XRP (Ripple) experienced a significant price increase on May 8th, reaching an intraday high of $2.27. Several factors contributed to this surge, including positive market sentiment following a potential trade deal announcement, increased accumulation by large XRP holders (whales), and a bullish technical pattern.

Key Factors Driving the XRP Price Rally

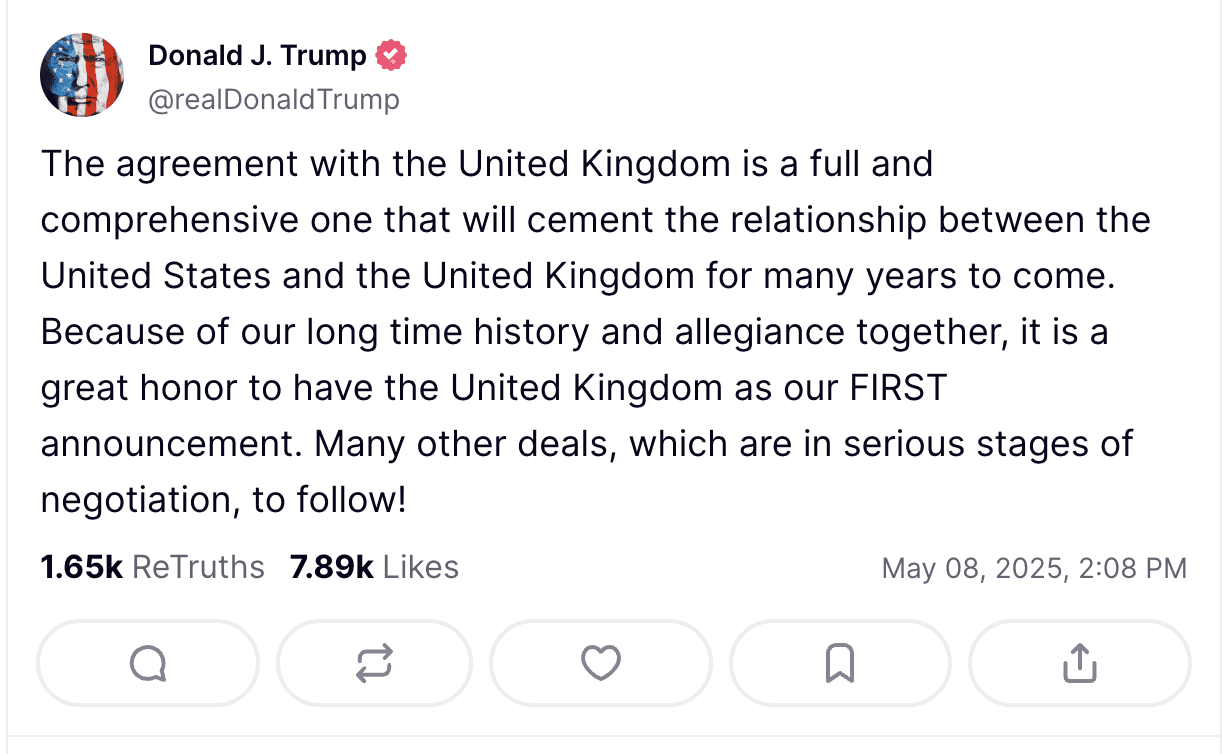

- US-UK Trade Deal Sentiment: A potential trade deal between the US and the UK, teased by former US President Donald Trump, boosted overall market risk appetite, positively impacting cryptocurrencies like XRP.

