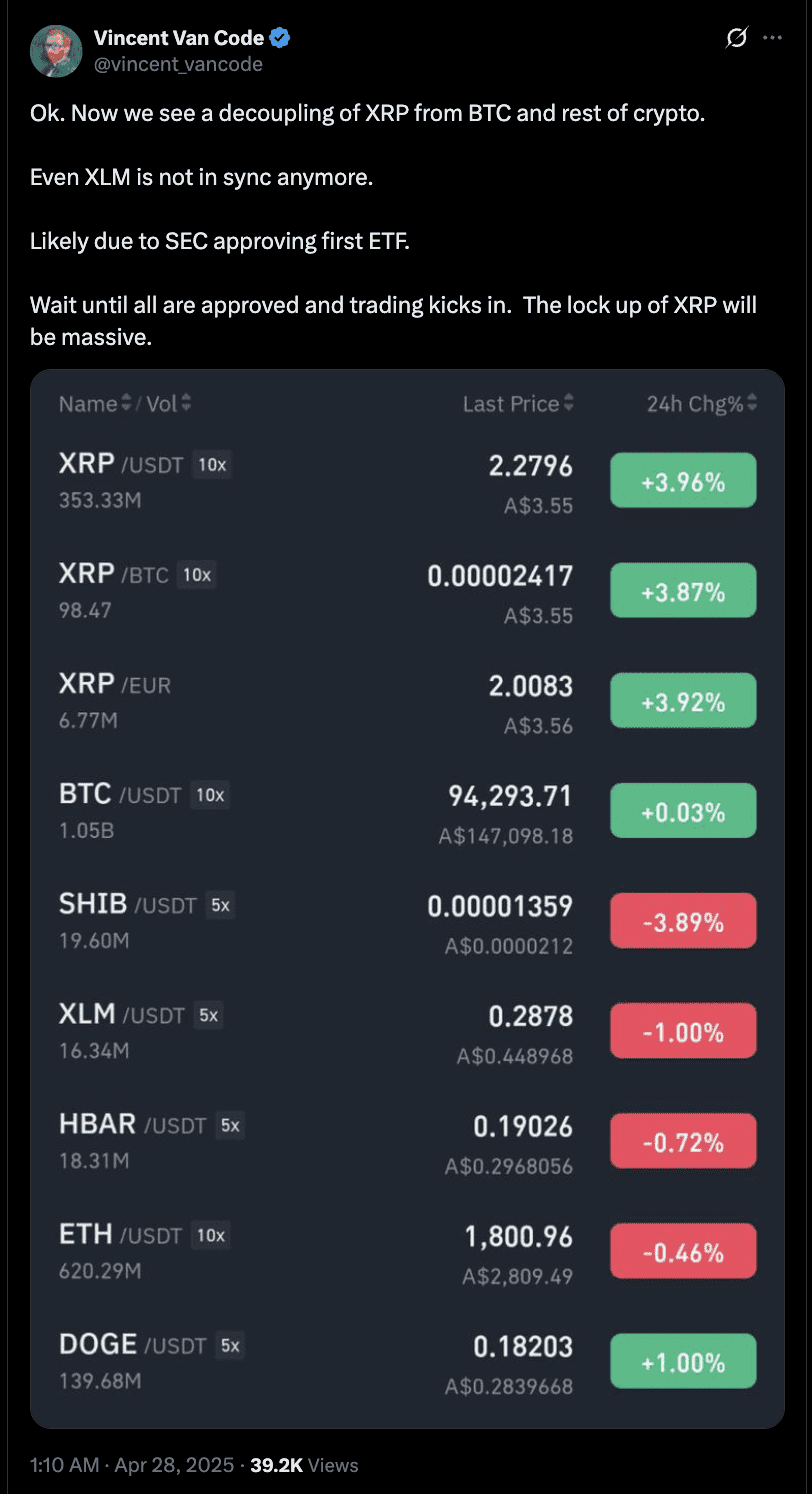

XRP (Ripple) has experienced a notable price surge recently, prompting investors and analysts to explore the underlying factors driving this momentum. Several key elements appear to be contributing to the bullish sentiment surrounding XRP.

