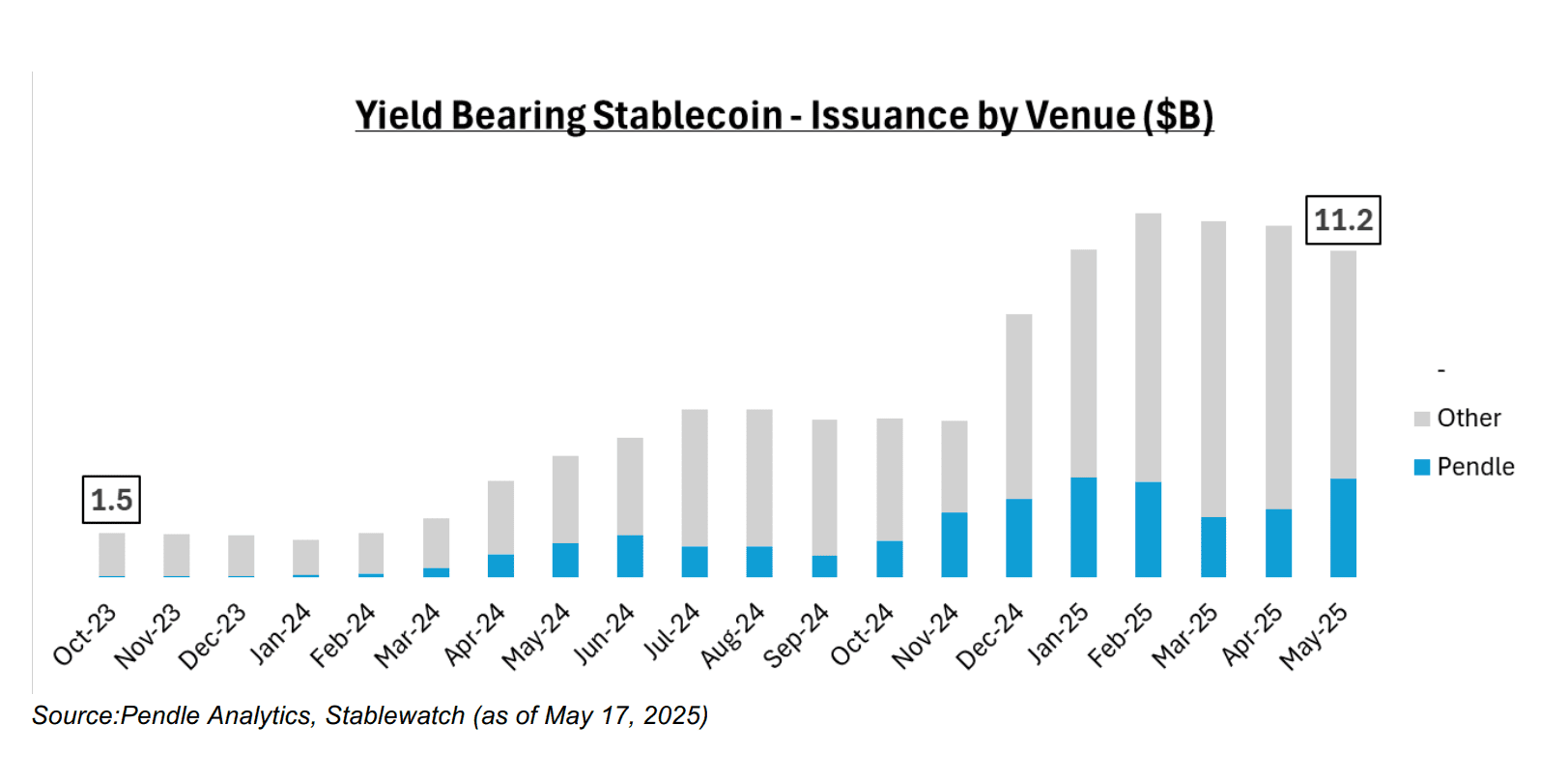

Yield-bearing stablecoins have experienced remarkable growth, reaching $11 billion in circulation and capturing 4.5% of the total stablecoin market. This significant increase from $1.5 billion and a 1% market share at the beginning of 2024 highlights the increasing demand for assets that offer both stability and yield.