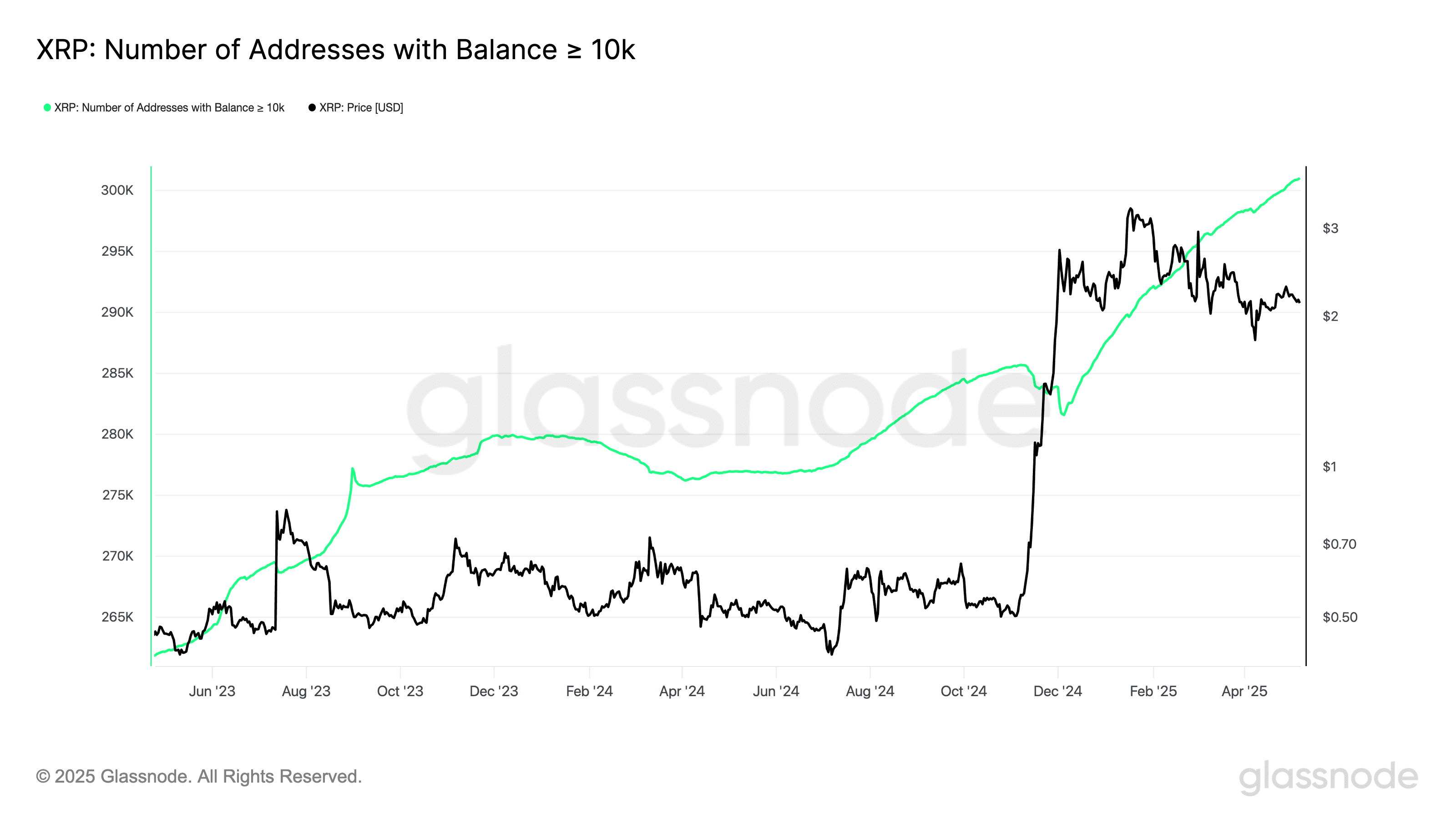

- Whale Accumulation: Data indicates a continuous accumulation of XRP by addresses holding 10,000 or more tokens. This suggests strong confidence among large investors in XRP’s future potential.