Key Factors Influencing XRP’s Price:

- Potential XRP Futures ETF Approval: The anticipation surrounding the potential launch of XRP-based futures exchange-traded funds (ETFs) by ProShares is a significant driver. These ETFs, including the ProShares XRP Strategy ETF, ProShares Short XRP Strategy ETF, and ProShares XRP Blend Strategy ETF, could provide investors with indirect exposure to the XRP market, potentially increasing demand. The rumored launch date is April 30th.

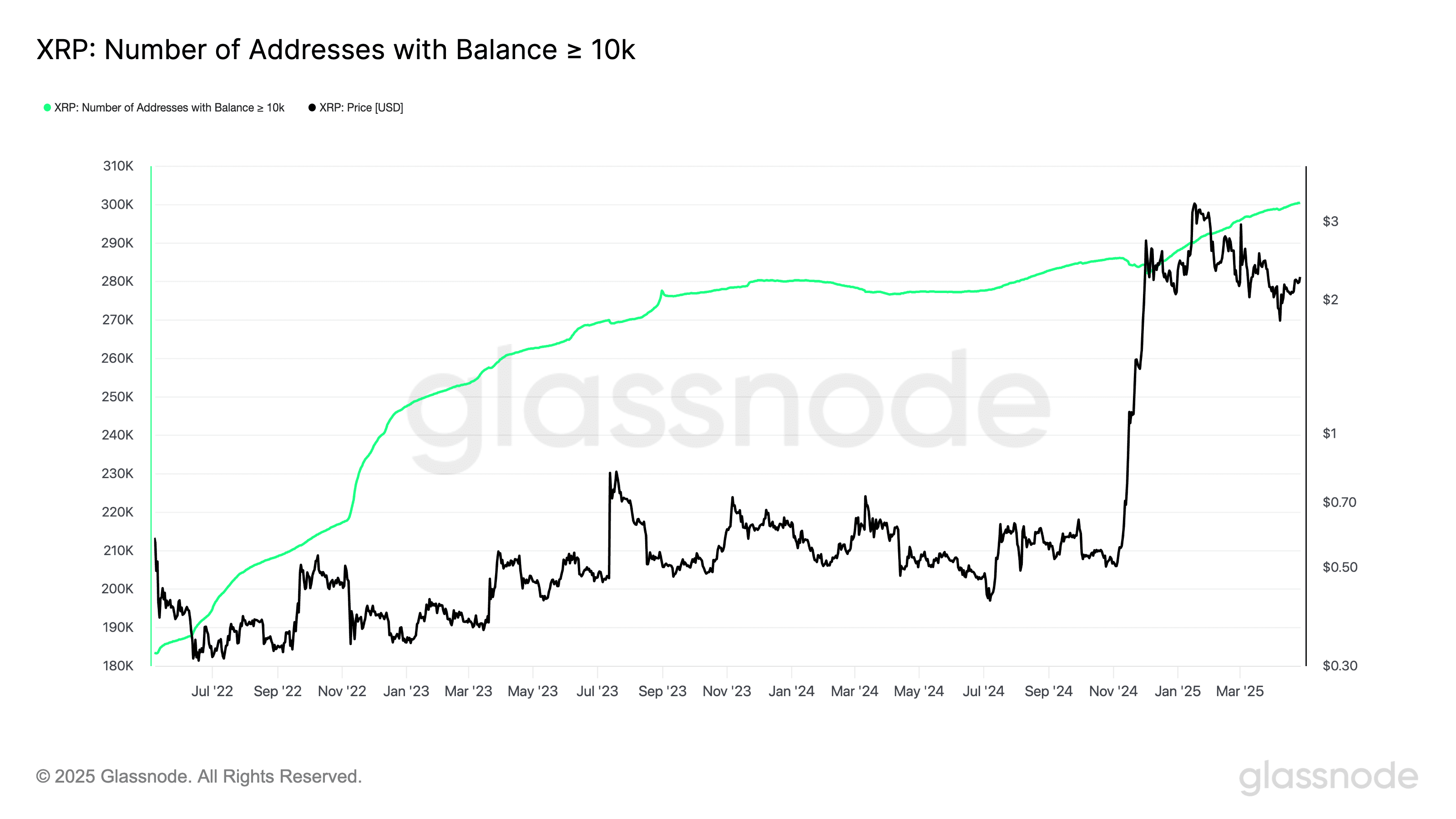

- Whale Accumulation: Despite recent market corrections, large XRP holders (whales) are actively accumulating more tokens. This indicates strong confidence in XRP’s long-term potential and suggests that selling pressure remains limited. Data from Glassnode shows a consistent increase in the number of XRP addresses holding at least 10,000 tokens.

