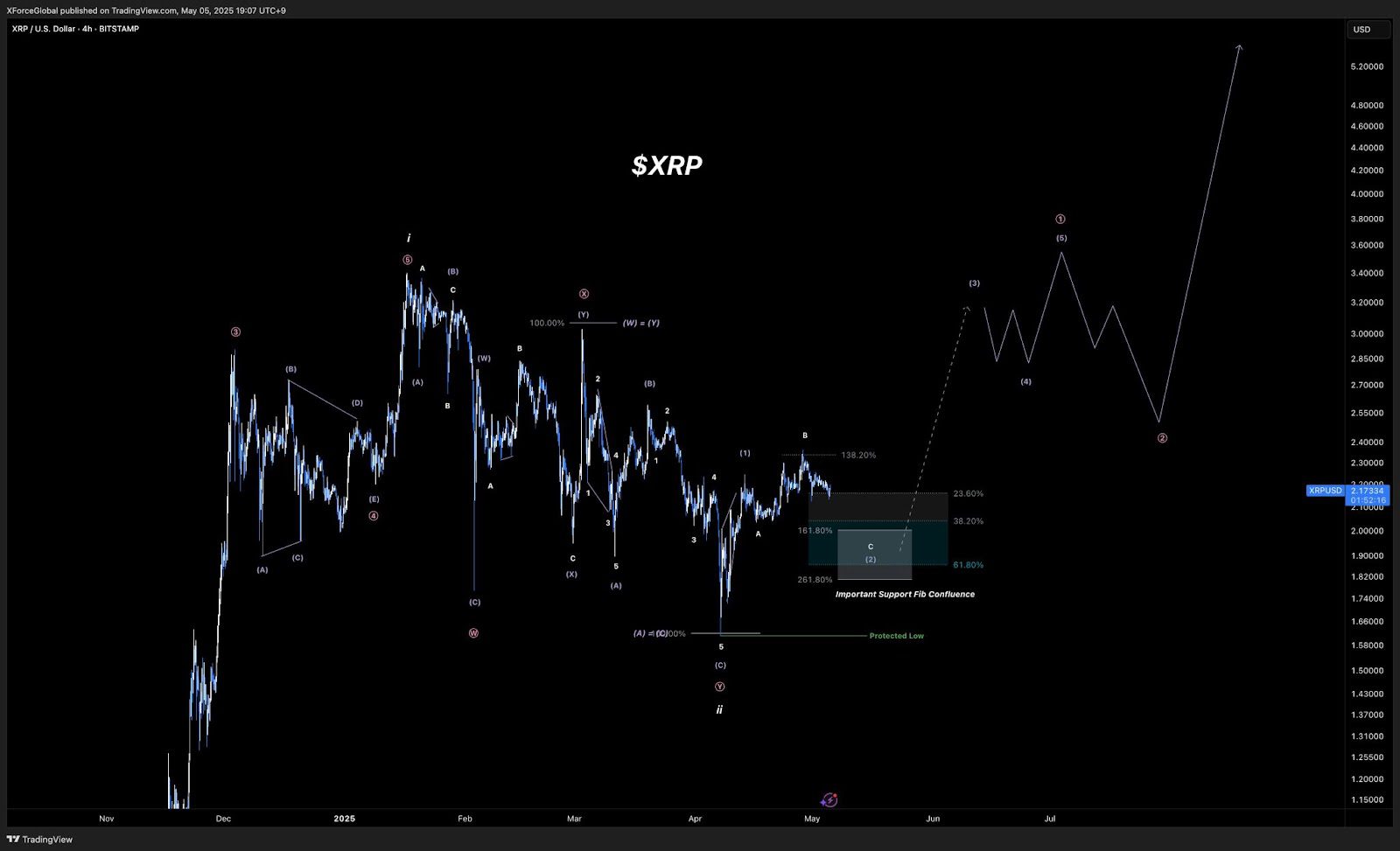

Pseudonymous analyst XForceGlobal maintains a bullish outlook as long as XRP remains above the multi-month low of $1.60 reached on April 7. They believe that new all-time highs are imminent if this level holds.

Factors Influencing XRP’s Price

Several factors could influence XRP’s ability to reach $4. These include:

- Market Sentiment: Overall sentiment in the cryptocurrency market, particularly towards altcoins, will play a significant role. Positive news and increased investor confidence could drive XRP higher.

- Ripple’s Legal Battles: The ongoing legal battles surrounding Ripple Labs continue to cast a shadow over XRP. Positive developments in the case could significantly boost its price.

- Adoption and Utility: Increased adoption of XRP for cross-border payments and other use cases would strengthen its long-term value proposition.

- Broader Economic Conditions: Macroeconomic factors, such as inflation and interest rates, can influence investor behavior and impact the cryptocurrency market as a whole.

Conclusion: A Cautiously Optimistic Outlook

While reaching $4 in May is ambitious, XRP exhibits bullish signals, particularly with whale accumulation and key support levels. The market outlook depends on the successful defense of crucial price points and positive external factors. Investors should exercise caution, conduct thorough research, and carefully consider the risks involved before making any investment decisions.