Key Takeaways:

- Market Growth: Yield-bearing stablecoins have surged to $11 billion, making up 4.5% of the total stablecoin market.

- Pendle’s Dominance: Pendle, a decentralized protocol, leads the market with 30% of all yield-bearing stablecoin total value locked (TVL), approximately $3 billion.

- Regulatory Clarity: Increasing regulatory clarity, particularly in the U.S., is fostering the growth of yield-bearing stablecoins.

- Future Projections: Stablecoin issuance is expected to double to $500 billion in the next 18-24 months, with yield-bearing stablecoins potentially capturing 15% of this market ($75 billion).

Pendle: A Leader in Yield-Bearing Stablecoins

Pendle, a decentralized protocol, has emerged as a key player in the yield-bearing stablecoin market. It enables users to lock in fixed yields or speculate on variable interest rates. The platform now accounts for 30% of all yield-bearing stablecoin total value locked (TVL), amounting to roughly $3 billion.

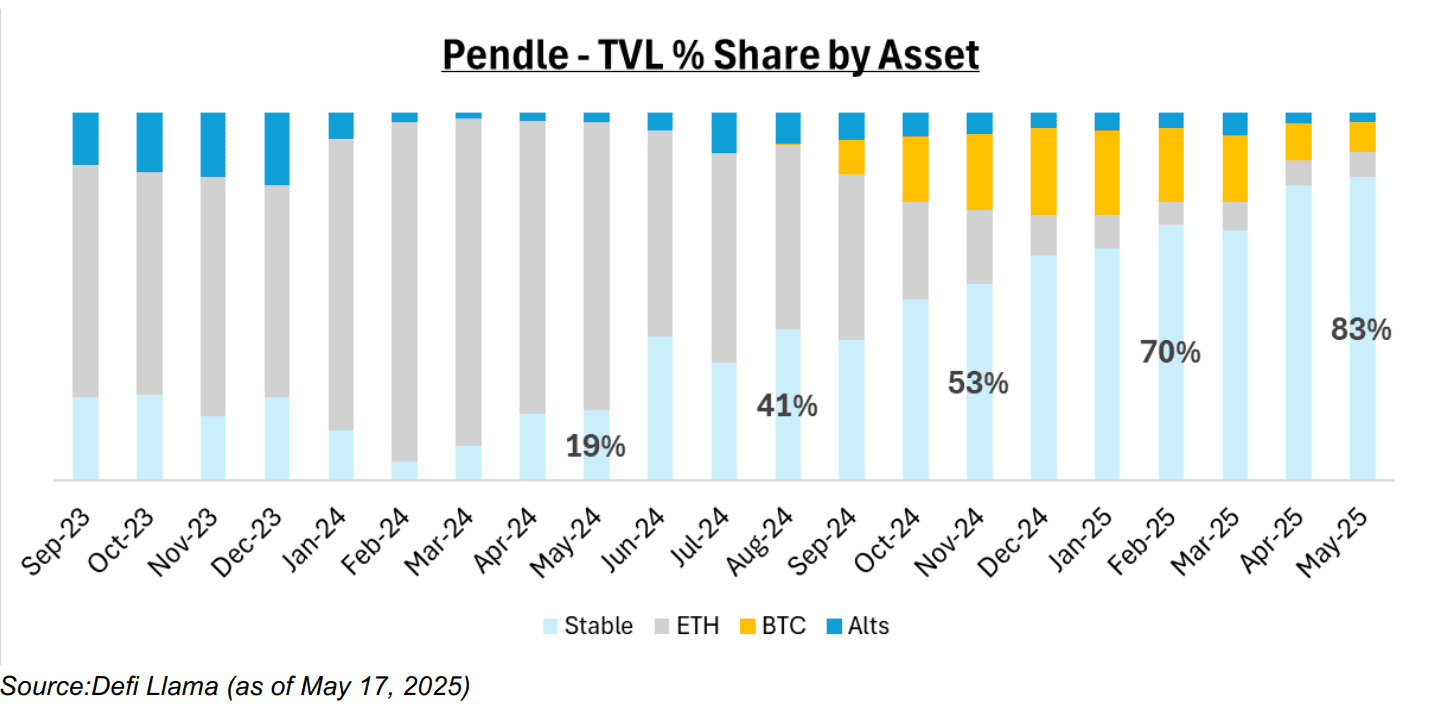

Notably, stablecoins constitute 83% of Pendle’s $4 billion total value locked, a substantial increase from less than 20% a year ago. Assets like Ether (ETH), which previously contributed 80%-90% of Pendle’s TVL, have decreased to less than 10%.

The Opportunity Cost of Traditional Stablecoins

Traditional stablecoins like USDT and USDC do not distribute interest to holders. With over $200 billion in circulation and U.S. Federal Reserve interest rates at 4.3%, it’s estimated that stablecoin holders are missing out on over $9 billion in annual yield. This potential loss is driving interest in yield-bearing alternatives.

Regulatory Developments Fueling Growth

The expansion of yield-bearing stablecoins is supported by increasing regulatory clarity, particularly in the United States. Recent actions by regulatory bodies signal a more favorable environment for these assets.

In February 2025, the U.S. Securities and Exchange Commission (SEC) approved yield-bearing stablecoins as “certificates” subject to securities regulation, rather than outright banning them. This approval subjects yield-bearing stablecoins to specific rules, including registration, disclosure requirements, and investor protections, which aim to provide a safer and more transparent environment.

Proposed bills like the Stablecoin Transparency and Accountability for a Better Ledger Economy (STABLE) Act and the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act also indicate a positive regulatory trend.