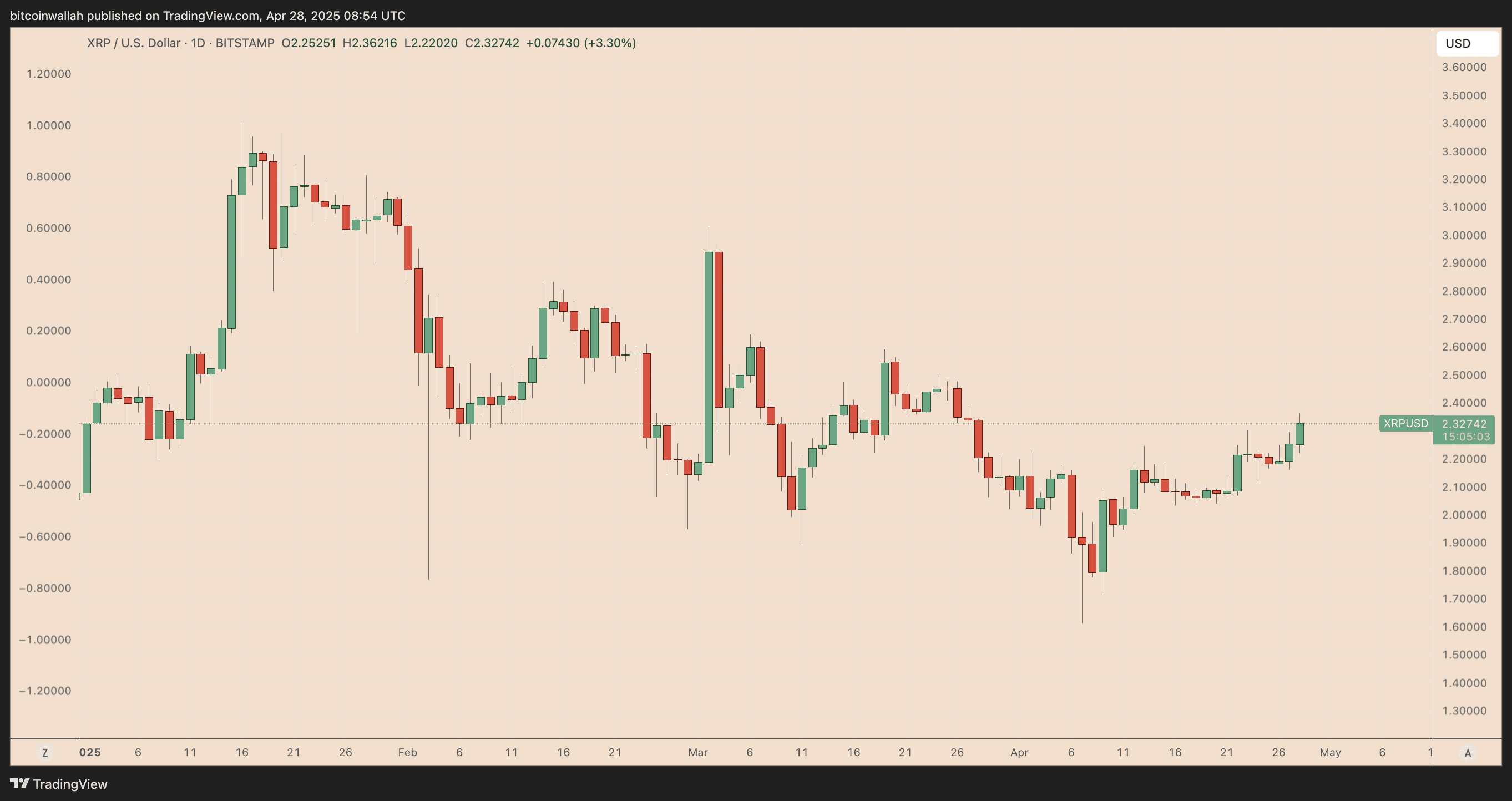

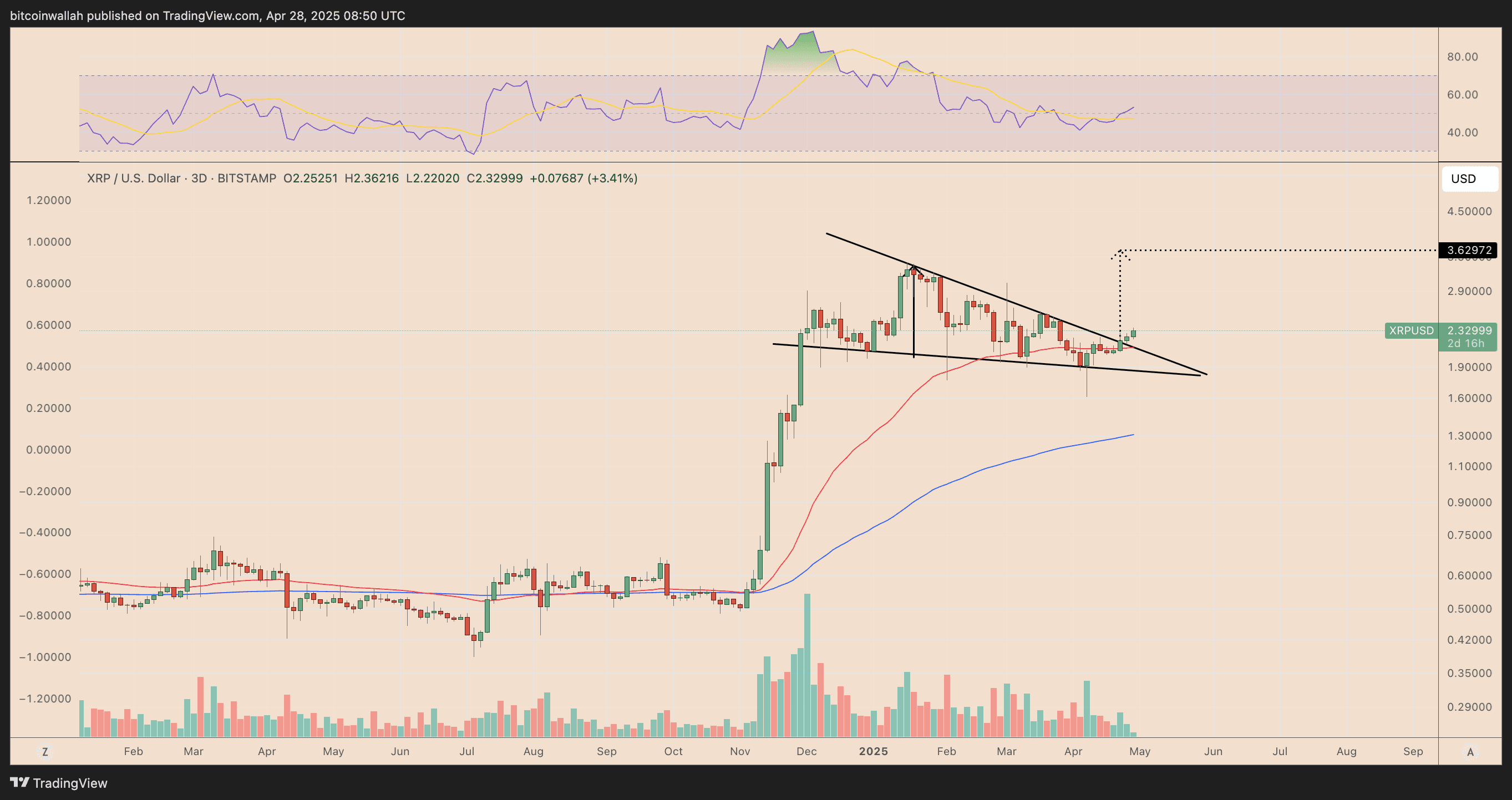

- Technical Breakout: From a technical analysis perspective, XRP appears to be experiencing a falling wedge breakout, a bullish reversal pattern. Breaking above the upper trendline of this pattern suggests a potential 55% rally toward $3.63.

Deeper Dive into the Key Factors:

1. XRP Futures ETFs: A Closer Look

The potential launch of XRP futures ETFs is generating considerable excitement within the XRP community. While not a direct investment in XRP, these ETFs allow investors to gain exposure to XRP’s price movements through futures contracts. This can attract both institutional and retail investors who may be hesitant to directly hold XRP.

It’s important to distinguish between futures ETFs and spot ETFs. While futures ETFs track the price of XRP futures contracts, a spot ETF would hold actual XRP tokens. The approval of a spot XRP ETF would likely have a more significant impact on XRP’s price, as it would directly increase demand for the underlying asset.

2. Whale Activity and Market Sentiment