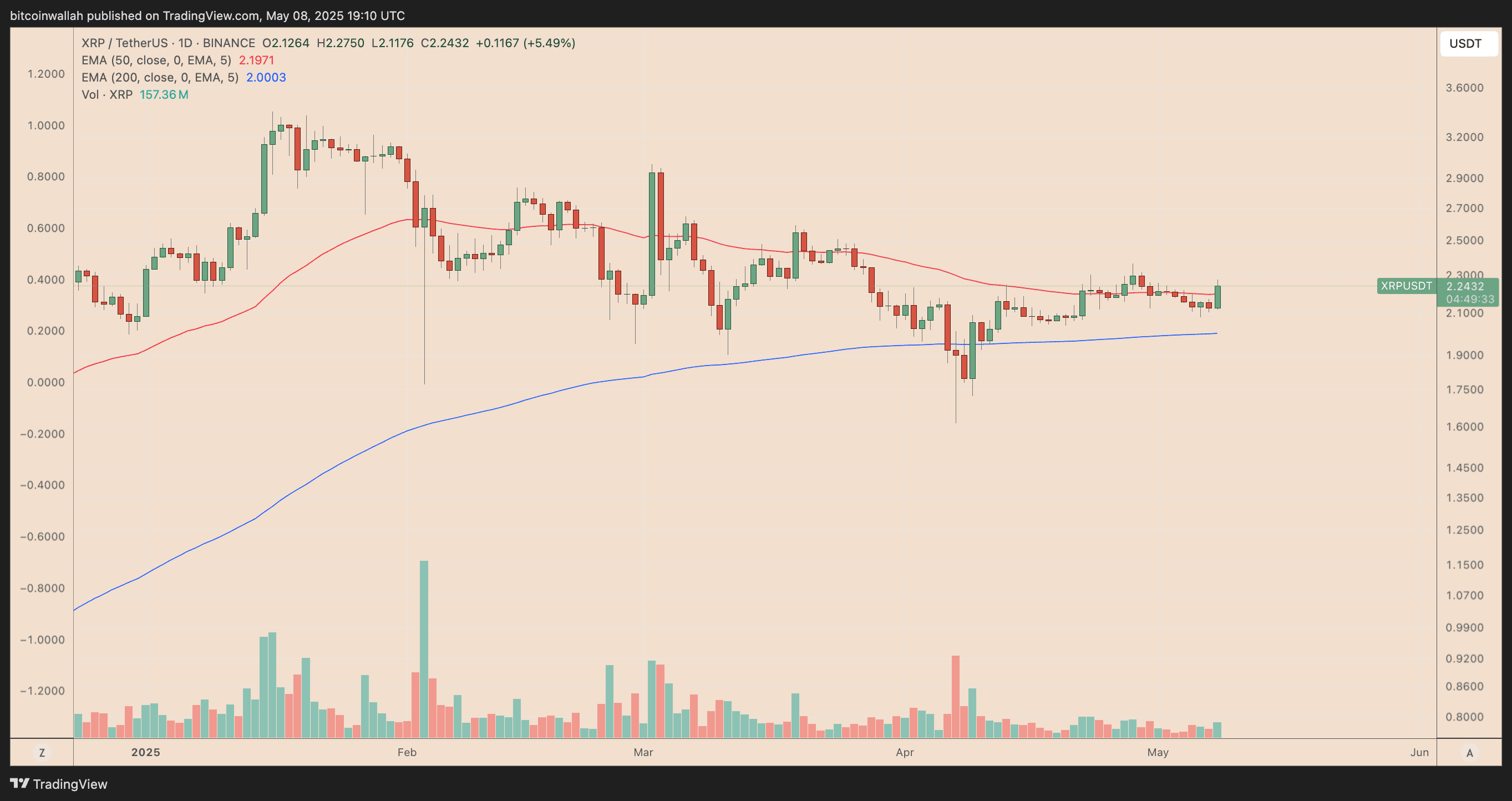

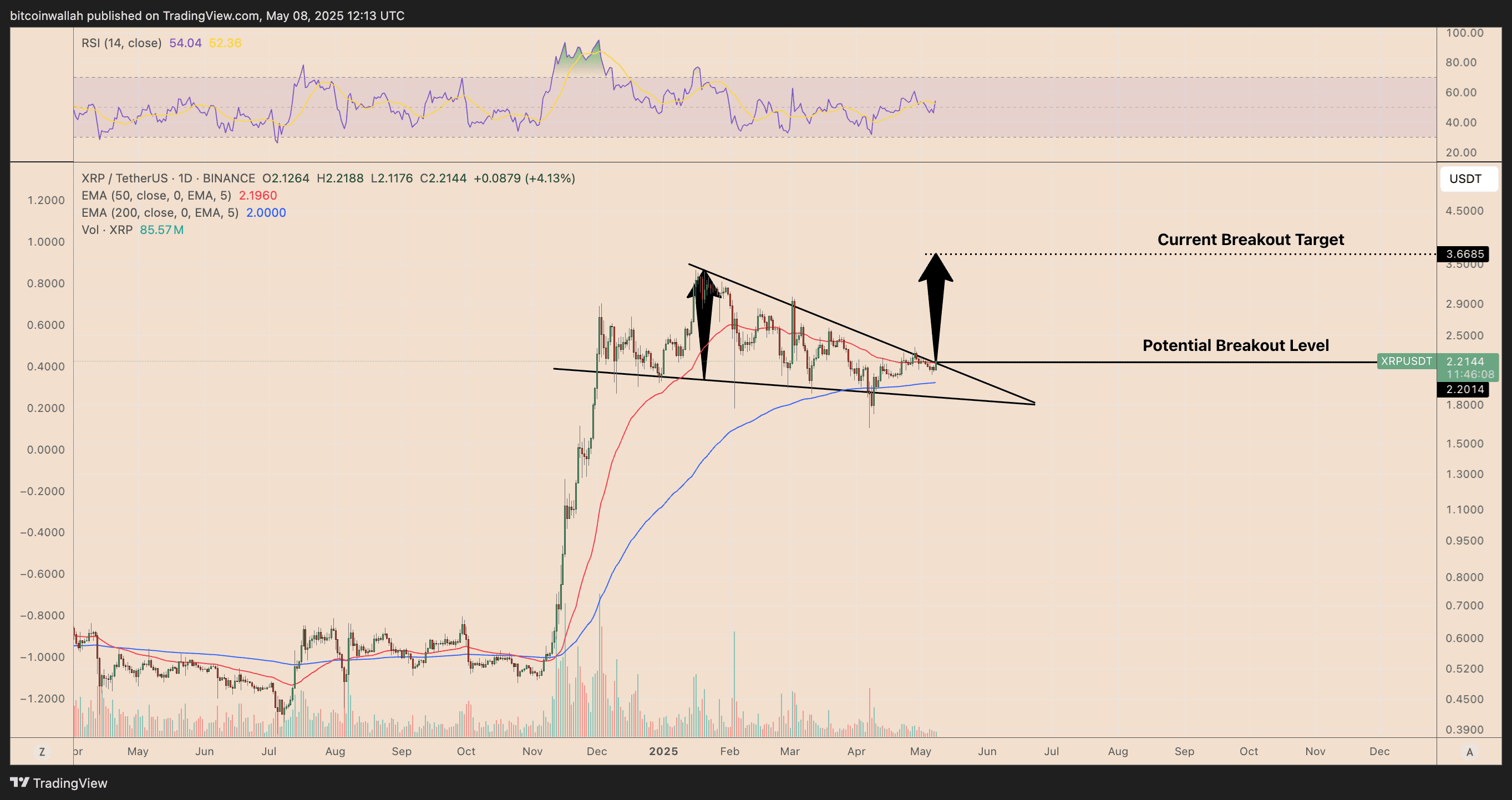

- Falling Wedge Breakout: XRP broke above a key resistance trendline forming part of a falling wedge pattern, a bullish signal suggesting a potential upward price movement.

Diving Deeper into the Catalysts

The Impact of the US-UK Trade Deal

Former US President Donald Trump’s announcement of a potential “major trade deal” involving the UK created a wave of optimism in the financial markets. The proposed deal aims to reduce tariffs on key sectors like cars and steel, leading to increased risk appetite among investors. This positive sentiment spilled over into the cryptocurrency market, boosting the price of XRP.

Whale Activity and Market Confidence

An important indicator of market sentiment is the behavior of large cryptocurrency holders, often referred to as “whales.” Data from Glassnode reveals a consistent increase in the number of addresses holding at least 10,000 XRP tokens. This accumulation trend, even during price dips, suggests that whales are confident in XRP’s long-term prospects. Factors like favorable outcomes in Ripple’s SEC lawsuit and speculation about a potential spot XRP ETF may be fueling this accumulation.

Technical Analysis: The Falling Wedge Pattern

Technical analysis plays a crucial role in understanding potential price movements. XRP’s price broke above a resistance trendline that was part of a falling wedge pattern. This pattern is generally considered bullish, indicating a potential reversal of a downtrend. A clear breakout above the upper trendline of the falling wedge could lead to a significant price increase.

Potential Price Targets and Key Levels to Watch

Based on the falling wedge breakout, some analysts predict a potential rally toward $2.80 or even $3.66. However, it’s crucial to monitor key support levels. A drop below $2.20 could lead to further declines toward the 200-day exponential moving average (EMA), currently around $2.00. A decisive break below the lower trendline of the falling wedge, around $1.80-$1.85, would invalidate the bullish outlook.