Future Outlook for Yield-Bearing Stablecoins

Pendle anticipates stablecoin issuance to double to $500 billion in the next 18 to 24 months. They also project that yield-bearing stablecoins will capture 15% of this market, resulting in $75 billion in issuance, a sevenfold increase from the current $11 billion.

Pendle’s Evolving Focus

Initially focused on airdrop farming, Pendle has transitioned into an infrastructure layer for decentralized finance (DeFi) yield markets. This strategic shift positions Pendle as a vital component in the broader DeFi ecosystem.

Ethena’s USDe stablecoin currently accounts for approximately 75% of Pendle’s stablecoin TVL. However, newer entrants like Open Eden, Reserve, and Falcon have increased the share of non-USDe assets from 1% to 26% over the past year, indicating a diversification of assets on the platform.

Pendle is also expanding its reach beyond Ethereum, with plans to support networks like Solana and integrate with Aave and Ethena’s upcoming Converge blockchain. This multi-chain approach aims to capture a wider audience and further solidify Pendle’s position in the yield-bearing stablecoin market.

Growing Interest in Yield-Generating Strategies

Interest in yield-generating strategies within the cryptocurrency sector has surged in recent years, driven by both retail and institutional investors seeking to maximize returns on their digital assets. The allure of earning passive income on stablecoins has attracted significant attention.

On May 19, Franklin, a hybrid cash and crypto payroll provider, announced the launch of Payroll Treasury Yield, which utilizes blockchain lending protocols to help firms earn returns on payroll funds. This example highlights the innovative approaches being developed to leverage yield-generating opportunities in the crypto space.

Conclusion

The surge in yield-bearing stablecoins represents a significant shift in the cryptocurrency market. With Pendle leading the charge and increasing regulatory clarity providing a more stable foundation, the future looks promising for these innovative assets. As the market continues to evolve, yield-bearing stablecoins are poised to play an increasingly important role in the broader DeFi landscape, offering users new avenues for earning passive income and maximizing their digital asset holdings.