The continued accumulation of XRP by whales is a positive sign for the cryptocurrency. Whales often have a significant influence on market trends, and their accumulation patterns can provide insights into their expectations for the future price of XRP. The fact that whales are increasing their holdings even during price dips suggests a belief that XRP is undervalued and poised for future growth.

3. Technical Analysis: Falling Wedge Breakout Explained

The falling wedge pattern is a bullish reversal pattern that typically forms after a period of price decline. The pattern is characterized by two converging trendlines that slope downward. A breakout above the upper trendline of the wedge signals a potential reversal of the downtrend and the beginning of a new uptrend.

In the case of XRP, the confirmed breakout from the falling wedge pattern, coupled with increased trading volume, suggests a strong possibility of further price appreciation. The target of $3.63 is based on the maximum height of the wedge pattern, projected from the breakout point.

XRP’s Price Performance and Market Context:

XRP’s recent price surge comes amidst a broader recovery in the cryptocurrency market. Bitcoin (BTC) and Ethereum (ETH) have also experienced gains, contributing to a positive overall sentiment. The combination of positive market trends and XRP-specific catalysts has created a favorable environment for XRP’s price appreciation.

Challenges and Risks:

While the outlook for XRP appears positive, it’s important to acknowledge the potential challenges and risks. The ongoing regulatory uncertainty surrounding XRP remains a concern. The SEC’s lawsuit against Ripple has cast a shadow over XRP for several years, and the outcome of this legal battle could significantly impact XRP’s future.

Additionally, the cryptocurrency market is inherently volatile, and unexpected events can trigger sudden price swings. Investors should be prepared for potential downside risks and manage their investments accordingly.

Conclusion:

The recent surge in XRP’s price is likely driven by a combination of factors, including the anticipation of XRP futures ETFs, whale accumulation, and a bullish technical breakout. While challenges and risks remain, the current market dynamics suggest that XRP could continue to experience price appreciation in the near term. As always, investors should conduct their own thorough research and consider their individual risk tolerance before making any investment decisions.