Key Levels to Watch:

- Resistance: $2.80, $3.66

- Support: $2.20, $2.00, $1.80 – $1.85

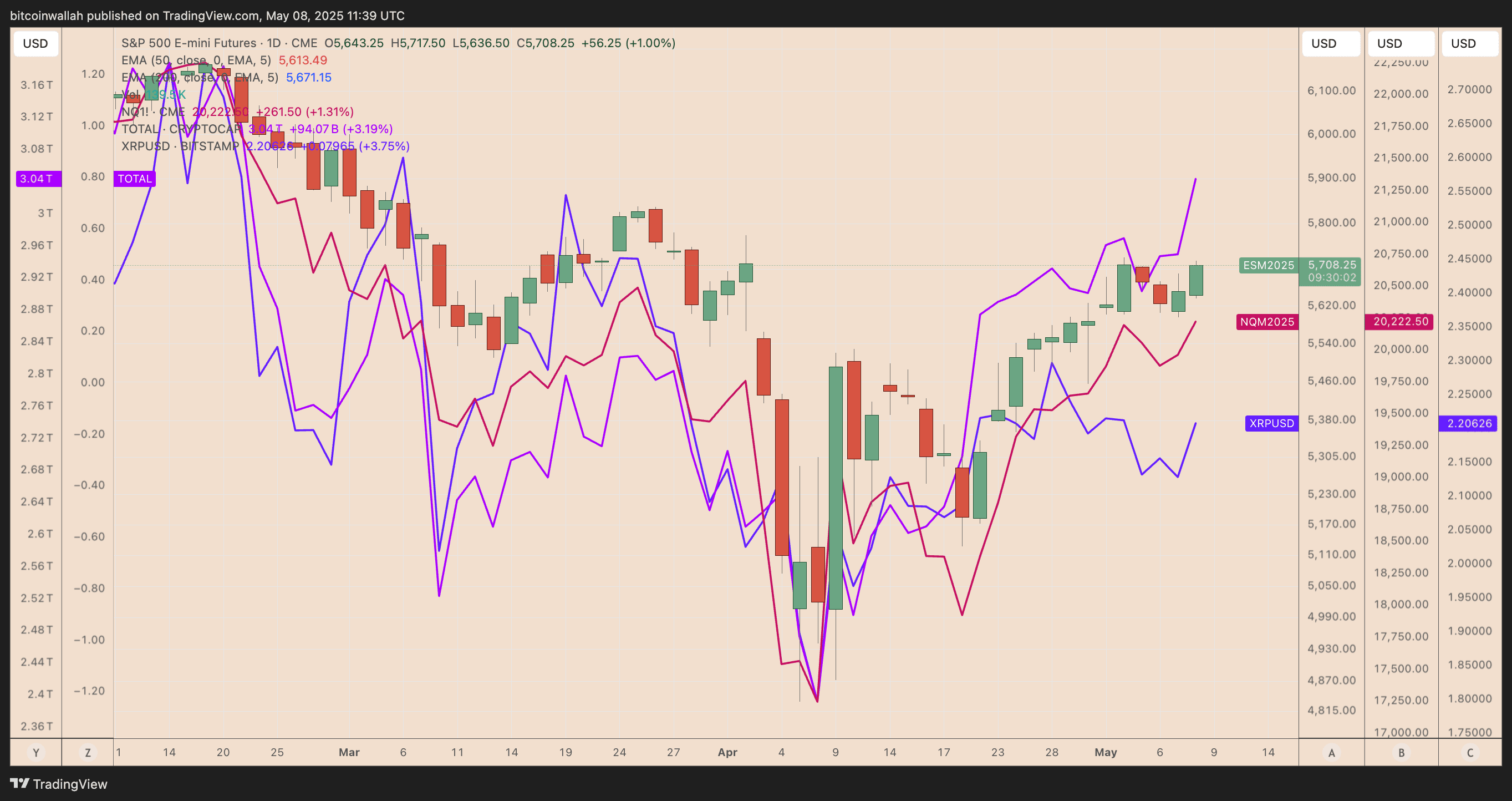

XRP’s Correlation with the S&P 500

Interestingly, XRP’s correlation with the S&P 500 index has increased since November 2024. On May 8th, the correlation coefficient was around 0.54, although it was lower than its year-to-date peak of 0.74. This indicates that XRP’s price movements are, to some extent, influenced by broader market trends in the stock market.

The Importance of Fundamental Factors

Beyond technical analysis and market sentiment, fundamental factors also play a crucial role in XRP’s price. Positive developments in Ripple’s ongoing lawsuit with the SEC, as well as the potential for a spot XRP ETF, could significantly impact the cryptocurrency’s value.

Conclusion

XRP’s recent price surge was driven by a combination of factors, including positive market sentiment, whale accumulation, and a bullish technical pattern. While the short-term outlook appears positive, it’s essential to monitor key support and resistance levels and stay informed about fundamental developments within the Ripple ecosystem and the broader cryptocurrency market.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments are inherently risky, and investors should conduct thorough research before making any investment decisions.